“What could be more advantageous in an intellectual contest – whether it be bridge, chess, or stock selection than to have opponents who have been taught that thinking is a waste of energy?” –Warren Buffett, 1985 Berkshire Hathaway Letter to Shareholders

More than thirty years removed from that quote and it has never been more relevant than it is today. Investors today are flocking to strategies founded on the idea that “thinking is a waste of energy” giving investors willing to do otherwise a terrific advantage.

Everywhere you turn these days you will find articles, advertisements and other sorts of solicitations to abandon “active investing” in favor of “passive investing.” Before I go any further, however, I need to clarify one thing: There is no such thing as “passive investing.”

If you accept Benjamin Graham’s definition…

An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.

…then “passive investing” becomes an oxymoron simply because “passive” doesn’t allow for the sort of “thorough analysis” which promises “safety of principal” or “adequate return.” In fact, it eschews just this sort of process.

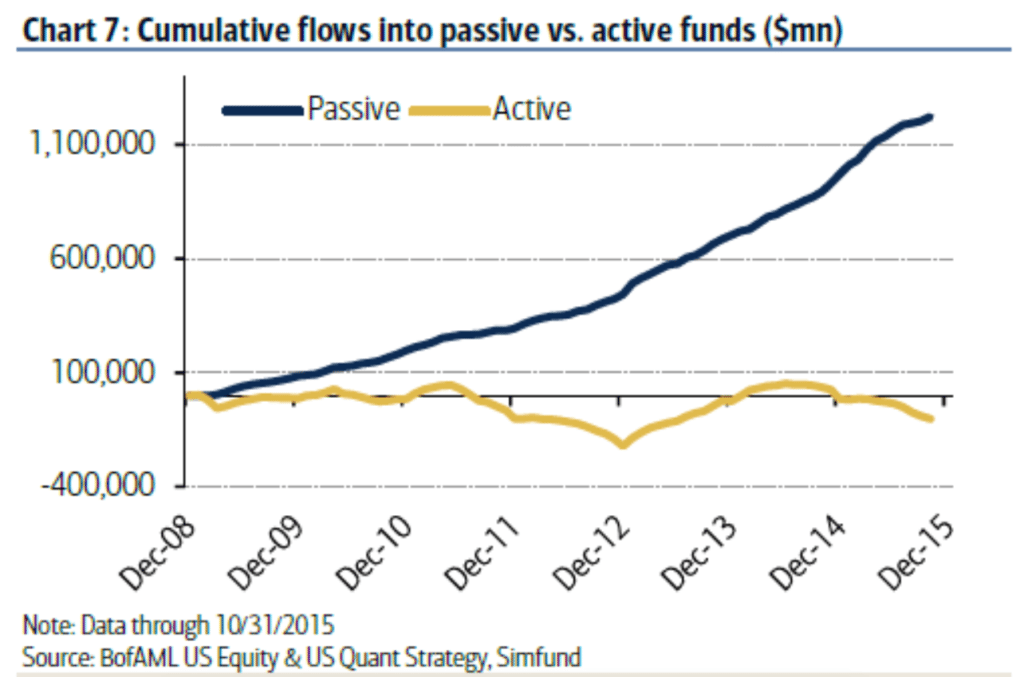

With that out of the way, let’s get back to the point of this piece and that is that “passive” has never been more popular than it is today. Just look at the list of the largest money managers on the planet and it’s a who’s who of index fund providers: BlackRock, Vanguard, State Street, etc. More money is allocated to passive today than ever before and by a very large margin.

Furthermore, the shift to passive is only accelerating. Yesterday, we learned that, despite the S&P 5oo hitting new, all-time highs, investors are now abandoning active funds at the greatest rate since the heart of the financial crisis, when stock prices were plunging.

Investors in June pulled the most money from actively managed stock funds since October 2008 https://t.co/KshDx270vY

— Bloomberg Markets (@markets) July 18, 2016

In other words, more investors are shunning “thinking” for “not thinking” than ever before and at the greatest rate ever seen. If you are one of the few “thinking” investors left today, this can only be seen as a wonderful advantage, perhaps the greatest advantage any “thinking” investor has ever seen before.

For the few left in the “thinking” camp, this phenomenon has already provided some wonderful opportunities in gold and long bonds. I expect we will continue to see these sorts of opportunities arise as prices are increasingly driven by dogma rather than discipline.