This blog post is based on an excerpt from a recent report featured on The Felder Report PRO.

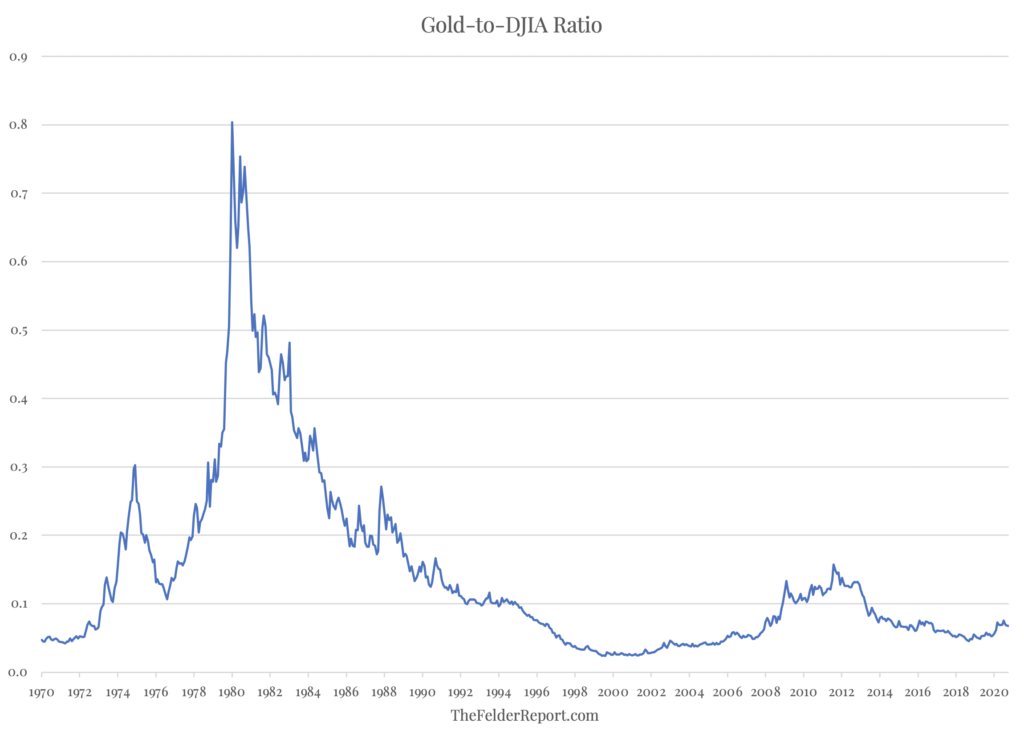

With the gold price up about 100% since it bottomed five years ago, some investors seem to believe that it has gotten overpriced. In addition to watching important drivers of the gold price, one way to look at its valuation is to simply compare it to popular alternatives. The gold price relative to the Dow Jones Industrial Average would seem to suggest it is not expensive at all. In fact, to match the valuation peak it reached about a decade ago, gold would need to double again from its current price. Of course, that would still leave it far below the peak seen four decades ago. So gold’s upside potential over the long run looks far from exhausted even after its terrific run over the past few years.