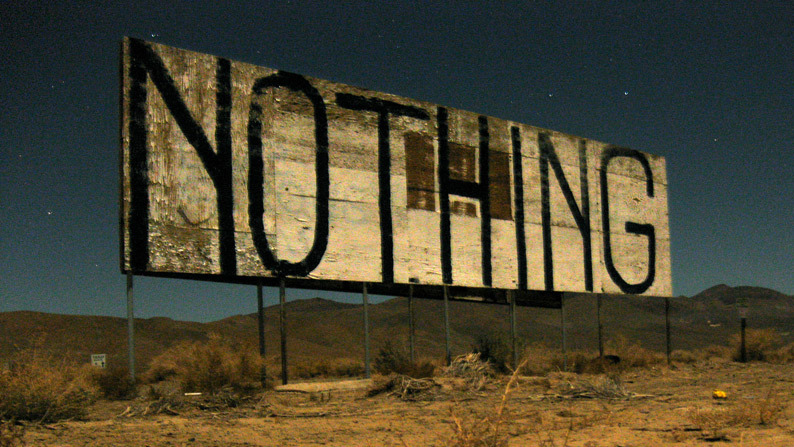

Master The Art Of Doing Nothing

“One of the best rules anybody can learn about investing is to do nothing, absolutely nothing, unless there is something to do… I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up… I wait for a situation that is like the proverbial ‘shooting fish in a barrel.’” -Jim Rogers, Market Wizards

Perhaps the most important lesson about investing I’ve learned is when there is nothing to do, do nothing. The problem is nothing may actually be the hardest thing to do. We all want to feel like we are being proactive and that requires doing something even when there’s really nothing to be done. So it takes a great deal of discipline to actually resist the urge to do something and commit to doing nothing. In that way, however, committing to doing nothing is probably the most proactive thing to do.

When it comes time to actually do something, to put money to work, you will know by the fact that it is such an attractive opportunity you would be foolish not to take advantage of it. These certainly don’t come around often but when they do they are so obvious they slap you upside the head. As Jim Rogers says, it’s like seeing, “money lying in the corner,” and all that is required of you is bending over and picking it up. That’s what it feels like when it’s time to stop doing nothing and start doing something.

Another way to think about this is to realize that the vast majority of mistakes investors make come out of a feeling of needing to do something, of being proactive, rather than of simply waiting patiently to react to a truly fantastic opportunity. Rather than react only to true opportunity, they react to social pressure or envy when they see their neighbor making a “killing” in dotcom stocks, ala 2000, or residential real estate, ala 2005, or in call options today.

Meanwhile, when a truly terrific opportunity arises they are paralyzed by the fear of going it alone, without the comfort of the company of others, ala stocks in 2009, real estate in 2012 or gold in 2015. Or they just aren’t paying attention. They order Domino’s Pizza every week for decades but never think about buying one of the best performing stocks of the past several decades. They upgrade their iPhone every year or two but are too afraid to buy the stock after Steve Jobs passes away and the stock tanks to its lowest valuation in years.

Right now, due to the extraordinary circumstances in the world, politics, the economy, monetary policy and more, the urge to do something is even greater than normal. However, the opportunity to put money to work is simply not there. At least not yet. But it’s coming. And until it does, the most proactive thing an investor can do is simply commit to doing nothing, understanding that that is not a passive decision but a very proactive and very wise one, indeed.

A Do Nothing Master

Over the course of my career in the markets, which now spans almost 25 years, one person who I have seen consistently do nothing very well is Warren Buffett. Not only does he do it well, he does it in the face of widespread criticism, criticism which usually marks the point at which his patience will begin to be rewarded.

Late in every bull market, I have seen Buffett’s Berkshire Hathaway build up a large cash pile. This is the direct result of him doing nothing with the cash the company generates until there is something to do. And every time the company does this, without fail, Buffett is loudly criticized by the financial media for being out of touch with the raging bull market. Today is no different.

Over the past few months I’ve seen headlines proclaim:

Bill Ackman Gives Up On Warren Buffett –Bloomberg, May 27, 2020

Berkshire Hathaway’s Recent Track Record Is Really, Really, Bad –MarketWatch, May 23, 2020

Could This Be The Death Of Buffett-Style Investing? –The Times, May 22, 2020

Dud Stock Picks, Bad Industry Bets, Vast Underperformance – It’s The End Of The Warren Buffett Era –MarketWatch, May 16, 2020

Has Warren Buffett Lost His Magic Touch? –Financial Review, May, 7 2020

All of this appears to be in response to Buffett’s annual shareholder meeting which was held, virtually, at the beginning of the month. At the time, Berkshire disclosed it had done more selling in the equity markets than buying, raising even more cash pushing the company’s hoard of greenbacks to record levels.

And, as Andrew Ross Sorkin noted in the New York Times, during the meeting, “he spent a notable portion of the meeting detailing the economy’s performance since 1789, with a particular focus on the years between 1929 and 1951, a period in which the stock market took 22 years to get back to its highs.”

Clearly, this is not the bullish Buffett seen back in 2008 who wrote for the very same periodical, “Buy American. I am.” This is a much more bearish version of the Oracle of Omaha, more akin to the one who wrote in late-1999 for Fortune, “Stocks Can’t Possibly Meet The Public’s Expectations,” and this Buffett has been deeply unsettling to the financial media.

Interestingly, late-1999 was also the last time the media proposed, “After more than 30 years of unrivaled investment success, Warren Buffett may be losing his magic touch.” It ran in December of 1999 in the Wall Street Journal under the headline, “What’s Wrong, Warren?”

With more than a small sense of irony, the stock market index carrying the name of the company that owned that publication, the Dow Jones Industrial Average, put in its peak a mere two weeks later and lost 40% of its value over the following three years. Berkshire Hathaway saw its share price outperform that index by more than 60% over that span.

Warren turns 90 this August and I would love to see him live to see his patience and discipline vindicated in this way once again. On the other hand, he probably has enough faith in his own process that he doesn’t worry much at all about that sort of thing.

Less Than Nothing?

If there is anything at all to do today, it’s to sell. In fact, that’s all uncle Warren has been doing. And one of the most famous sellers of all time appears to agree with both Buffett and Rogers when it comes to the most important rule of investing. In Reminiscences of a Stock Operator, Jesse Livermore concedes:

I always made money when I was sure I was right before I began. What beat me was not having brains enough to stick to my own game that is, to play the market only when I was satisfied that precedents favored my play. There is a time for all things, but I didn’t know it. And that is precisely what beats so many men in Wall Street who are very far from being in the main sucker class. There is the plain fool, who does the wrong thing at all times everywhere, but there is the Wall Street fool, who thinks he must trade all the time.

Livermore’s most famous trade, when he was sure, “the precedents favored [his] play,” was in 1929 during the Great Crash. He sold the market short and made $100 million in his personal account ($1.5 billion in today’s dollars).

I find it interesting to hear that Buffett is now focused squarely on this earlier time. There are a number of parallels, not the least of which is the current valuation of the equity market and the fact we may be facing another economic depression.

Buffett is certainly not trading from the short side with Berkshire’s capital. As his partner Charlie Munger has said of the practice, “We don’t like trading agony for money.” But he certainly seems to be positioning the company for the possibility of such an outcome, selling both banks and airlines among other stocks in the portfolio.

What’s more, I can’t recommend that anyone try to, “trade agony for money.” It’s not for everyone. Still, I feel comfortable suggesting today that if the real opportunity today is in selling, and only in selling, investors ought to consider what that means for them individually, given their own expertise and comfort level.

For most, this likely means doing as Buffett is doing and raising cash, awaiting a new opportunity to arise over the next few months or years. For more intrepid investors, it may mean some sort of hedging program or learning to trade from the short side, which requires far greater discipline than trading from the long side.

Either way, I expect it will behoove investors to simply avoid playing the “Wall Street fool” at a time when that class is growing very crowded.