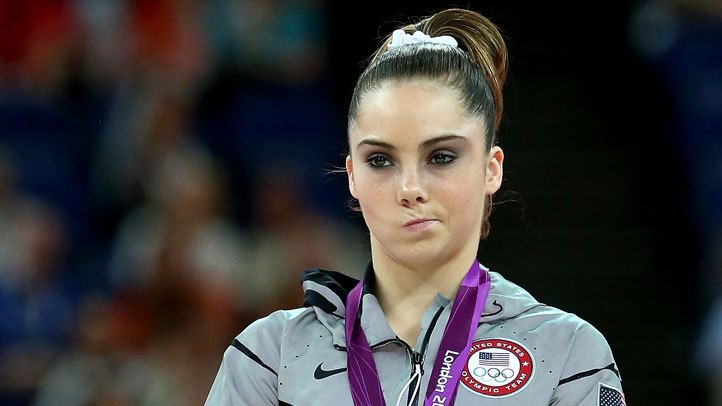

You may remember McKayla Maroney’s reaction to winning the silver medal (losing gold?) in the vault during the 2012 Summer Olympics. It became such an online sensation that the president struck the pose with her when she visited him in the oval office after the games. After Apple’s earnings report yesterday, Mr. Market made the same “unimpressed” face and sent the shares down 12% in today’s trading session.

The reason Mr. Market is unhappy with Apple’s earnings is that the company was unable to grow its reported profits from the same quarter last year. Sales were up nearly 18% from the year earlier but costs per sale increased enough (gross margins declined enough) that net earnings matched the year earlier’s number. Investors are lamenting that one of the greatest growth stories of all time is seemingly coming to an end. But if you know Mr. Market you know he doesn’t always act rationally and I would suggest that this is one of those times.

Though earnings didn’t grow, sales grew significantly suggesting that the appetite for Apple’s products is still very healthy. In addition, cash flow grew from the prior year by 33%. Personally, I prefer to look at cash flow over earnings because it’s the true measure of how much cash a company generates. When a company’s earnings are better than their cash flows I raise a skeptical eyebrow. In Apple’s case it’s just the opposite. Cash flows in the last quarter were significantly healthier than reported earnings.

Free cash flow, or cash flow minus capital expenditures, was very healthy, as well. Apple grew free cash flow 30% in the quarter to over $21 billion. Over the past twelve months the company has generated a total of $47.4 billion in free cash flow taking its cash pile north of $137 billion. These numbers are simply phenomenal. To put them in perspective, Business Insider noted today that Amazon.com has earned a mere $5 billion in its entire history. Apple generated nearly triple that amount in its last quarter.

To further demonstrate Apple’s amazing profit machine consider that aside from the company’s cash pile it has about $32.5 billion at work on its balance sheet that is responsible for generating that $47.4 billion in free cash flow. That’s greater than a 145% return on invested capital. A company generating a 45% return is considered a super star in the corporate world. 145% is absolutely astronomical. Put the cash back in to the equation and the company generates a still meaty 28% return on total assets.

So let’s take a look at what investors are really paying for in Apple’s shares today. The current market capitalization is $422 billion (938 million shares times $453 per share). Back out the cash of $137 billion and you get an enterprise value of $285 billion. That amounts to a mere 6 times the company’s free cash flow over the past twelve months. In other words, investors get a 16.6% free cash flow return on their investment at the current share price. What’s more, Apple, on an enterprise value to EBITDA measure, is now cheaper than the likes of Microsoft and Radio Shack.

Even when you don’t back out the cash in its bank accounts the stock currently trades at its cheapest valuation at any time over the past decade. Over that time, Apple’s stock price has typically found a bottom near 10 times gross cash flow. In 2011, it bottomed at 8.5 times cash flow before running 75% higher over the next 12 months. Today, it trades at 7.5 times cash flow. Any way you slice it that’s damn cheap and for one of the most admired brands/most profitable companies in history.

Now this is all rear view mirror analysis. We all know that the market is a discounting mechanism so what really matters is what Apple does over the next twelve months and beyond. The current valuation suggests to me that investors believe the company is already in decline like Microsoft and Radio Shack, as I mentioned above. Think about that: even if Microsoft were to acquire Radio Shack to have a retail presence to compete with Apple stores would you take that bet? Not a chance. There’s no way in hell those two could come close to generating an 18% sales gain let alone free cash flow margin of 28.8% like Apple just did in this last quarter (Microsoft just announced a 2.7% sales gain and 16% free cash flow margin, in fact. Radio Shack’s numbers are worse.).

Looking forward, Apple’s product demand remains strong. The company said on the conference call that manufacturing and supply constraints are still a major problem for their most popular products. In my world, that is the best kind of problem to have. To me it indicates future sales will continue to be strong. Apple has also said they will not chase market share for its own sake and so I expect gross margins to hold around 35-40%. All in all, then, sales and cash flow should continue to grow.

I wrote about “capitulation” the other day. In Apple’s case it feels like the bulls are capitulating here. There is so much negativity surrounding the stock right now that just can’t be justified by the hard numbers. Based on sales and free cash flow the company is still killing it. Their products are in amazing demand. They sold 75 million mobile devices in one quarter, for crying out loud. Investors are not so much reacting to these numbers as they are to their own emotions at seeing the stock price fall 35% over the past few months.

I bought a couple of shares for my kids today and explained it this way: buying the stock at the current price is better than buying a new iPad at half price. You get something great at a fabulous discount and rather than be on the buying end of the upgrade cycle you’ll be on the selling end. And I expect sometime soon Mr. Market and everyone else who sold today will look as silly as McKayla did frowning at something that should be celebrated.

Chart(s) of the Day

On the daily chart I’ve added Tom DeMark’s sequential indicators. I know Tom loves this 9-13-9 pattern; he considers it one of the most powerful in his arsenal. As you may remember he called a bottom in the stock on that last 9 a little over a week ago. Today’s selloff took the share price below this and even his “risk level.” Normally, this risk level indicates where you should put your stop loss but Tom has also said that a false break of the risk level is sometimes the best place to buy. We’ll see if the stock can manage to regain that level over the next couple of sessions. The next step would be a move above the upper line of that ending diagonal ($520ish) to confirm that pattern. We’ll keep our eyes open.

This next chart is absolutely critical. Apple has fallen to a key level that marks the intersection between its 38.2% retracement (a Fibonacci level) and its weekly uptrend line. Actually, it broke below this level which sits at about $463. If it can regain this level I believe it has a very good chance of forming a bottom here. Stay tuned, folks.