It’s been almost five years since I wrote, “It’s Time To Get Greedy In The Gold Market.” Gold prices have risen from under $1,100 an ounce to roughly $1,600 an ounce today, almost doubling the return in the S&P 500. And there are a couple of reasons to expect that this relative outperformance has only just begun.

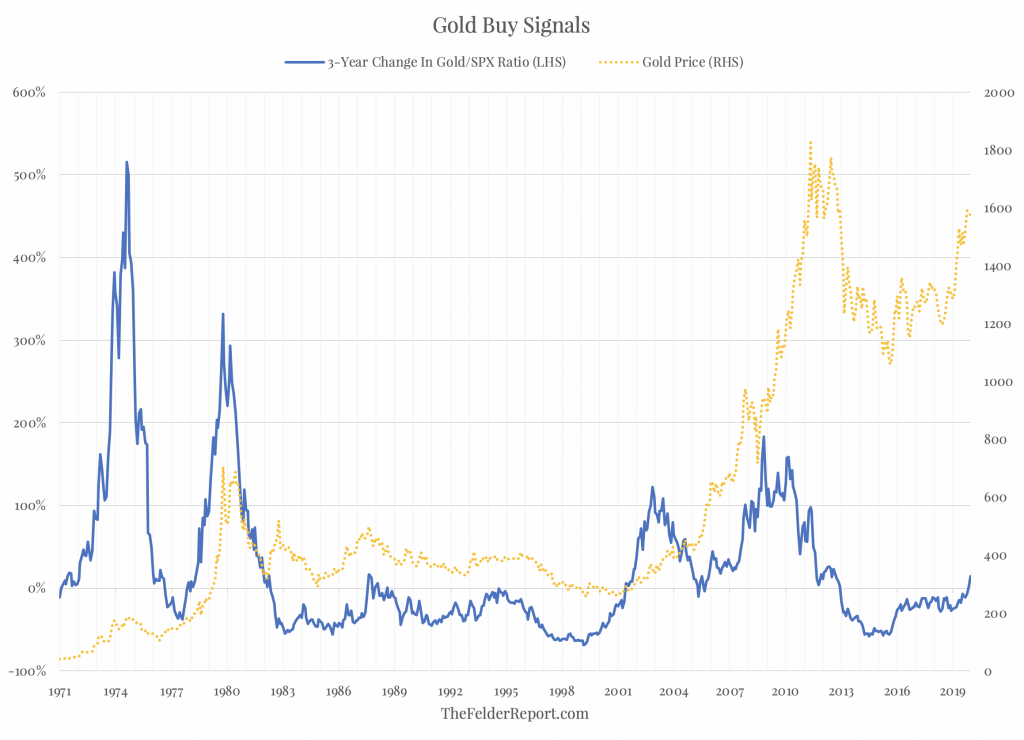

First, as I have written before, there are times to own gold and times to own stocks but there aren’t really times when it makes sense to own both. The 36-month rate of change in the ratio between gold and the S&P 500 has provided a pretty good signal in this regard. In the past, when it has crossed above the zero line it has been a good buy signal for gold and good sell signal for stocks. It did so at the end of February (proving its worth once again).

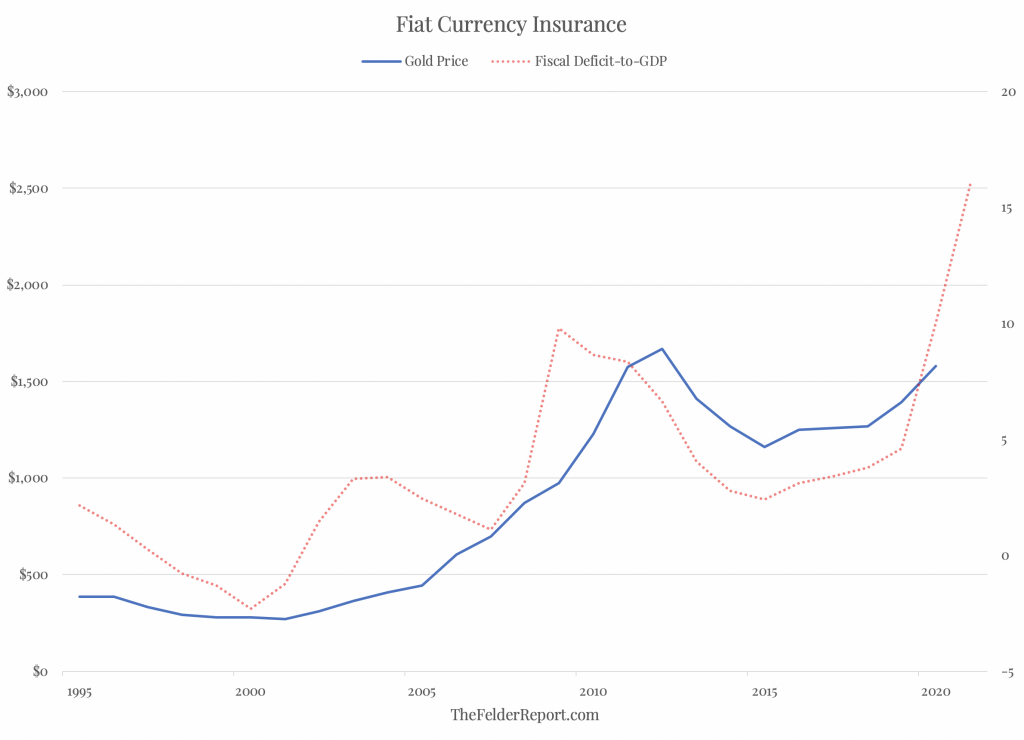

Furthermore, gold prices tend to rise when the fiscal deficit as a percent of GDP is rising. Part of the reason for gold’s strong performance recently is the fact that the annual deficit recently rose above $1 trillion for the first time since the aftermath of the Great Financial Crisis when gold prices rise to nearly $2,000 an ounce. Some expect the deficit to expand by a much greater degree in the current crisis than it did a decade ago as a result of the combination of record fiscal stimulus paired with falling revenue. If so, gold would very likely break out above the high it set in 2011.

Together these two indicators would seem to make a compelling case for allocating a significant portion of your investment portfolio to gold right now, if you haven’t done so already. Not only can it act as an effective diversifier in normal times, there are not-so-normal times when not owning gold can be dangerous to your wealth. As Ray Dalio has famously said, “If you don’t own gold, you don’t know history.” Or, as I like to say, “Gold: It does a portfolio good.”