You can always count on a blowoff in the stock market to bring out the most creative and sincere of rationalizations. Most often we hear something along the lines of, “it’s a liquidity-driven rally,” suggesting that monetary policy is forcing stock prices higher. This is one we have heard not just for the past few months but for the entire duration of the bull market. And it’s popular because there is some semblance of truth to it even if it is not the whole truth.

Another rationalization that has been popular for quite a while but has made a comeback with the surge in equities is the idea that because interest rates are so low, much higher valuations are justified. These folks like to point to a comment Warren Buffett made last in a CNBC interview last May: “I think stocks are ridiculously cheap…” They fail, however, to remember how he qualified that statement: “…if you believe that 3% on the 30-year bonds makes sense.”

Another rationalization that has been popular for quite a while but has made a comeback with the surge in equities is the idea that because interest rates are so low, much higher valuations are justified. These folks like to point to a comment Warren Buffett made last in a CNBC interview last May: “I think stocks are ridiculously cheap…” They fail, however, to remember how he qualified that statement: “…if you believe that 3% on the 30-year bonds makes sense.”

Here’s where the larger context can be very instructive. Buffett’s quip about stocks being cheap was in response to a question about broad stock market valuations but it followed on the heels of his business partner, Charlie Munger, answering the same question by discussing the valuations in the fixed income markets, if in a very roundabout way:

I am so afraid of a democracy getting the idea that you can just print money to solve all problems and eventually I know that will fail… All the politicians in Europe and America have learned to print money… Who knows when money printing runs out of control? At the end, if you print too much you end up with something like Venezuela.

Does this sound like someone who believes 3% on the 30-year bond makes sense? So Buffett’s quote was really more than an answer to a question about valuations; it was really an answer to the question, ‘Are both stock and bond valuations too high?’ Here’s how he answered:

I probably could not have conceived a world… where you would have full employment, 5% budget deficits with actually the probability of those rising from that level and at the same time have the long bond at 3%. I would have said that that couldn’t happen… The convergence of these factors would have seemed impossible to me and, generally, if I think something is impossible it’s going to change. Over time, I don’t know in what way but I don’t think we can continue to have these variables in this relationship. Now if we can, then stocks are ridiculously cheap… It looks like Nirvana; it looks like we’ve found the promised land where essentially money doesn’t cost anything and you can print lots of money and no inflation… I wouldn’t think you could have these things at these levels. Long-term rates, inflation rates, budget deficits and have that be a stable situation for a long time. And I still believe that.

To me, that sounds like someone who believes 3% on the 30-year bond should be impossible given where unemployment and the fiscal deficit currently sit. Should those latter two variable stay the same, then interest rates should be higher and thus equity valuations lower. To justify 3%, on the other hand, unemployment would have to be higher or the deficit much lower. Either way, you’re looking at recession and thus lower equity valuations.

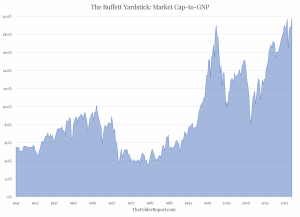

Perhaps, this is why Warren currently holds his largest cash position in history. He certainly is not acting as if stocks are “ridiculously cheap” as so many would like to believe today in rationalizing a stock market trading at its highest valuation in history. And, in light of his comments, I’m sure he wishes he had been able to buy precious metals over the past few years rather than allow that cash pile to grow to where it is today.