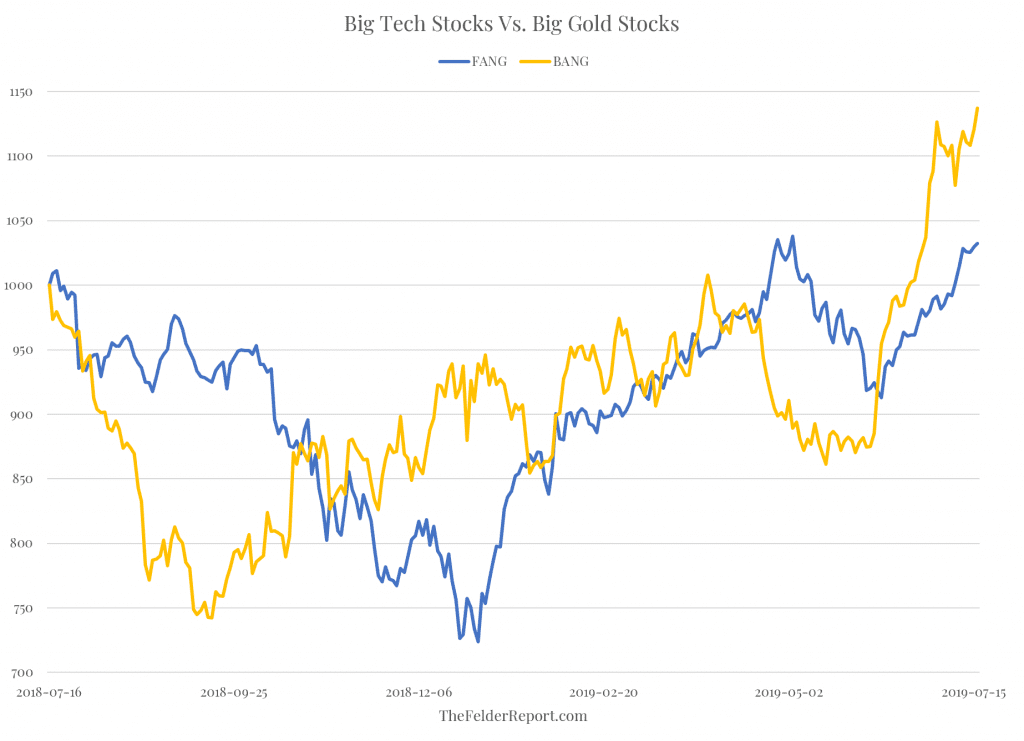

Over the past year or so I’ve been writing that Facebook, Amazon, Netflix and Alphabet/Google, the FANG stocks as they are well known; were likely to be overtaken by Barrick, Agnico Eagle and Newmont Goldcorp, a group I have dubbed the “BANG” stocks (see: BANG: Why The Gold Miners Could Soon Make FANG Look Tame and BANG: The Ultimate Anti-Passive Investment). Recently, this prediction was borne out. Over the past 12 months, BANG performance has beaten FANG and it has done so by more than 10%.

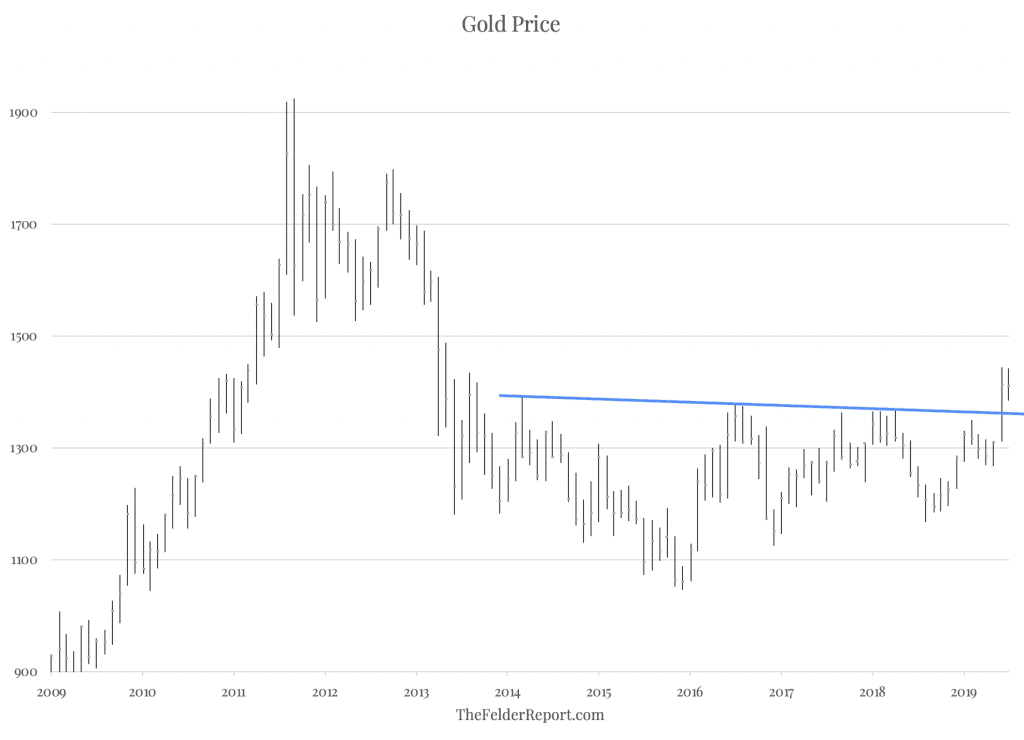

This is largely in reaction to the recent breakout in gold prices above multi-year resistance. And there’s plenty of reason to believe gold prices could continue to march higher over the next several years (see: The Fundamental Case For Owning Gold Today and Why Warren Buffett Would Be Buying Precious Metals Again Today (If He Could).

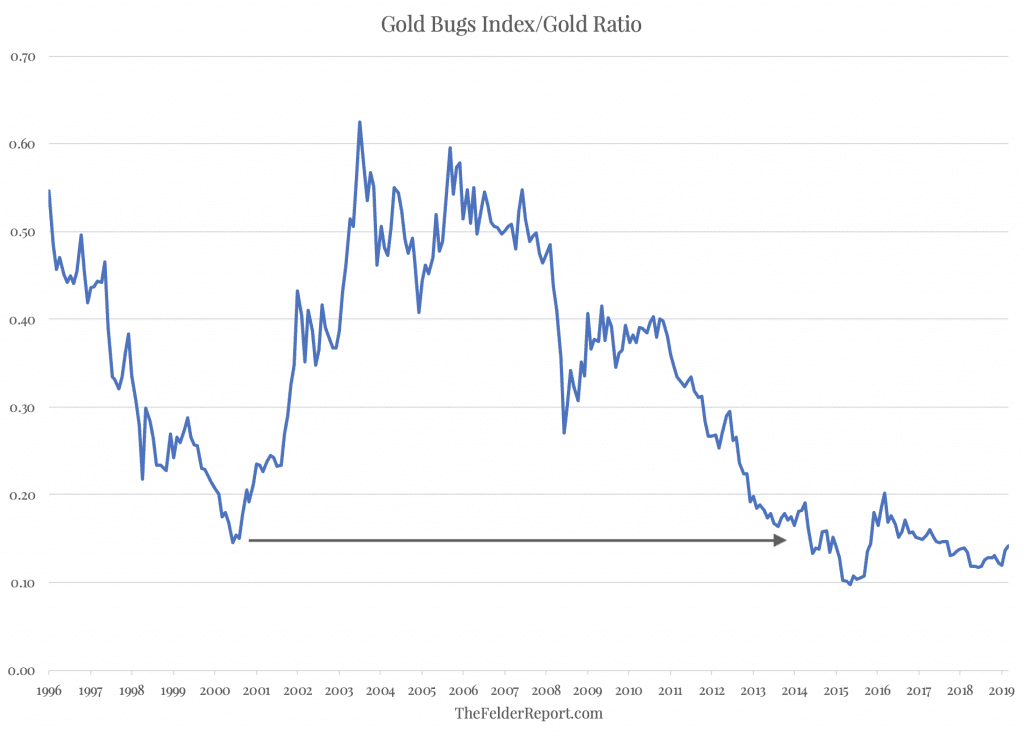

Finally, the gold miners remain extremely cheap relative to the precious metal. The ratio of the Gold Bugs Index (HUI) to the gold price essentially remains near its lowest levels on record. If this ratio were merely to return to the middle of its historical range around 0.35 it would mean the Gold Bugs Index would have to rise another 150% beyond its 100% rise since 2015, even without any further rise in the gold price.

Should gold continue higher, as Paul Tudor Jones recently suggested it would, then the outperformance of the mining stocks over the broad market, and even its most popular favorites, has only just begun.