Below is our third quarter discussion of the major asset classes in our tactical ETF portfolio.

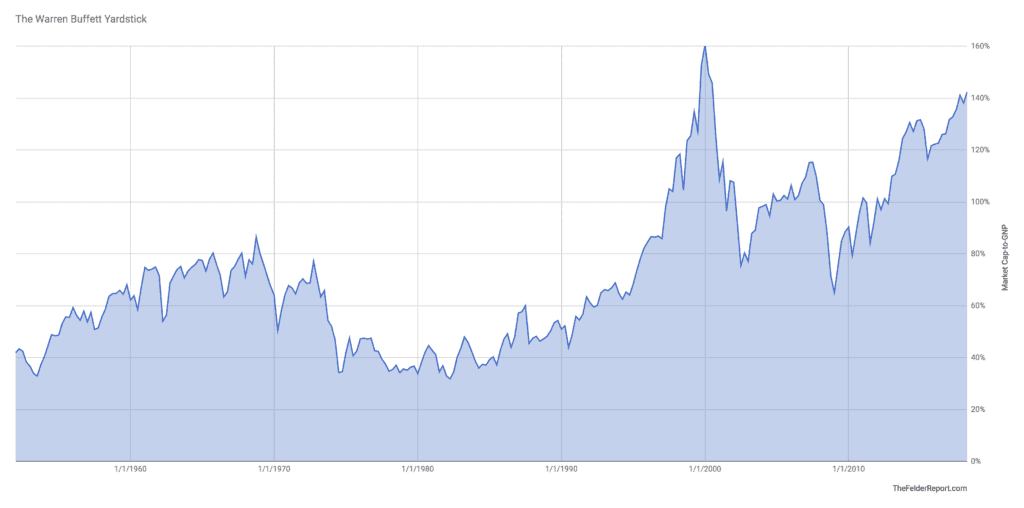

Stocks rallied to new highs in the third quarter taking the Buffett Yardstick to a new high, as well. In other words, the value of the stock market relative to the size of the economy remains at a very rare extreme. Only during the brief span of Q4 1999-to-Q3 2000 were stocks more expensive than they are today, at least according to this measure. (Many other measures, like the median price-to-sales, show stocks being much more expensive today than ever before.)

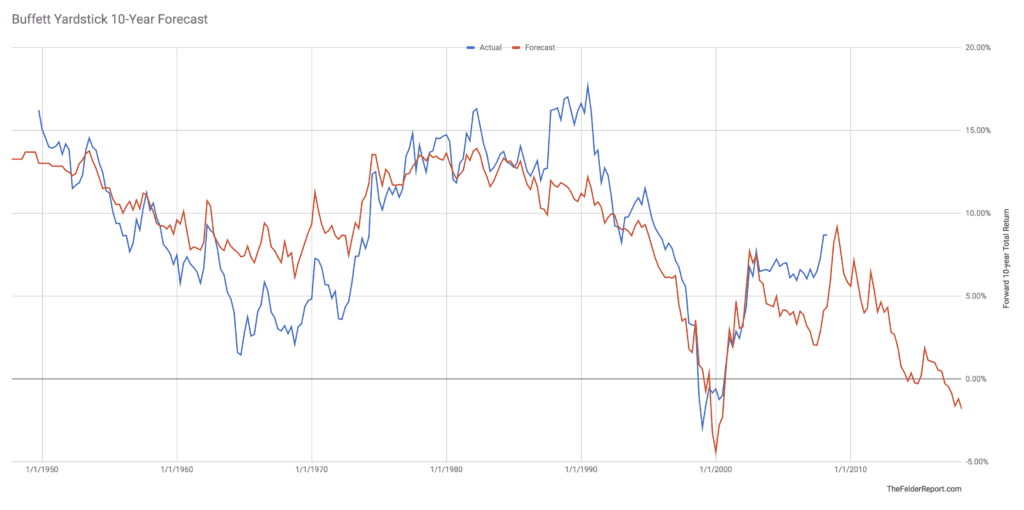

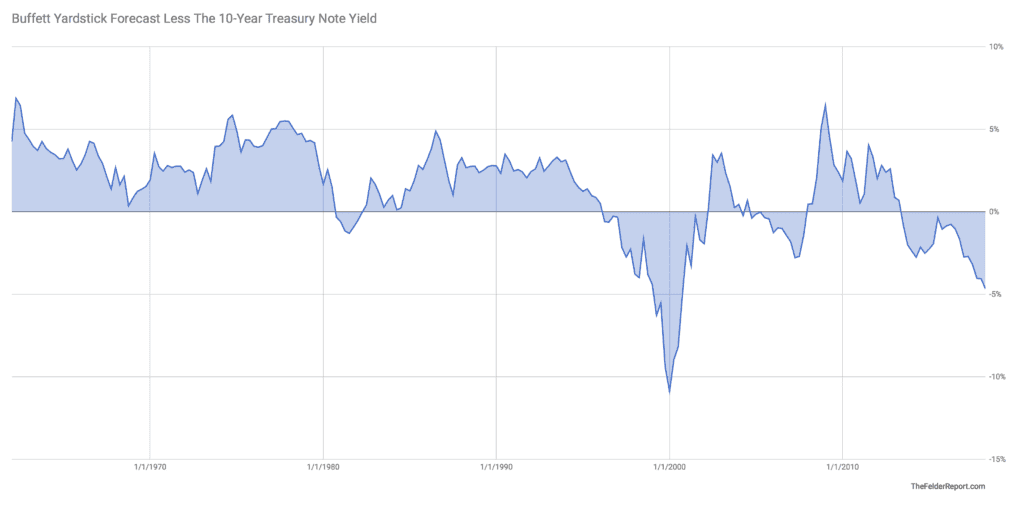

As Warren Buffett has famously said, “the price you pay determines your rate of return.” Because investors are paying some of the highest prices in history today they are very likely going to receive some of the lowest returns. The forecast derived from Buffett Yardstick now suggests stocks should average a loss of 1.8.% per year, including dividends, over the coming decade.

This certainly compares very unfavorably with the near-3% offered by the 10-year treasury note currently.

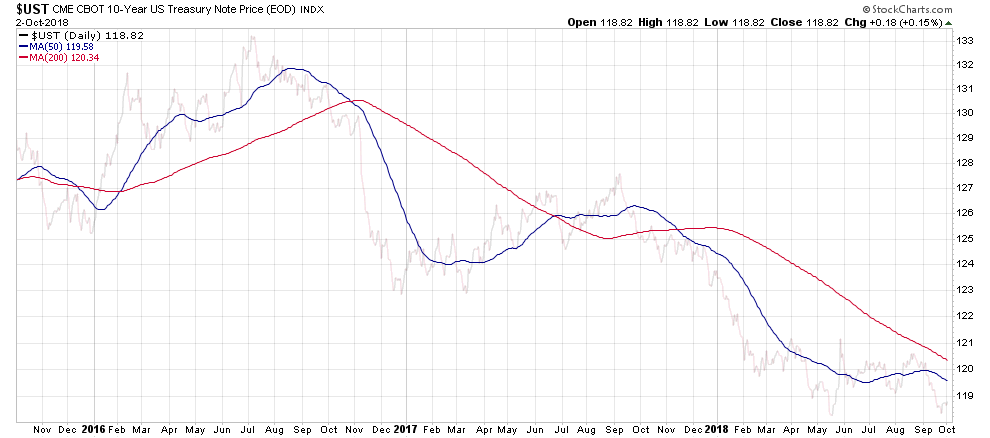

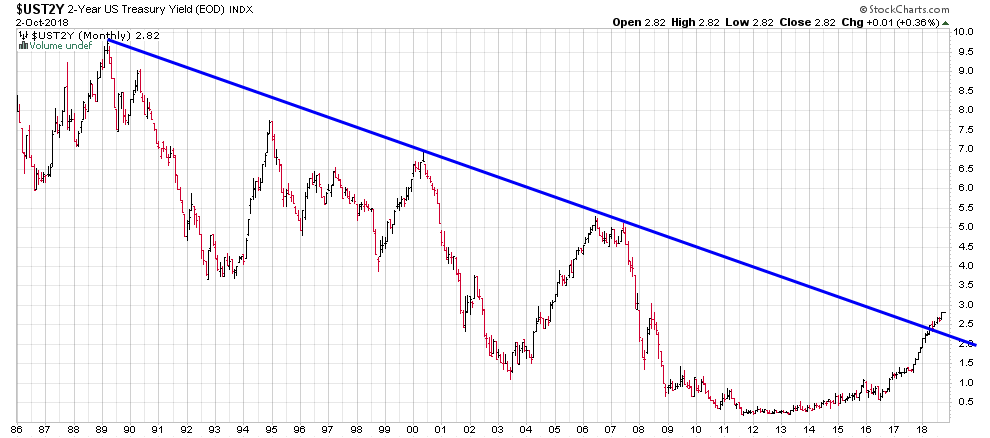

But treasury notes have not fared well lately and remain in a clear downtrend.

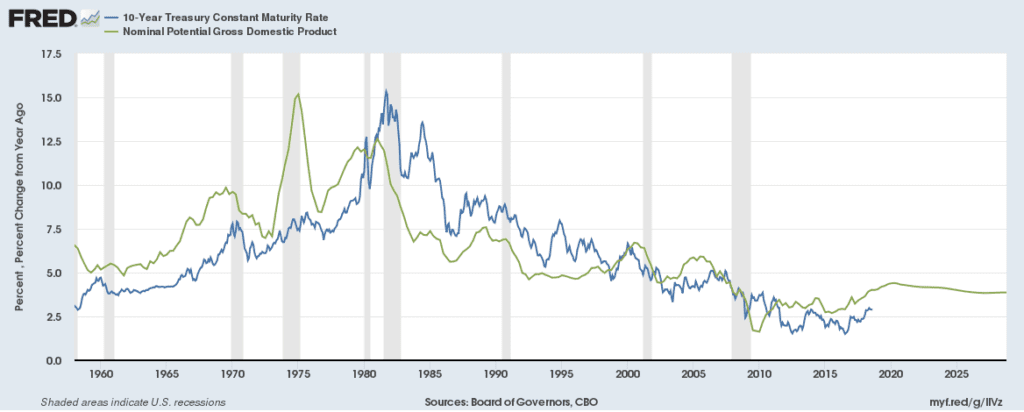

And with inflation continuing to gather steam, it looks like the current bear market in bonds could have much farther to go. In fact, it looks very similar to the period of the mid-1960’s when nominal potential GDP really began growing again, mostly as a result of rising inflation, and interest rates, with the help of an overly easy Fed, began a long period of persistently playing catch up.

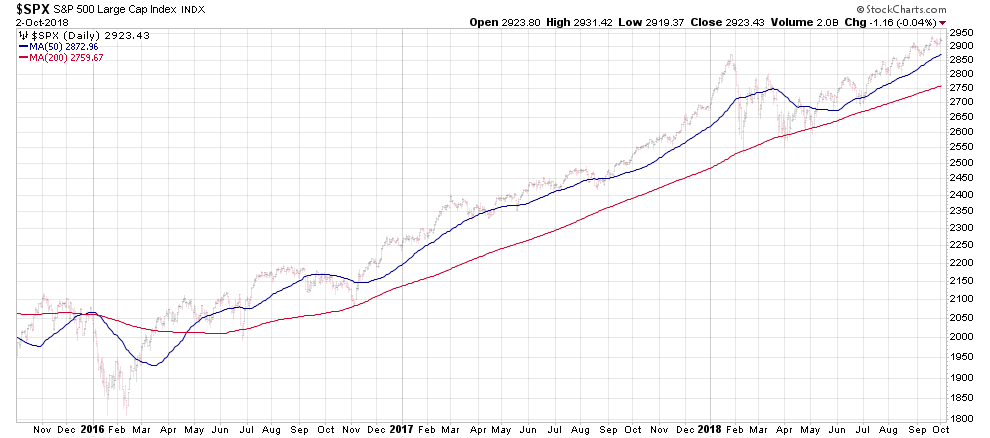

For these reasons we remain underweight both asset classes at present. Though, because stocks remain in a technical uptrend, it is understandable that investors might want to “let it ride” for the time being. That being said, because valuations are so extreme even a technical uptrend can’t justify an overweight position at present.

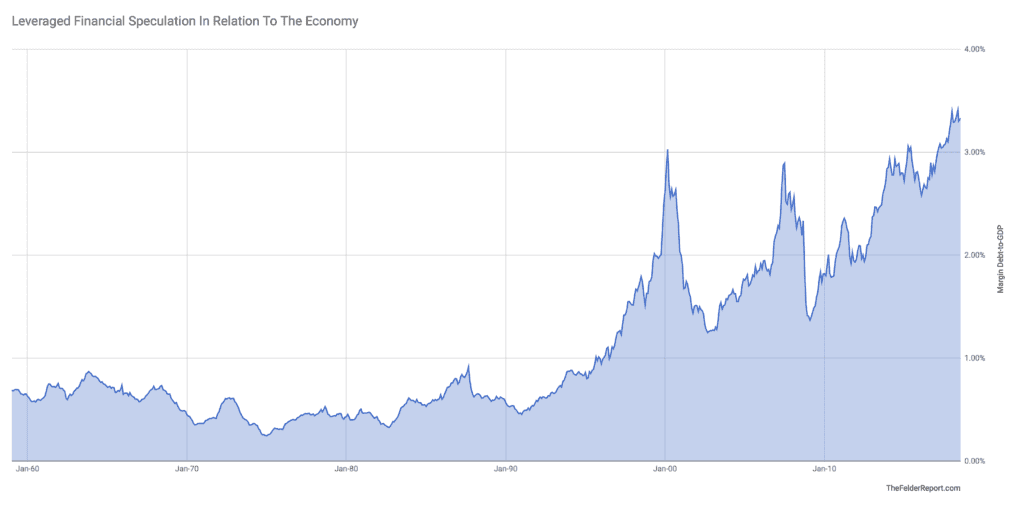

That hasn’t stopped most investors from going heavily overweight recently. Almost every measure I look at to assess investor positioning is at an all-time extreme. Margin debt levels or, as John Kenneth Galbraith referred to it, “the index of the volume of speculation,” continues to demonstrate that leveraged speculation as a percent of the overall size of the economy is totally off the chart. As the previous two peaks, in 2000 and 2007, demonstrated, this debt quickly becomes forced supply in a bear market. Thus risk to the equity market today is as great as it has been at any time during the past half-century at least.

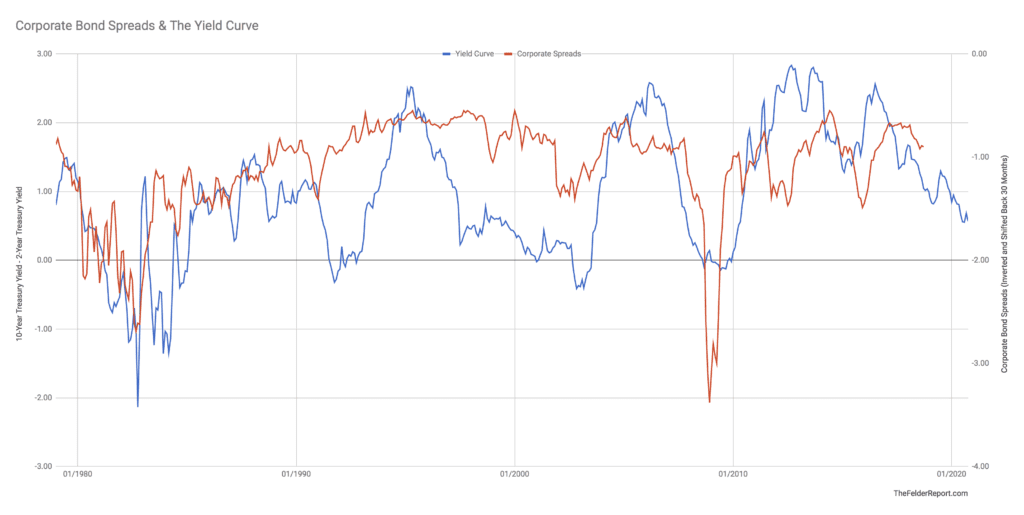

Corporate bonds are no better than stocks or treasuries. If inflation takes off, as I think it will, there’s a good chance corporate bonds will suffer from not just a rise in interest rates but also a squeeze in corporate profit margins and a resulting widening in spreads. Even barring such an outcome, the yield curve (the spread between the yield on the 10-year treasury and the 2-year) is suggesting spreads should continue to trend wider over the next few years pressuring bond prices (and, almost certainly, stocks).

Investors looking for income would do well to focus on the short end of the yield curve utilizing some sort of bond ladder. The 2-year treasury now yields nearly as much as the 10-year (hence the flattening of the yield curve, the blue line in the chart above). The 3-month treasury bill yields 2.19%. Spreading some money across those maturities and a few in between seems like a very good way to earn some income while avoiding the current unattractive risk/reward equation in most asset classes. It also provides some significant optionality if/when that equation becomes more favorable.

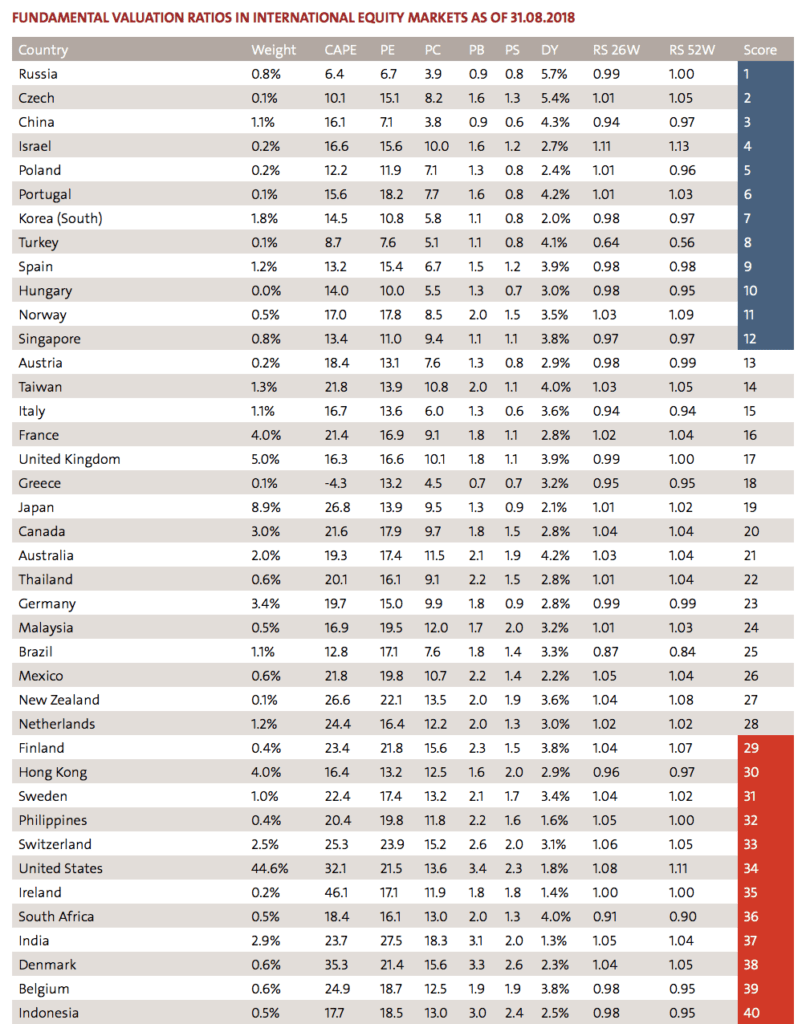

While our markets are currently priced for perfection, markets overseas are much more reasonably priced, especially emerging markets like Russia and China, both of whom find themselves at the bottom of the global valuation range (chart below via StarCapital). This is the main reason we currently have an equal-weight position in EM. Should they manage to turn technically from downtrend to uptrend we will likely go overweight. Should developed foreign markets do the same we will probably go to an equal weight position there but, for now, they are just not cheap enough and are far too highly correlated to the US market over time to have much confidence in them right now.

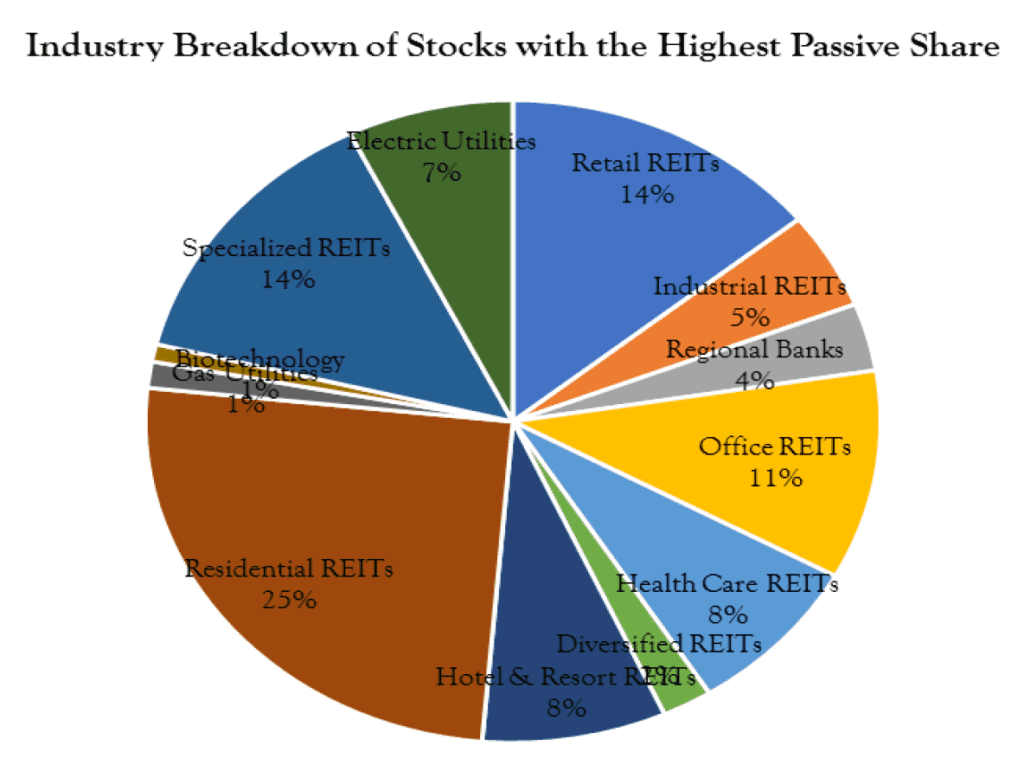

As and asset class, real estate, like bonds, is at risk of repricing due to rising interest rates. In fact, there was a recent research report put out demonstrating that the passive investing push in recent years has, in fact, been responsible for a great deal of the extreme pricing in the securities markets and REITs are the single most affected sector (chart below via Vincent Deluard). For this reason alone, real estate could be the most overvalued sector in the market at present.

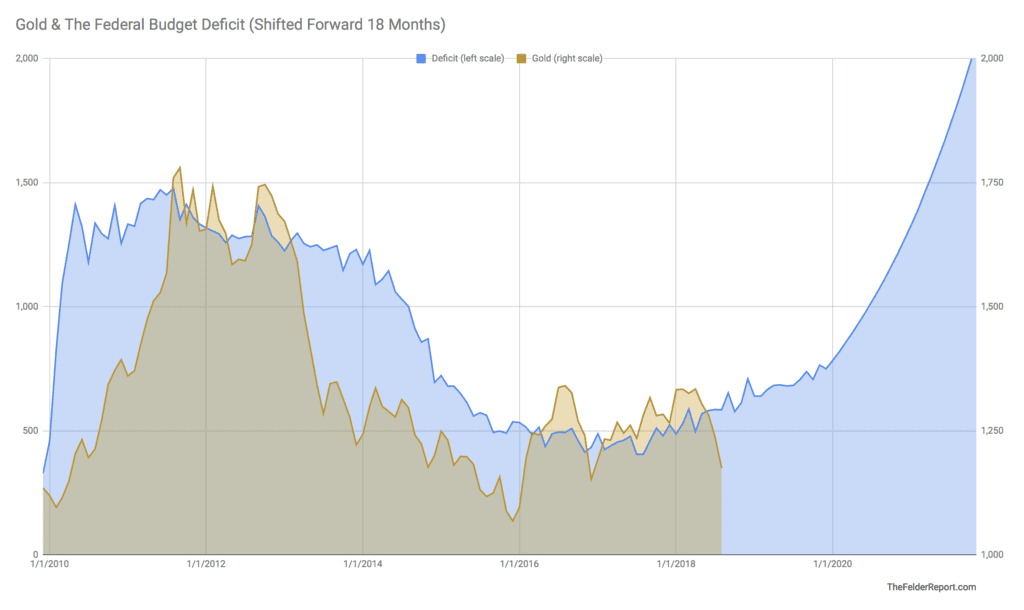

By far, the most attractive asset class and the best hedge against rising interest rates and inflation is precious metals. Gold, in particular, is an asset class that I believe could very well be the focus of the next bubble that has moved from cryptocurrency to cannabis this year. As the federal deficit widens it provides a massive tailwind to the price of gold. And, for the first time since the late-1960’s it is widening during an economic expansion (though it is already larger, as a share of the economy, today). Should we get a recession it will quickly surpass the peak deficit we saw during the financial crisis. Either way the tailwind behind the gold price is only growing stronger.

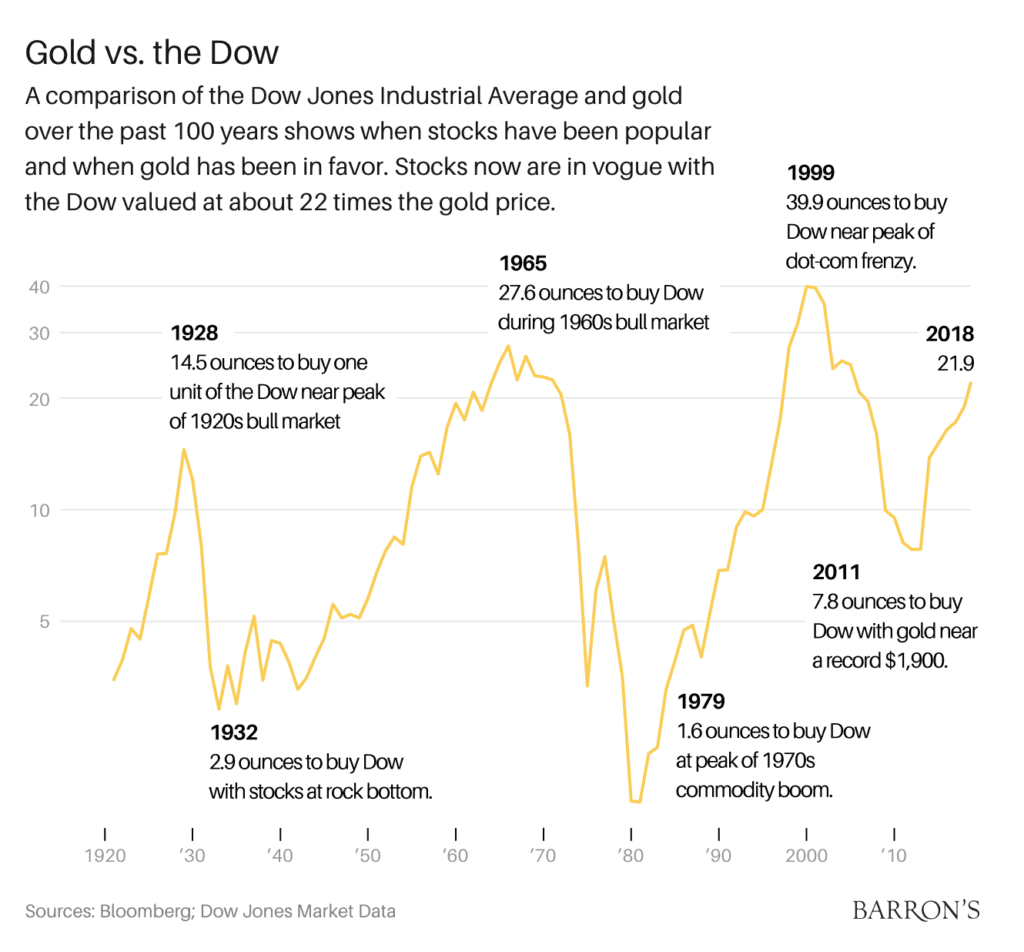

And, as pointed out by Barron’s recently, the gold price relative to the Dow Jones Industrial Average is about as cheap as it was back in 1965 before it took off on one of its most spectacular bull markets in history. Typically, at bull market peaks in the gold price reaches parity with the Dow which currently trades at over 26,000. Even if we were to get another 50% crash in that index a 13,000 price target for gold would mean a 10-fold rise from its current level.

My favorite vehicle for investors to use here is the Sprott Physical Gold and Silver Trust. First of all, it currently trades at a 4% discount to the precious metals it holds in storage, a wonderful bargain for investors looking for exposure. Second, since Sprott took it over they allow investors to redeem their shares in the fund for physical bullion so there is no concern about the limitations of owning “paper gold” or the potential problems in certain ETFs.

The bottom line is that financial assets, in general, remain highly unattractive while real assets, namely precious metals, represents a very rare opportunity for investors with the wherewithal and patience to take advantage.