Wall Street is in the midst of some pretty massive change right now. And I’m talking about Wall Street as it relates to Main Street. I’m talking about how individual investors are being courted (hunted) and cared for (killed) by the new wolves of Wall Street.

Brokers have now become an endangered species as the model has been attacked on two sides by fee-only investment advisers (aka, RIAs) and discount brokers advocating a DIY approach. And now there’s a third entrant attacking both the brokers and RIAs: robo-advisers. All in all this evolution is good for investors as it ultimately brings down costs.

But don’t underestimate greed’s resilience and its willingness and ability to adapt. As they say, “the more things change, the more the stay the same.” Many brokers are making the switch to RIAs. In fact, they’re doing it in droves (witness the growth of the likes of LPL Financial). Changing your title and even your business plan, however, won’t magically turn a wolf into a sheep but it does make him harder to identify.

Make no mistake. There are plenty of wolves left on Wall Street. They just don’t call themselves wolves anymore. In fact, they do everything in their power to look like innocent, cuddly sheep. They setup as RIAs now. Many even preach a low-cost, passive or index-based approach to investing, aligning themselves with the likes of Burton Malkiel, Warren Buffett and Jack Bogle, some of the most respected names in the business.

It’s the ultimate hypocrisy. You see, while they preach a low-cost approach and may actually use low-cost products like index ETFs, they’ll charge you an arm and leg for the privilege – as much as 2% per year. As Meb Faber put it, “you’re a predator if you’re charging 2% commissions and or 2%+ fees for doing nothing.” I’m sure the wolves, who normally brag about ‘eating what they kill,’ would take this as a compliment. Meb continues,

Anything more than 0.5% or so on top of fund fees is either paid a) out of ignorance, which is not always the investor’s fault or b) as a tax for being irresponsible. For the latter I mean a fee to keep you out of your own way of chasing returns and doing something stupid, much in the same way someone pays Weight Watchers or any other diet advice program when you know what you should be doing (eat less, exercise more).

I’d say that anything more than 0.25% for “managing” a passive portfolio of index ETFs these days is obscene (it’s not even really “managing” if it’s passive – more like “overseeing”). And there are plenty of advisers charging nearly ten times that amount. And what’s the money for? What are you paying these fees for year after year? Because if the funds themselves do all the work and merely need to be rebalanced a couple of times it might take 15 minutes per year.

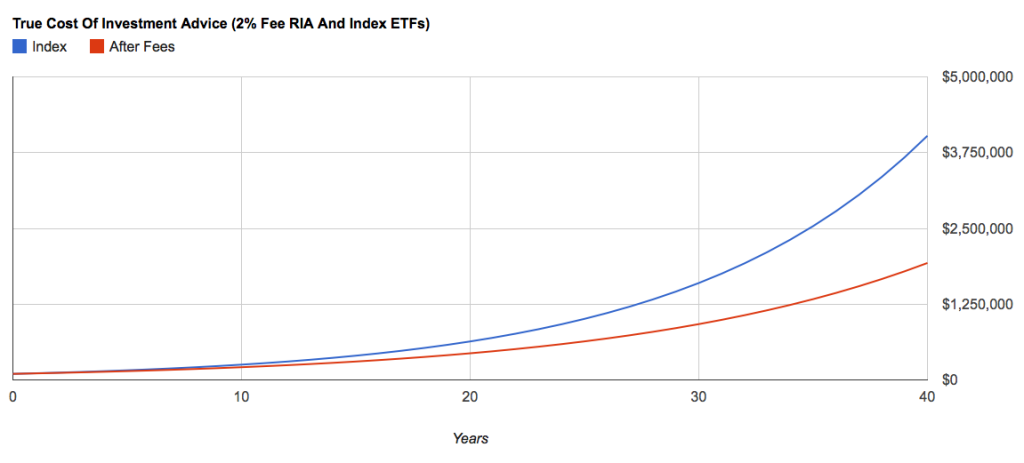

At the end of the day, you’re paying for the pleasure of their company. And that 2% fee might not seem like much but it really adds up over time. As Albert Einstein famously said, “compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” Over 40 years, on $100,000 initial investment, that 2% fee you’re paying compounds into roughly $2 million. Even Kate Upton‘s company is not worth that much.

That chart above shows the growth of $100,000 over 40 years assuming a rate of return of 9.68% for the index fund (the return over the past 40 years) and 7.68% for the investor paying 2% to his adviser. The DIY guy ends up with a little over $4 million and the guy with the wolf, I mean adviser, ends up with a little less than $2 million. That’s right, the wolf ends up eating over half of your profits.

So when I call these fees “predatory” or “obscene” this is why. Wolves preaching a low-cost, passive approach and charging these fees represent the height of hypocrisy – or the height of greed – take your pick.