It's either bullish that so many are calling for a market peak or super-bearish. Too many now looking for a standard correction. $SPY $ES_F

— Jesse Felder (@jessefelder) November 11, 2013

Right now it seems that the talk of an overbought market has become popular opinion. However, popular opinion is rarely (if ever) right. It works like this: Once enough people have latched onto an investment idea there there comes a point at which there are no longer any marginal buyers left to push it higher (or sellers to push it lower) and so the majority is proven wrong. This is the very foundation of contrarianism.

“All the people can’t be all right all of the time.” -Bob Dylan

So how do we deal with the fact that more and more people are coming around to the idea that ‘stocks are overbought and due for a pullback.’ First, because so many are now anticipating it, I think we safely rule the ‘standard pullback’ scenario out. The other possibilities are stocks continue to march higher, just meander sideways for a while or we see something more dramatic to the downside.

Because sentiment is so skewed bullish right now I think the possibility of higher prices becomes less likely over the intermediate term. Sure stocks can surge over the next few weeks on pure momentum but the already skewed sentiment makes me think that the odds of lower prices on a 1-3 month time frame are far more likely than higher prices. As for stocks meandering, that almost never happens, especially after the run up we’ve already witnessed – near parabolic in many cases.

That leaves the “something more than your average correction” scenario which I think is most likely at this point because it’s the least popular. Over the weekend, Henry Blodget penned a piece detailing this scenario and was met with fierce opposition mostly of the trollish kind. And when people get pissed off at a simple idea like this without even evaluating its merits it tells me he’s onto to something.

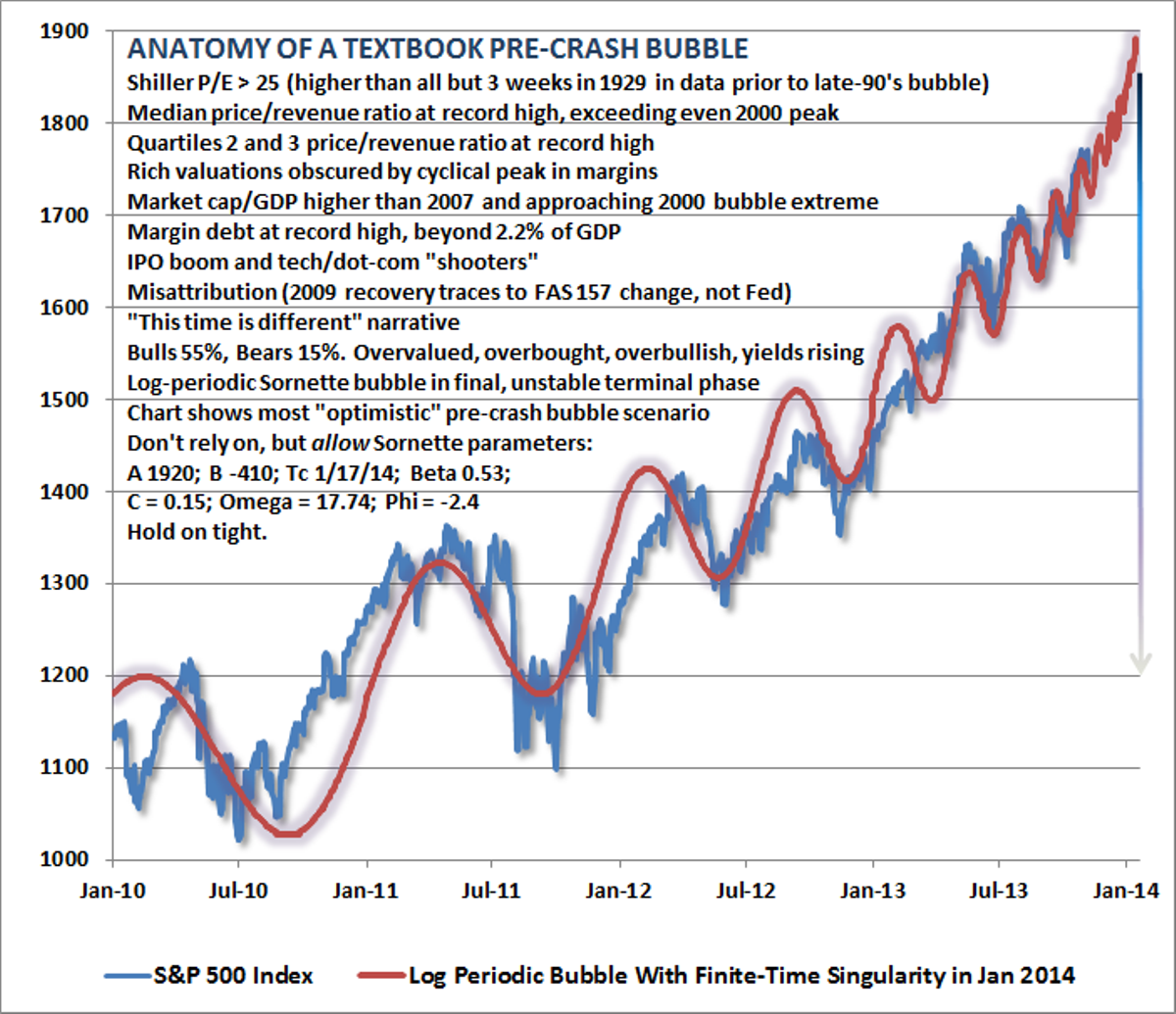

Chart of the Day

Presented without comment via @hussmanjp: