Hey listen here

Now your mortgages and homes

I got stiffness in the bones

Aint no beauty queens in this locality (I tell you)

Oh but I still get my pleasure

Still got my greatest treasure

Heap big woman you gonna make a big man out of me

Now get thisOh you gonna take me home tonight (please)

Oh down beside your red firelight

Oh you gonna let it all hang out

Fat bottomed girls you make the rockin world go round

Fat bottomed girls you make the rockin world go round

Get on your bikes and ride-Fat Bottom Girls (Queen)

The other day, one of my favorite analysts, Jason Goepfert, pointed out that the Bank Index was once again getting stretched pretty far from its 200-day moving average, a very common technical indicator.

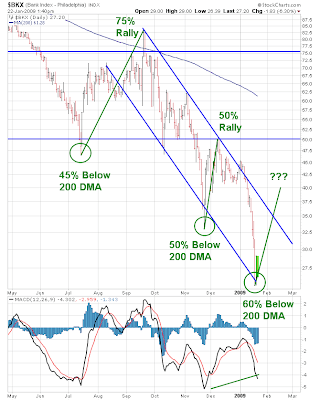

I thought it might be interesting to take a look at exactly how stretched it currently is and how it currently compares to other, recent occurrences. The chart below shows the past couple of times the Bank Index has dropped so far below its 200DMA (the only times in the history of the index that this has ever happened, according to Jason):

As the chart clearly shows, according to this measure (60% below its 200DMA) the index has never been this oversold. The past couple of times it has come close, in July and November of last year, the index saw dramatic snap-back rallies in pretty short order. Another difference this time is the potential for a divergence in the MACD lines, a bullish technical sign.

In addition to the positive technical picture, I am simply astounded at the pervasive negativity surrounding this sector. Sentiment is universally bearish – and I… well, I think I might be in love:

Note: Check out Jason Goepfert’s superb work at SentimenTrader.com – I highly recommend it.