Below are some of the most interesting articles, quotes and charts I came across this week. Click here to subscribe to our free weekly newsletter and get this post delivered to your inbox each Saturday morning.

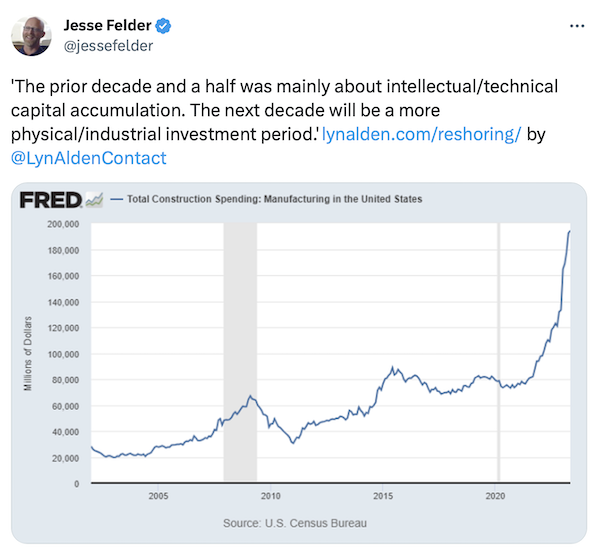

The long-term nature of the capital cycle means that major investment themes typically last a decade or longer. Recent trends in capital spending suggest a major transition is now underway.

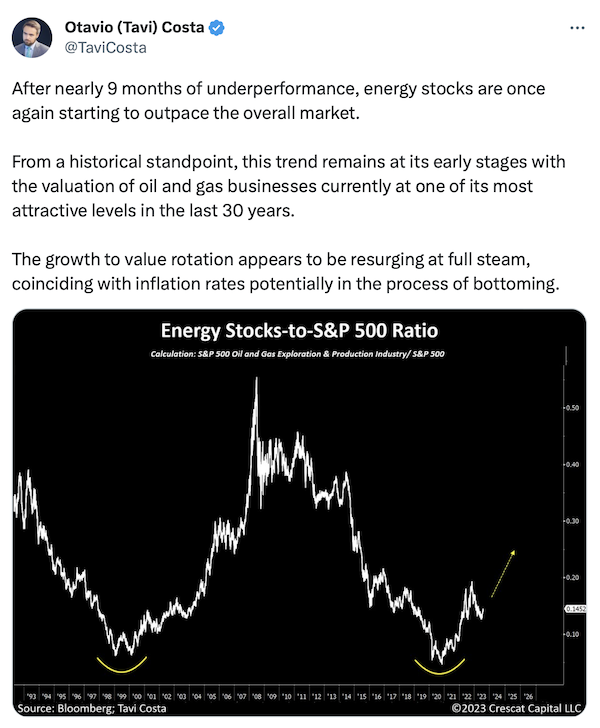

Significant investment in industrial capacity requires a great deal of energy, a fact investors have only just begun to appreciate.

Significant investment in industrial capacity requires a great deal of energy, a fact investors have only just begun to appreciate.

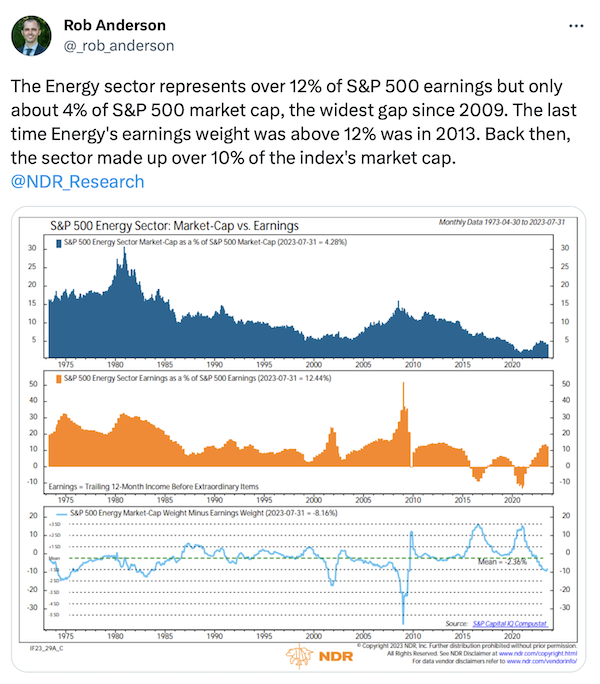

Despite the energy sector’s dramatic outperformance over the past few years, it remains significantly underrepresented in the major indexes and thus in investor portfolios, as well.

Despite the energy sector’s dramatic outperformance over the past few years, it remains significantly underrepresented in the major indexes and thus in investor portfolios, as well.

Trends in fiscal policy, partly related to the shift towards industrial investment and infrastructure renewal, are not disinflationary.

Trends in fiscal policy, partly related to the shift towards industrial investment and infrastructure renewal, are not disinflationary.

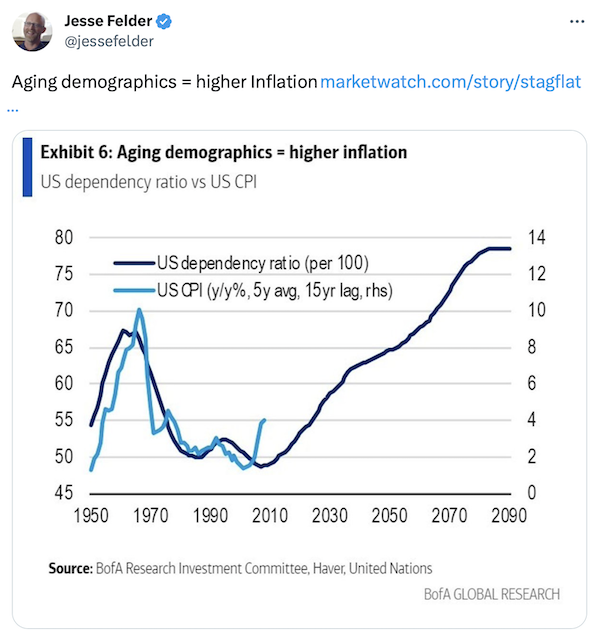

And expanding manufacturing and infrastructure spending at a time when the working population is rapidly shrinking relative to the total only compounds the problem.

And expanding manufacturing and infrastructure spending at a time when the working population is rapidly shrinking relative to the total only compounds the problem.

Thanks for reading and have a great weekend!

Thanks for reading and have a great weekend!