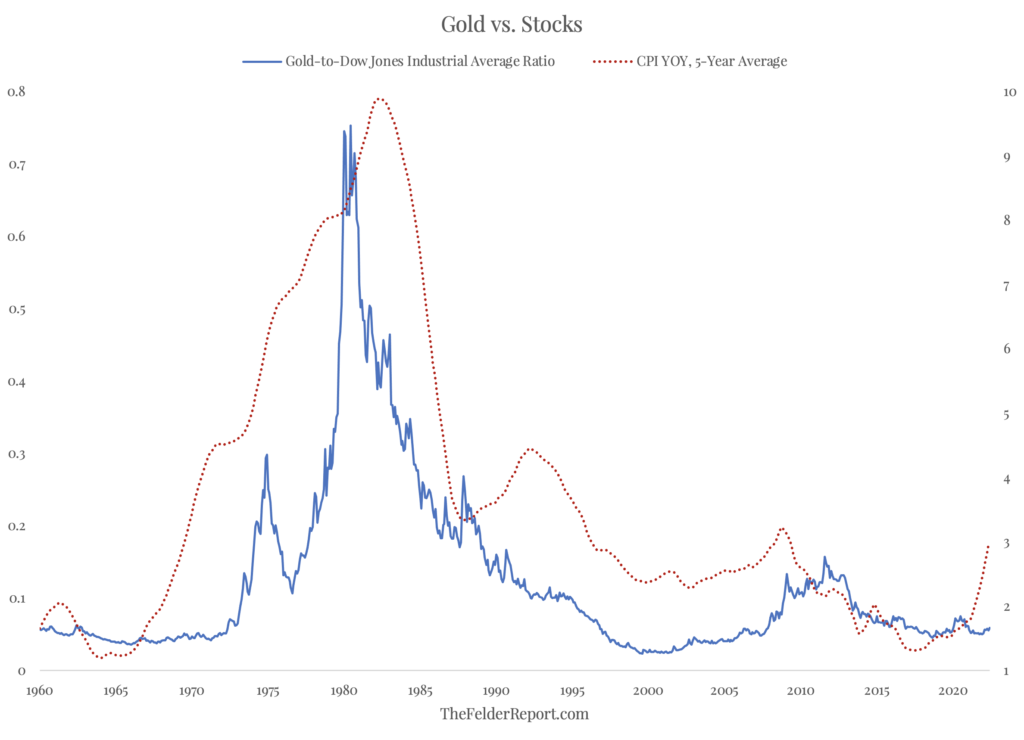

Volatility in the markets this year has largely been driven by the rise in inflation. So if rapidly rising price pressures are going to quickly dissipate, taking inflation back below 2%, then perhaps the moves in markets this year will be seen in hindsight as, “filled with sound and fury, signifying nothing,” to quote Shakespeare. Certainly, this is what markets are still discounting even after their recent ructions. Equity prices remain extremely elevated while gold prices remain relatively depressed. Episodes of rising inflation typically see just the opposite.

Therefore, if inflation proves more durable than markets currently discount, the recent volatility may be merely prelude to a more significant repricing across a number of asset classes. In fact, the level of CPI today already suggests that gold, relative to equities, may be just about as undeservedly cheap as it was a half century ago, the last time inflation really became a problem. And if inflation remains elevated, gold prices could have a terrific amount of upside ahead, especially relative to stock prices.