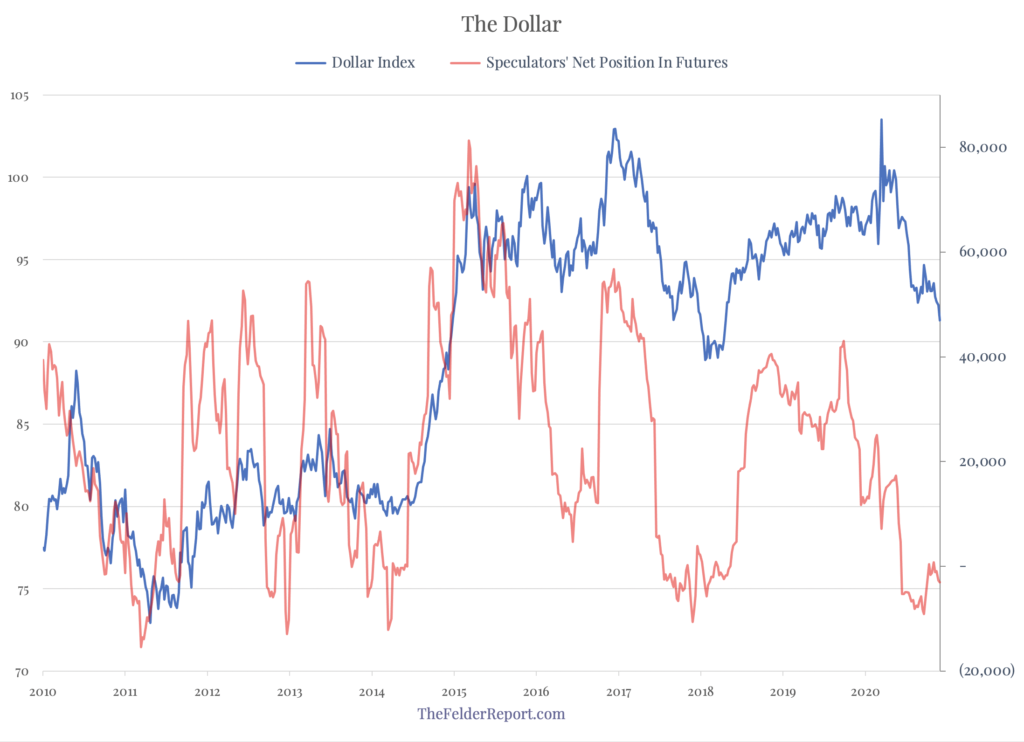

I have been long-term bearish on the dollar since late-2015. However, I have been looking for a short-term countertrend rally in the greenback for the past few months. That has failed to materialize as the dollar index has melted to new lows. Still, it appears the short-term bull case for the currency remains compelling. For starters, there is still a very large short position that could create a squeeze higher at some point.

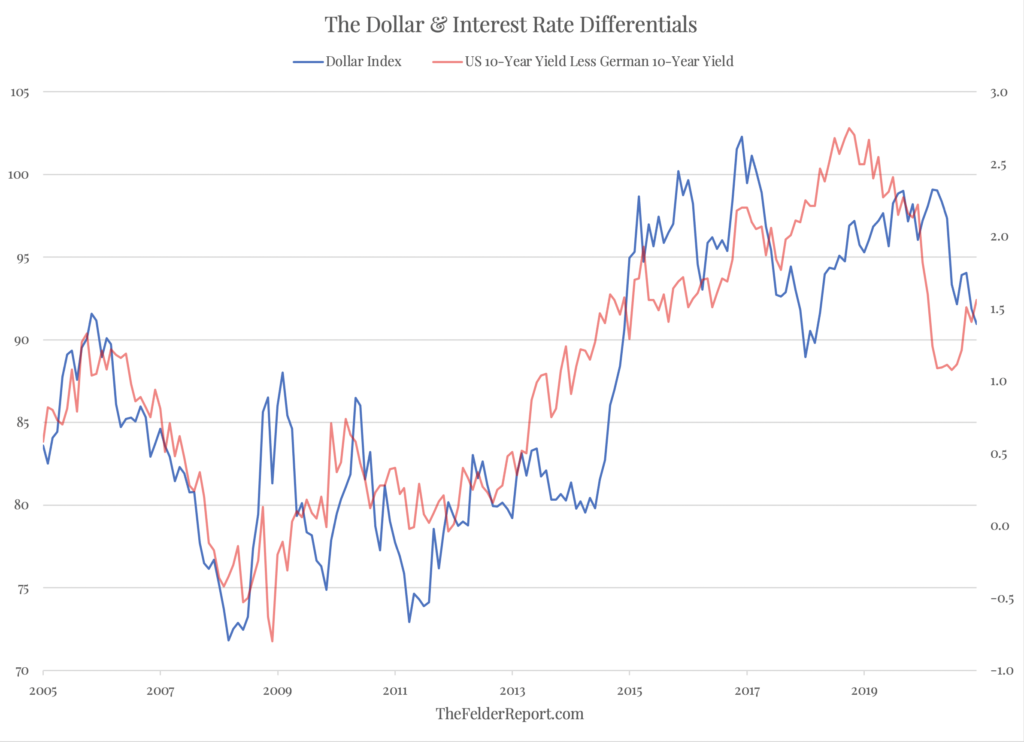

At the same time, the short-term fundamentals turned positive months ago and have only continued in that direction since. The difference between US and German yields bottomed back in March and has been growing ever since even as the dollar has continued to decline. Just as the dollar soared in the spring despite a plunging differential and then eventually caught down to this metric, it may now play catch up in delayed fashion.

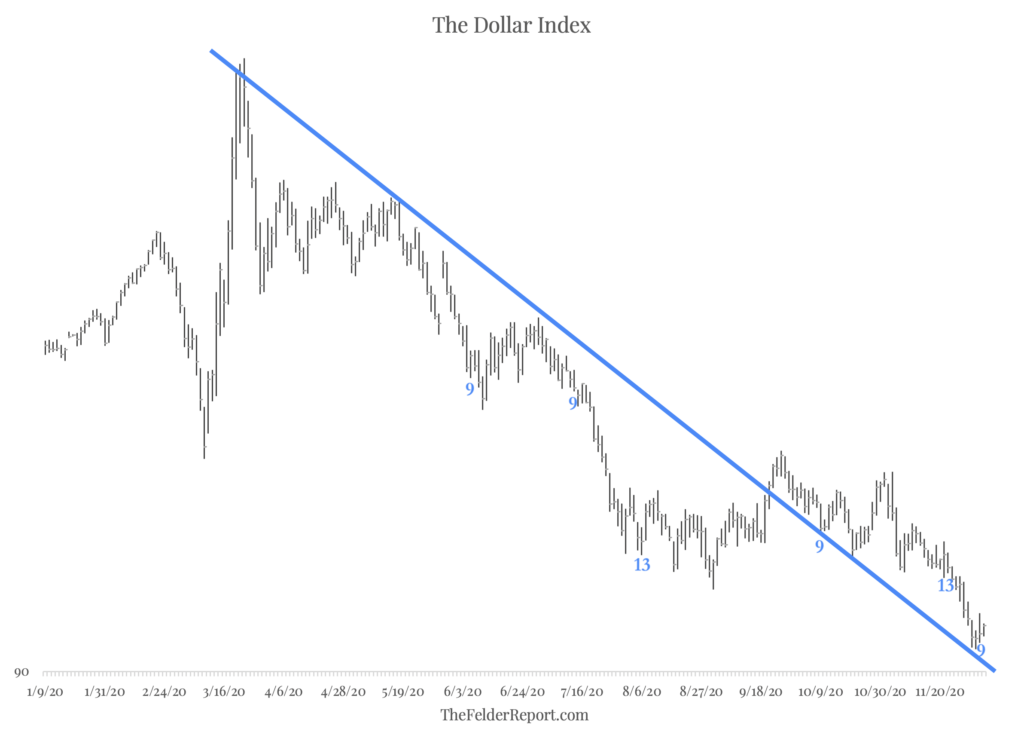

Technically, we are seeing more short-term downtrend exhaustion signals, as well. The dollar index this week completed a daily 9-13-9 DeMark Sequential buy signal, just as it tests the upper side of its 2020 downtrend line. Momentum also appears to be possibly forming a bullish divergence with price.

A dollar rally would, of course, be an important development for the gold price which has already been struggling for several months now. A rising dollar would only exacerbate its current challenges. In addition, though, it could coincide with a broader shift towards a “risk off” environment. Certainly, the greenback and the stock market have been almost perfectly inversely correlated since March.

In sum, while the dollar likely remains in a longer-term bear market, there is a window of opportunity here for a short-term countertrend rally. Should it materialize, it would likely mark a reversal of the risk-on rally in everything we have seen over the past nine months or so.