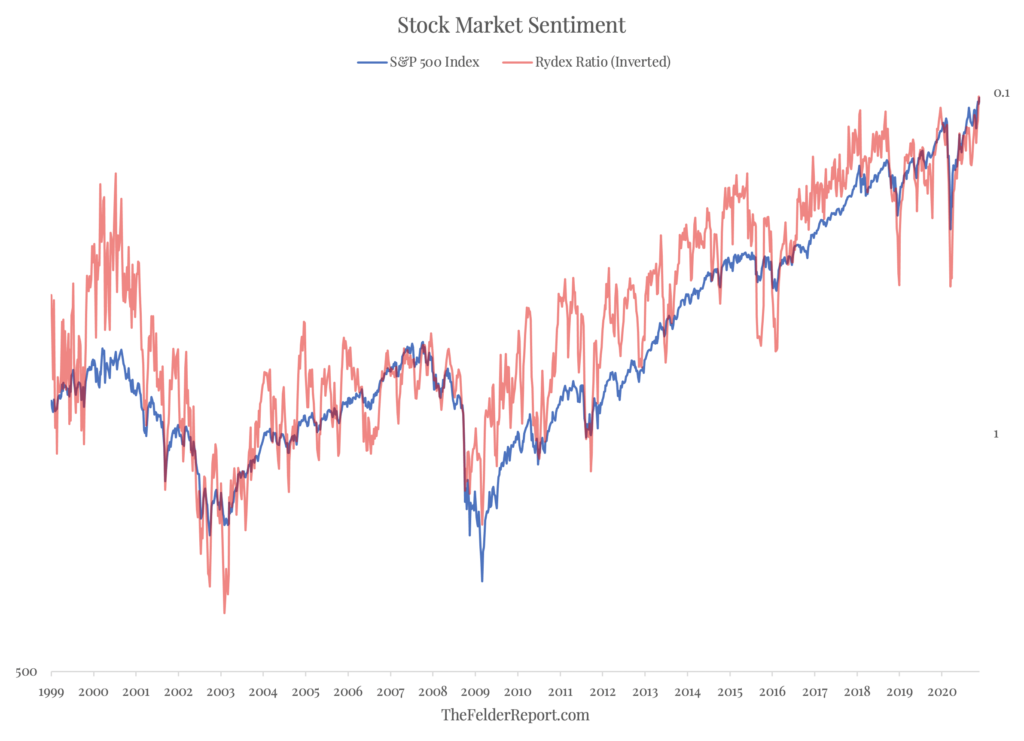

It was almost a year ago that I highlighted the fact that Rydex traders were getting very bullish again. To be clear, I’m referring to the Rydex Ratio, “or the measure of Rydex traders’ assets in bear funds and money market funds relative to their assets in bull funds and sector funds.” As of last week, this ratio fell to its lowest level on record. In other words, these traders are now positioned more aggressively bullish than ever before, including the heady days of the dotcom mania 20 years ago.

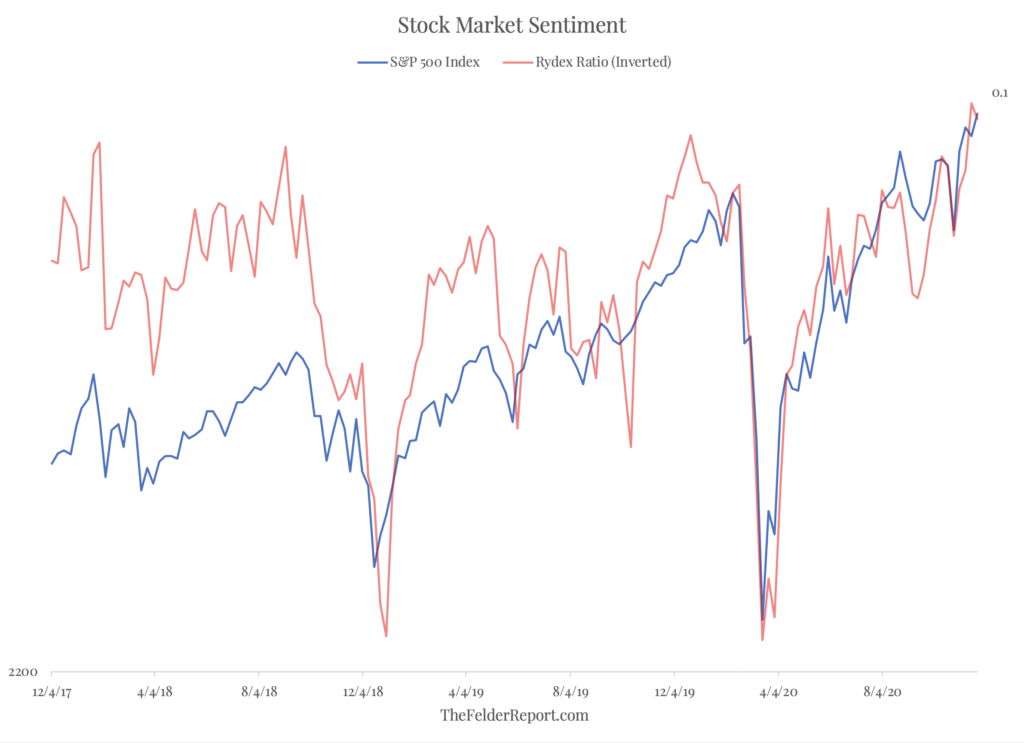

And when we zoom in a bit closer, it’s pretty clear to see that over the past few years when bullish sentiment has come near its recent extreme it has resulted in tough sledding for the stock market. Back in early-2018, after Rydex traders revealed extreme bullishness, we had the “volmageddon” episode. Later that year stocks swooned again after bulls became so brazen. Finally, December last year also showed a peak in sentiment that proved to be another good time for contrarians to, “be fearful when others are greedy,” as Warren Buffett famously put it.

Clearly, traders have become intoxicated once again by the strength of the rally off of the March lows. And with most of the major indexes up 50% or more over that span, who can blame them? It’s been a historic run. However, for those trying to take the market’s temperature here, it’s hard to shake off the feeling that we’ve now crossed the boiling point. For this reason, the stock market may be vulnerable to another reversal.