This post is based on an excerpt from a recent Chart Book published at The Felder Report PRO.

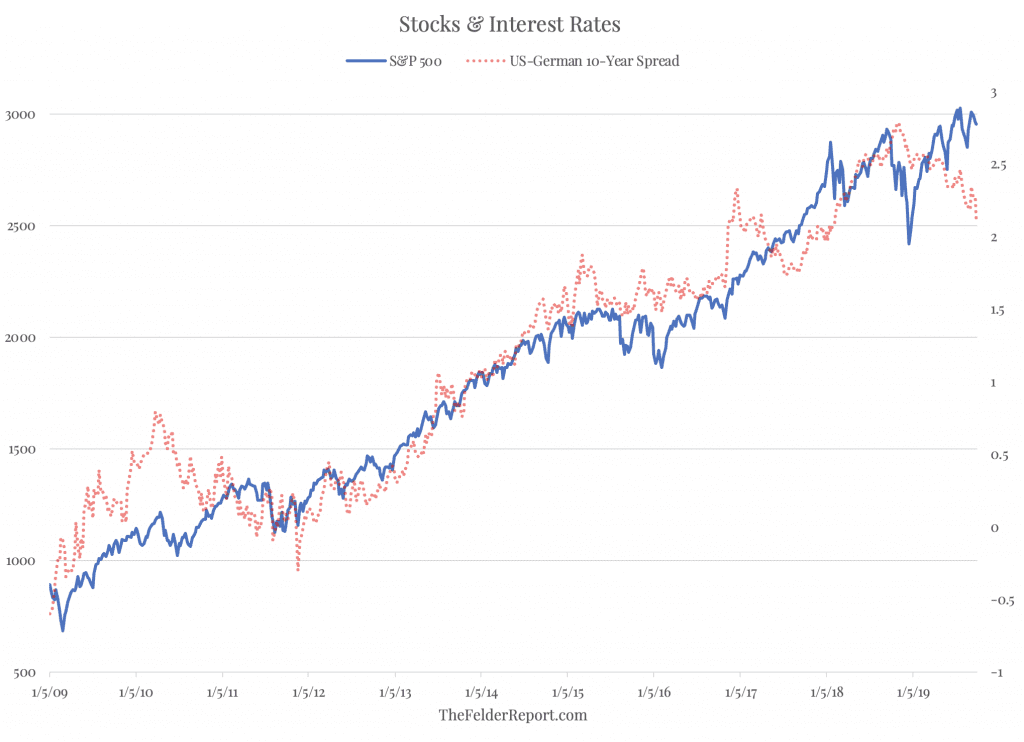

One of the main drivers of foreign risk appetite in US financial assets has been the enormous and growing differential between risk-free yields available here versus those overseas. Over the past decade, US interest rates have moved far higher than those in Germany making owning financial assets based in the US far more attractive to foreign investors. During this period the correlation between the S&P 500 and the spread on US and German 10-year yields was fully 95%. So US stocks have likely benefitted a great deal from money flowing into our markets looking to escape negative interest rates overseas.

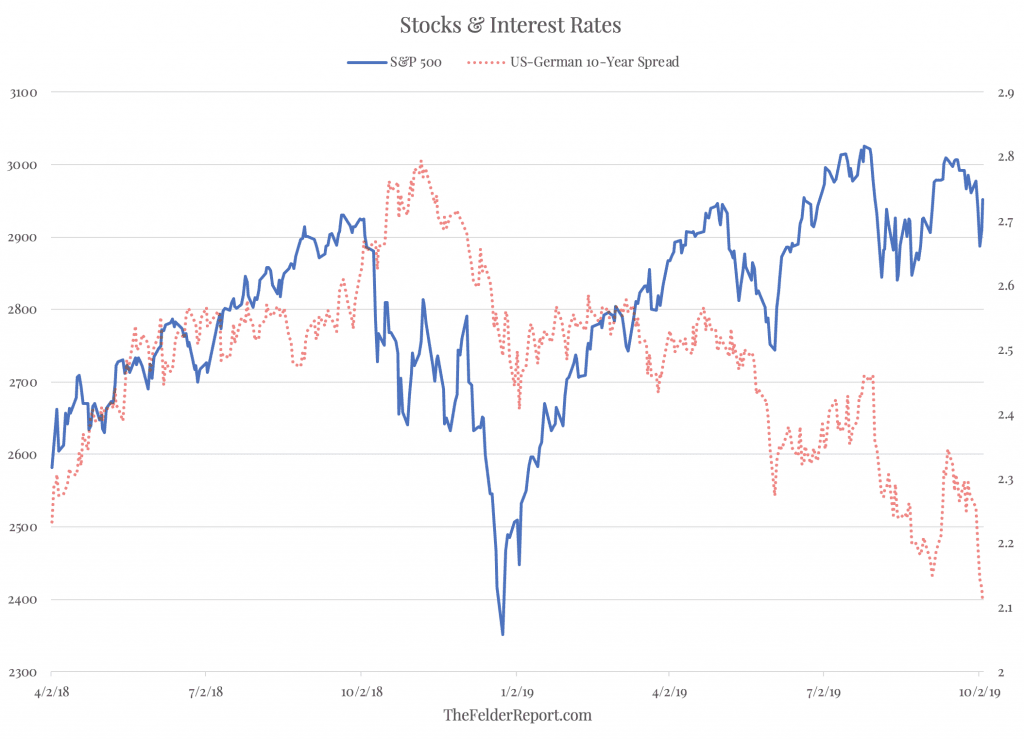

However, over the past year, the differential between US and German yields has been narrowing making it far less attractive for overseas investors to take the currency risk associated with buying assets here in the US. In fact, the spread between the two 10-year rates has now fallen to a multi-year low which should be a negative for foreign risk taking in domestic assets like stocks and bonds.