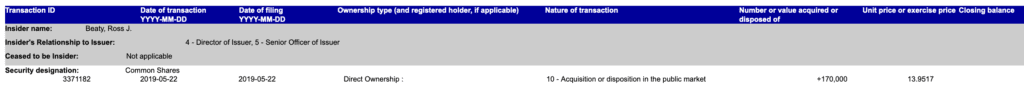

It recently came to my attention that Ross Beaty, the Chairman and Founder of Pan American Silver, recently bought a slug of stock, 170,000 shares to be precise. As a percent of his overall net worth this is not really a significant purchase but Beaty is one of the most successful insiders in the world of mining and so his purchases, regardless of size, should be noteworthy.

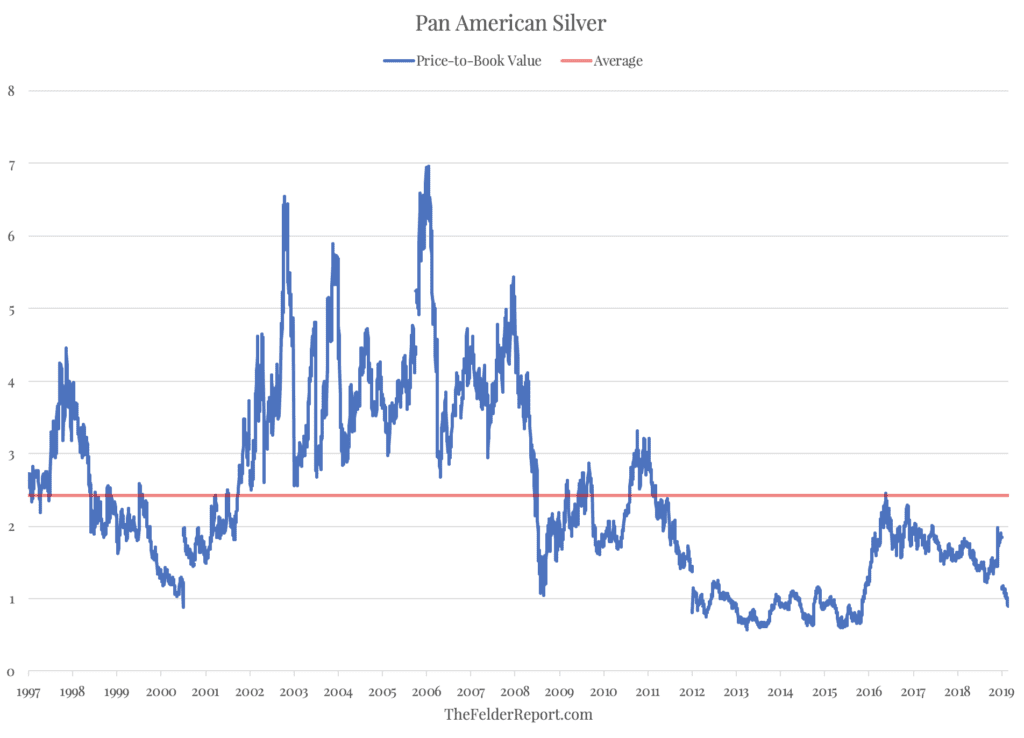

It is also noteworthy just how cheap this stock has gotten recently. Pan American, one of the largest silver miners in the world, now trades at a discount to book value. Outside of the period from 2012-2016, a brutal bear market for precious metals, the stock has never been as cheap as it is today. And this includes the early-2000 period as well as the October 2008 episode which saw the stock’s valuations hit rock bottom. So it’s not hard to understand why Beaty might be buying today.

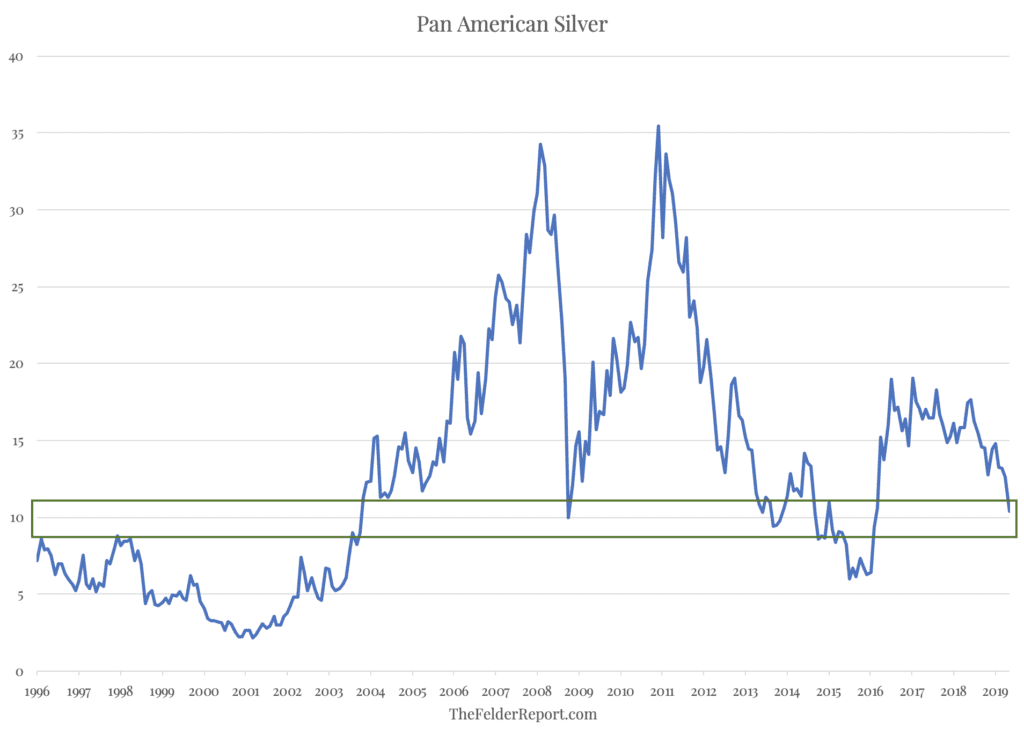

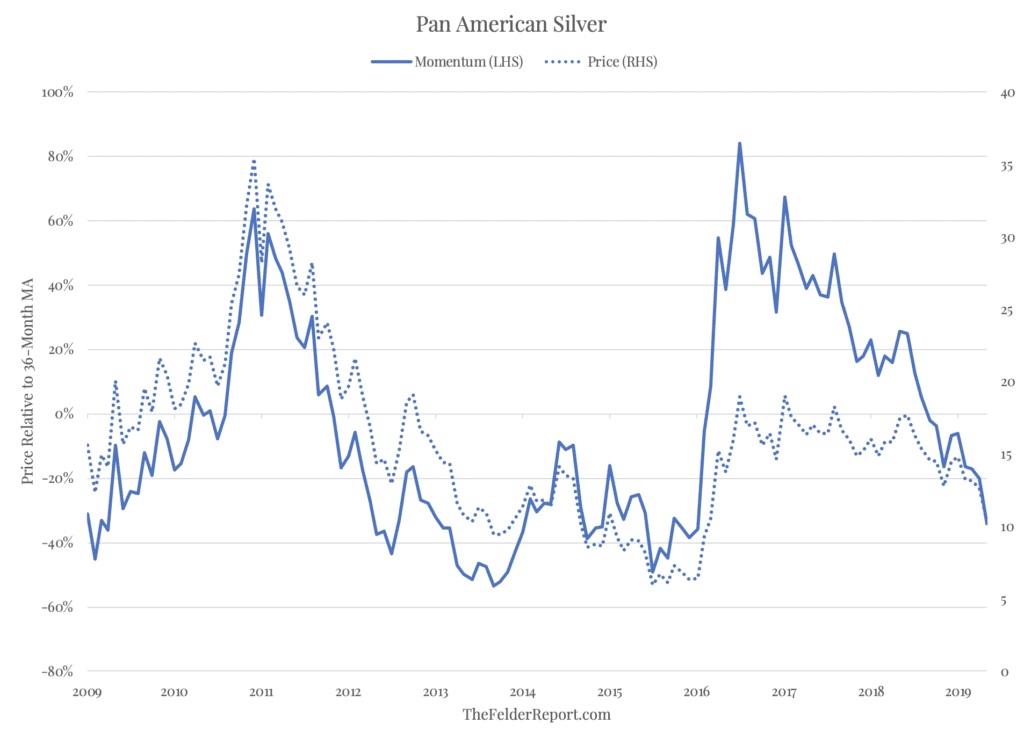

Investors are clearly pricing in a deflationary scenario across most asset classes (just look at the bond market). Pan American has seen its stock price react negatively, along with the silver price. However, from a long-term perspective it looks like the stock has fallen back into an important support area. Price could fall a bit further to test the $9 level but the area marked by the green box in the chart below could act as support for a longer-term reversal.

Momentum shows a positive long-term trend, as well. The breakout higher in 2016 made a higher high in momentum (above the 2011 high) and the current low in momentum could prove to be a higher lower (above the 2015 low). It also appears that negative short-term momentum is approaching an important level. When it has reached -40% in the past, it has pretty consistently led to rebounds in the stock over the next several months.

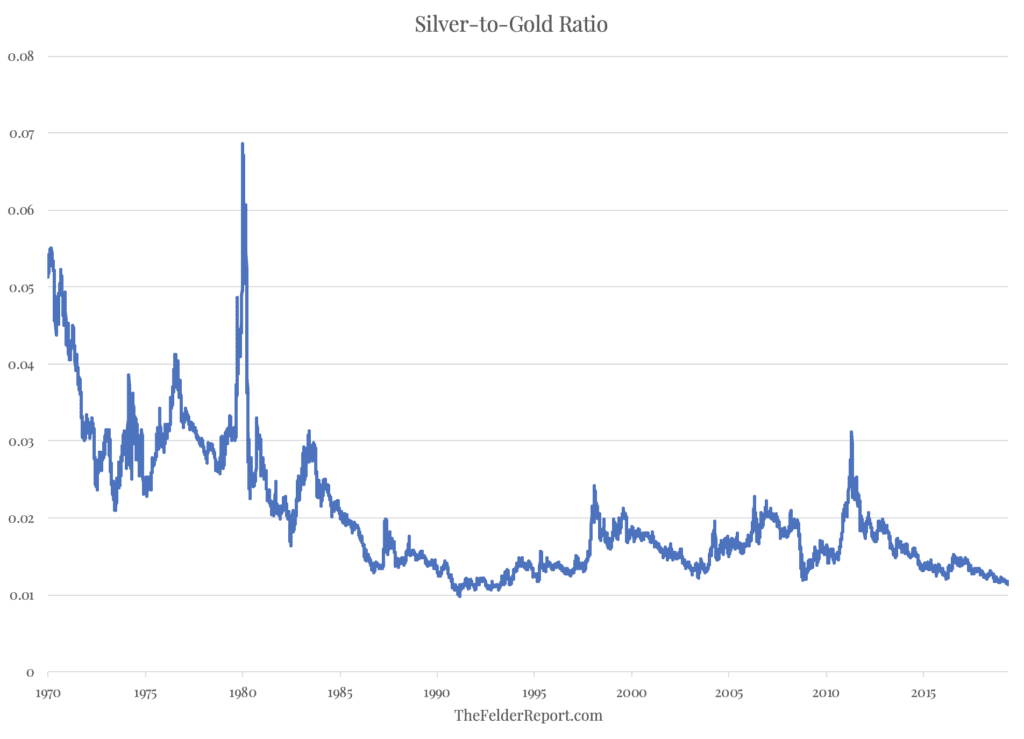

Finally, there is the bull case for silver to consider. As both are “precious” metals, this is closely related to the bull case for gold. However, silver has a couple of unique things working for it. First, the silver-to-gold ratio is now sitting at its lowest level of the past two decades. In other words, silver has very rarely been cheaper relative to gold than it is today.

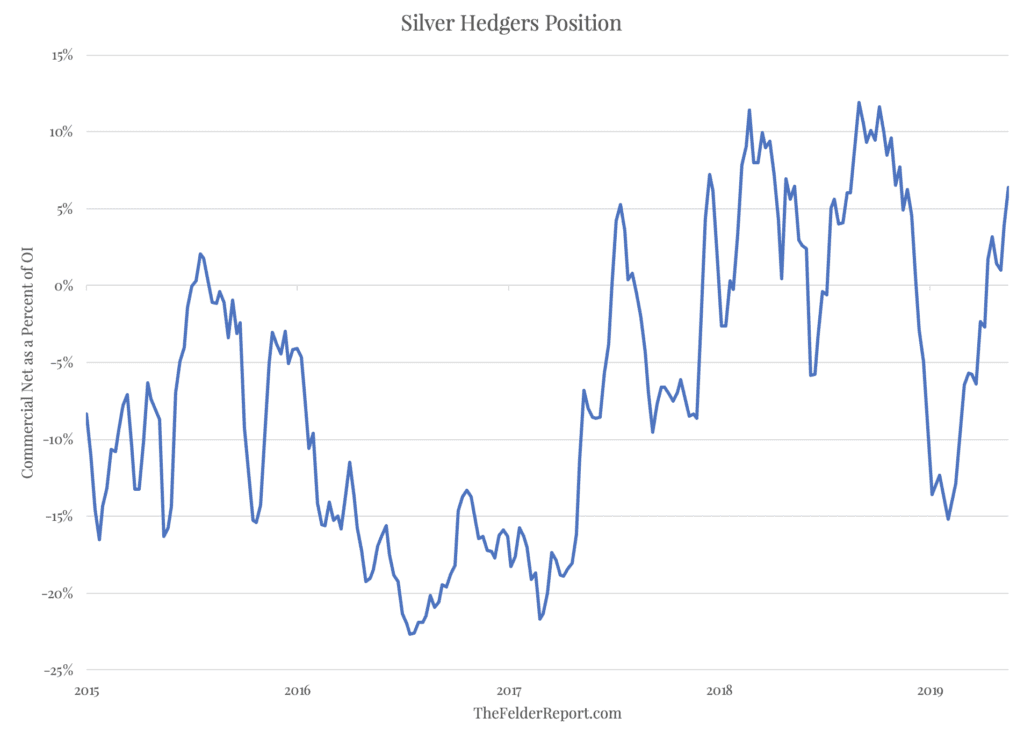

Second, commercial hedgers in silver futures, the “smart money”, are clearly very comfortable in going completely unhedged. Over the past year, they have generally been very bullish toward the precious metal and have steadily rebuilt these bullish positions over the course of 2019 after reining them in a bit late last year. It is worth mentioning that they are far more bullish today than they were in late-2015 just before the silver price nearly doubled in early-2016.

So Pan American Silver looks like a very cheap stock that is leveraged to a very cheap asset right now. This is why Ross Beaty is buying the former and commercial hedgers are increasingly allowing themselves to be exposed to the latter. If this smart money turns out to be right then this stock will almost certainly become a multi-bagger. And, as I outlined recently, I believe the bull case for precious metals is as compelling as ever.