“This is the only time in my 88 years when I saw technology stocks go to 100 times earnings; or, when there were no earnings, 20 times sales. It was insane, and I took advantage of the temporary insanity.” – John Templeton, May 28, 2001

Sadly, he passed away back in 2008 so I can only wonder how John Templeton might compare today’s mania to that earlier one. Valuations are just as insane today as they were back then. In some ways, they are even more extreme today than they were at the height of the dotcom mania.

And when it comes to IPOs, we are now seeing a very similar sort of insanity to what we saw back then. The percent of companies coming to market with negative earnings recently matched the peak set nearly 20 years ago. As Templeton points out, ‘when there are no earnings’ you must look to sales as a unit of measure for the purposes of valuation.

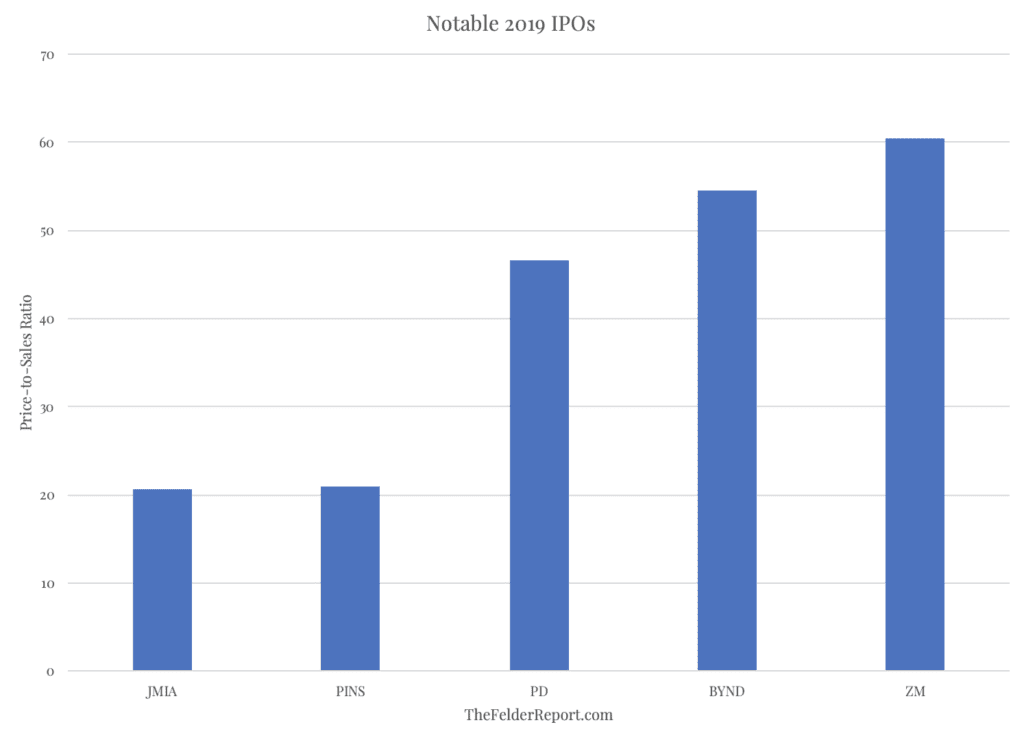

Using this methodology, Templeton clearly suggests that for investors to pay “20 times sales” they must be insane (and I’m sure Scott McNealy would agree). In that light, below are a few notable multi-billion-dollar IPOs this year that currently trade above that lofty mark.

While investors have been wowed recently by the Beyond Meat (BYND) IPO performance, and at over 50 times sales they should be wowed, Zoom (ZM) currently trades at an even loftier 60 times sales, fully three times the valuation Templeton saw as insane (and six times McNealy’s hurdle), inspiring the CEO, himself, to call the valuation, “crazy.”

What’s more, the IPO pipeline for the rest of the year looks just as insane as what we have seen so far. WeWork, Palantir and Robinhood are just a few of those poised to test the strength and duration of the current insanity. Based upon recent estimates, WeWork is looking to price at 26 times sales while Palantir is shooting for a 55x multiple. Robinhood may cross the 100x sales mark (the only revenue estimate I could find claimed $3.4 million supporting a $5.6 billion valuation).

Investors may want to remember just how Templeton “took advantage” of the insanity back in 2000. From Forbes:

He shorted 84 Nasdaq stocks, taking positions averaging $2.2 million each. In nearly half of the shorts he waited until prices dropped to 5% of what he paid, thereby cleaning up on such names as Foundry Networks, Breakaway Solutions and Vitria Technology. At other times he closed out his positions once the stock price dipped below 30 times trailing earnings. He took losses early, quickly covering positions where the stock price increased post-lockup. The early-2000 overpricing of Nasdaq is what they call a once-in-a-lifetime opportunity.

Well, maybe not “once-in-a-lifetime” after all.