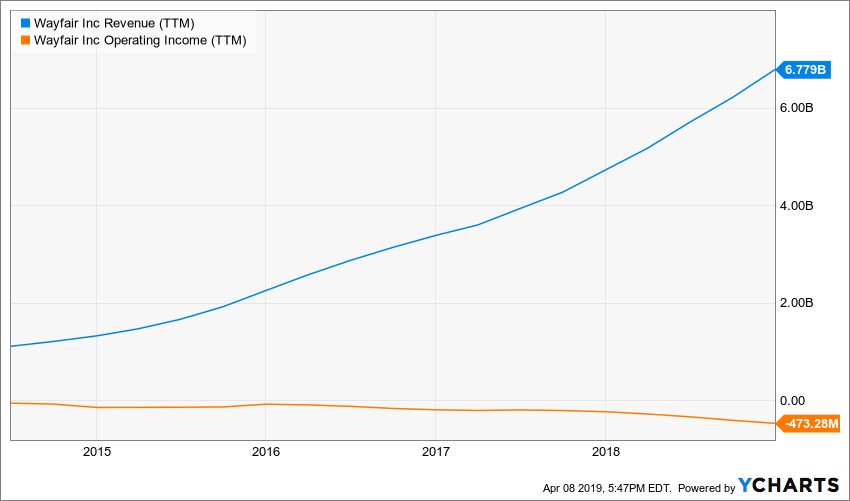

Last week the insider activity that really stood out to me was the insider selling at Wayfair (W). The company sells home furnishings online and has been growing rapidly in recent years. That’s the bull case. The bear case is that, despite growing sales roughly ten-fold over the past five years to $6.7 billion last year, the company still can’t turn a profit. In fact, operating losses (of nearly half a billion dollars last year) have grown at an even faster rate than sales over that time. It’s the old, ‘yeah, we lose money on every sale but we’ll make it up in volume,’ business model.

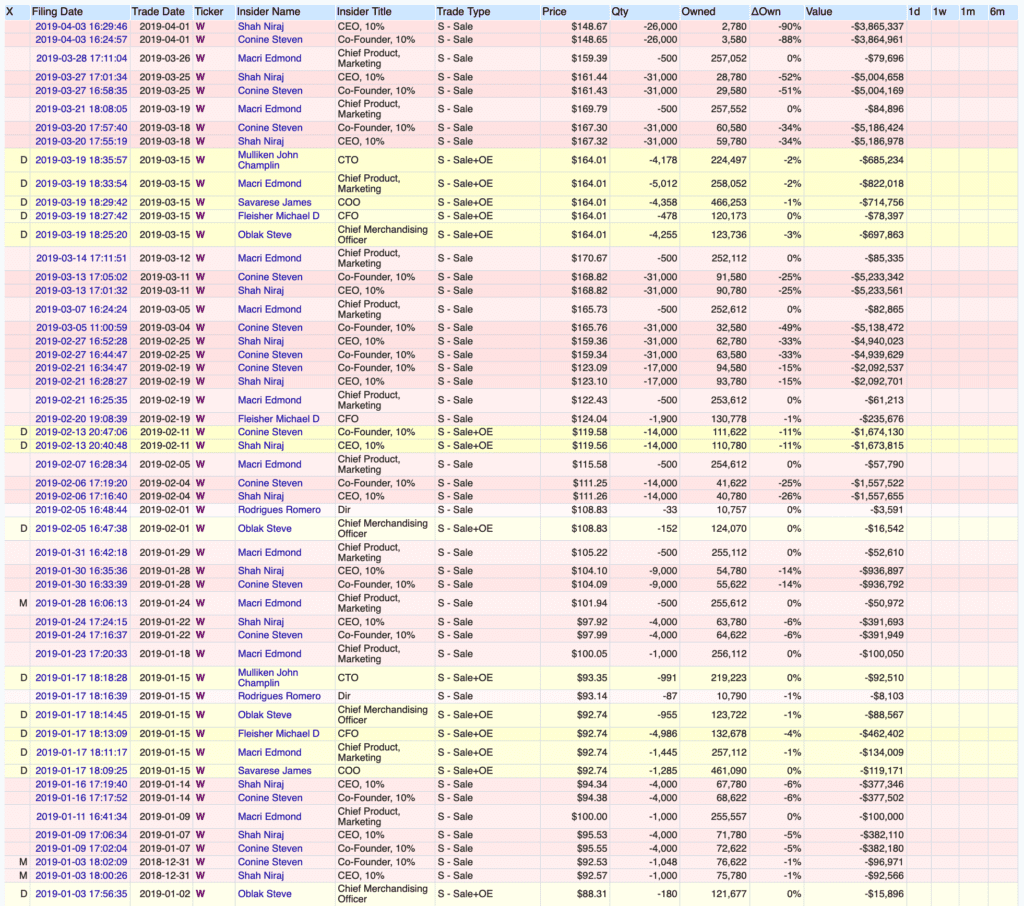

It appears that insiders don’t have much hope of turning the red tide, either. The two founders of the company, Niraj Shah and Conine Steven, recently liquidated very nearly their entire stakes even though they both continue to run the company. The chart below tracks all of the insider sales at Wayfair just since the start of the year and it’s truly astounding.

Actually, what is even more astounding is the fact that investors recently sent the shares to new all-time highs even as the real estate market has been weakening and Wayfair competitors like Restoration Hardware have recently warned of a real estate-related slowdown in their business. It seems highly likely that even if Wayfair’s earnings announcement a month from now is okay, guidance is likely to disappoint. If it does, there is a lot of room for this stock to fall. From a valuation standpoint, the stock price could be cut in half and still might prove expensive if sales growth doesn’t keep pace with recent years.

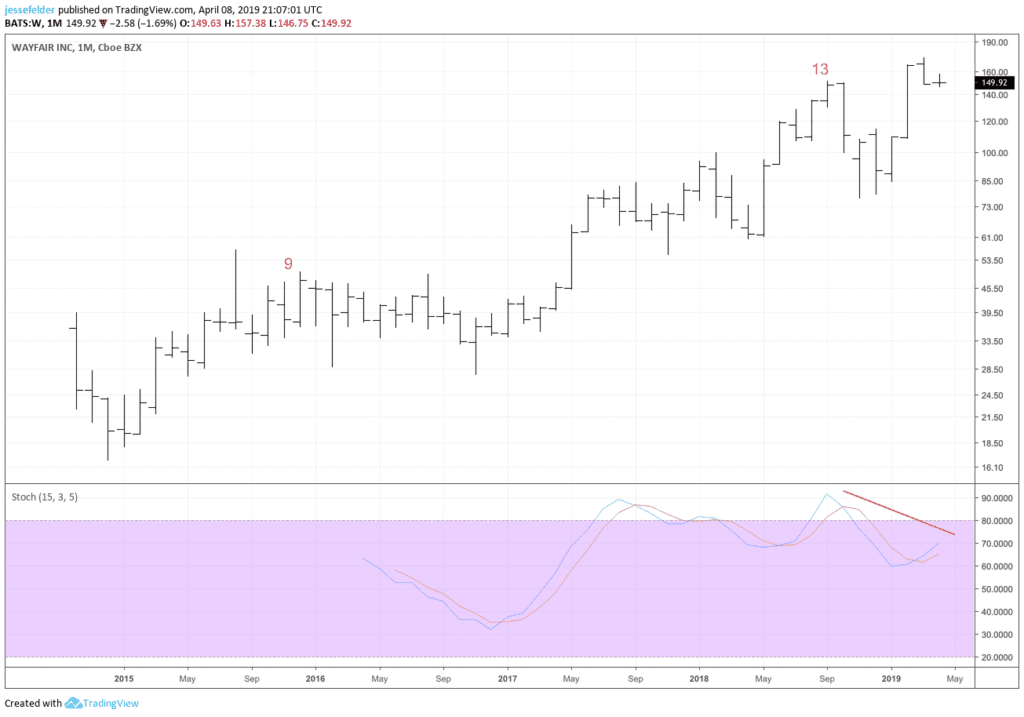

Technically, Wayfair looks tired. It completed a monthly DeMark Sequential (13) sell signal last fall. The surge to new highs this year is accompanied by a bearish stochastic divergence suggesting this could prove to be a false breakout.

So this is one of those zombie companies (whose operating income doesn’t cover interest expense) that has gotten a pass because investors have been so enamored with growth that they care not what the bottom line looks like. Investors sentiment, however, may be in the process of shifting. At the same time, that growth may start to disappoint. The combination of the two would be detrimental to Wayfair’s share price. Perhaps this is why the insiders appear to be getting out while the getting’s still good.