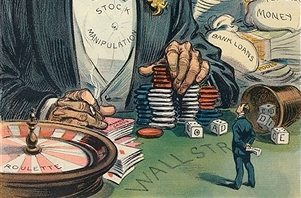

Have we entered a new era of sustainably high corporate profit margins or will they revert over time to more normal historical levels? This is the single most important question equity investors should be asking today and nobody has done more work on this topic than Jonathan Tepper. Formerly, an equity analyst at one of the most successful hedge funds on the planet, then a prop trader at one of the largest firms on Wall Street, Jonathan today runs Variant Perception, an institutional research service. He also recently published a new book, The Myth of Capitalism, his survey of the profit margin phenomenon and its consequences for investors and citizens alike. In this episode, we discuss the social and economic consequences of increased consolidation and regulatory capture in corporate America and what it means for markets going forward. Jonathan also shares the unique and tragic experiences of his formative years and how they inspired both a strong work ethic and a deep desire to make a difference. Below are a few links and other resources related to our conversation:

- Get Jonathan’s new book at MythofCapitalism.com

- Follow him on twitter: @jtepper2

- Check out his institutional research service: VariantPerception.com

Other links related to this episode:

- Stan Druckenmiller At The Lost Tree Club at Scribd

- Manias, Panics and Crashes: A History Of Financial Crises by Charles P. Kindleberger

- Monetary Regimes and Inflation by Peter Bernholz

- This Time Is Different: Eight Centuries Of Financial Folly by Carmen M. Reinhart and Kenneth S. Rogoff

- BIS: Can Demography Affect Inflation And Monetary Policy?

- Are U.S. Industries Becoming More Concentrated? by Gustavo Grullon, Yelena Larkin and Roni Michaely

- Thinking Strategically by Avinansh K. Dixit and Barry J. Nalebuff

- Warren Buffett On The Stock Market at Fortune