Goldcorp announced earnings this week. The report was not well received by the market and that’s an understatement. Reviewing the results and, more importantly, the guidance for the fourth quarter, it’s hard to see how Mr. Market saw fit to sell this thing off the way he did. The company continues to make progress on its 20/20/20 plan and one bad quarter is hardly cause to hammer this thing the way it was, especially when the future looks so bright.

Then again, even gold miners who crushed their earnings reports were indiscriminately sold yesterday even as the gold price held near multi-month highs. The best explanation I have heard was from my friend Bill Fleckenstein who wrote yesterday:

I don’t really think that the decline in the sector was any indication of company-specific problems or concerns as much as it was just indiscriminate selling for whatever reason. Perhaps some big fund decided to eliminate its mining exposure, or some variation of that theme, because the news just wasn’t that bad. In fact, I could argue that it was pretty decent, and you don’t have to look any further than Pan American Silver, which was also clobbered in the wake of the news announcement it made yesterday. Not that massive, indiscriminate selling is something to be ignored, but I think it is important to know whether it might imply serious bad news for every company that got sold. I don’t think that was the case. It was more an instance of an epic pukefest. That doesn’t change the P&L, but sometimes things happen that you can’t do anything about.

Clearly, Goldcorp’s report was not positive but it really wasn’t that bad at all. Yes, production was lower and costs higher resulting in a loss for the quarter but I take CEO David Garofalo at his word when he said, during the conference call:

Yes, we’ve underperformed, but what I would also say is we significantly derisked the portfolio by delivering on our expansion plans and we’ve done so on time and on budget. In fact, the reason we had a poor third quarter is because we delivered the Pyrite Leach project ahead of schedule and we decided to prioritize low-grade material in our flagship mine and flip around the course, so we’re going to see in Q4 what we expected in Q3. So, it was the acceleration of that project that led to an unusually weak third quarter, it was supposed to be Q4. So, I’m very, very pleased with how our operating team and our project teams have delivered our projects, they are on time and on budget. We’ve executed very well, we’re derisking these projects and we are setting ourselves up for sustained higher production at sustained lower costs.

It sounds as if the the worst is now behind them and things going forward are only going to get better. And with the ridiculously cheap valuation the stock currently trades at there is far more negativity being priced into it than can by justified by the fundamentals.

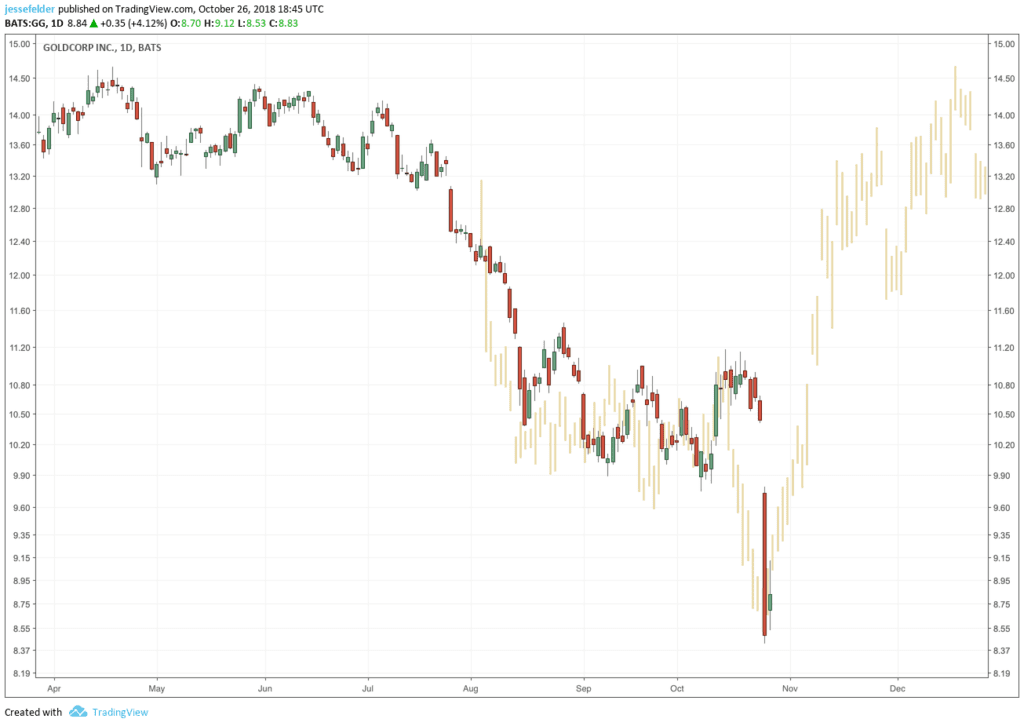

Technically, the stock looks very much like it did the last time it was this cheap when it bottomed and reversed hard three years ago (gold bars in the chart below) and I wouldn’t be surprised to see a very similar reversal over the next few weeks or months.

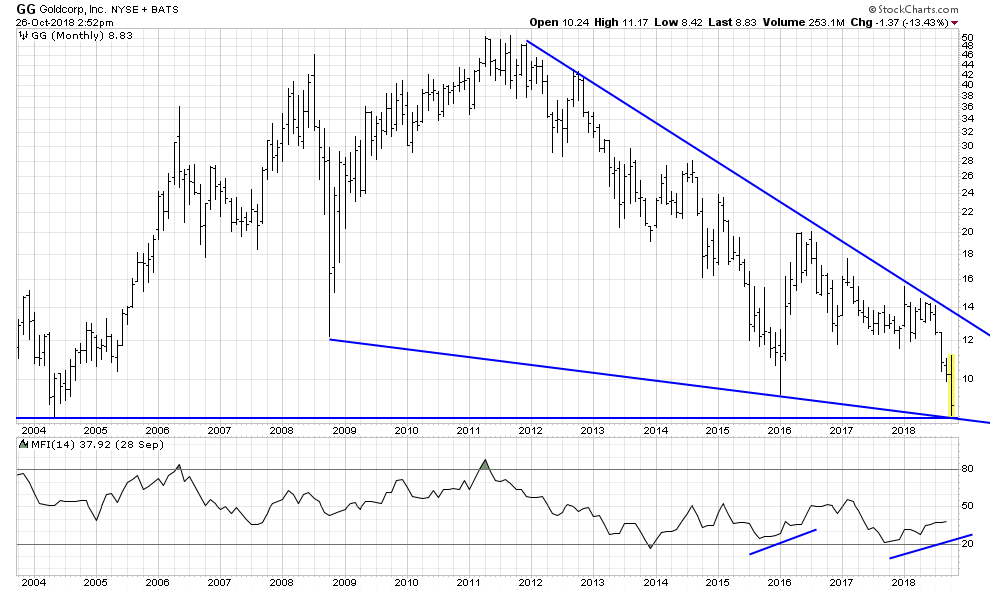

Longer-term there is good support at the recent lows provided by the 2004 low and the lower trend line of the bullish wedge pattern in the chart below. The bullish divergence in money flow is also very similar to what we saw at early-2016 low.

CEO David Garofalo continues to buy about 1,000 shares per month in the open market putting his money where his mouth is. I bought another slug on this most recent dip as I expect to see a much higher stock prices several years from now.