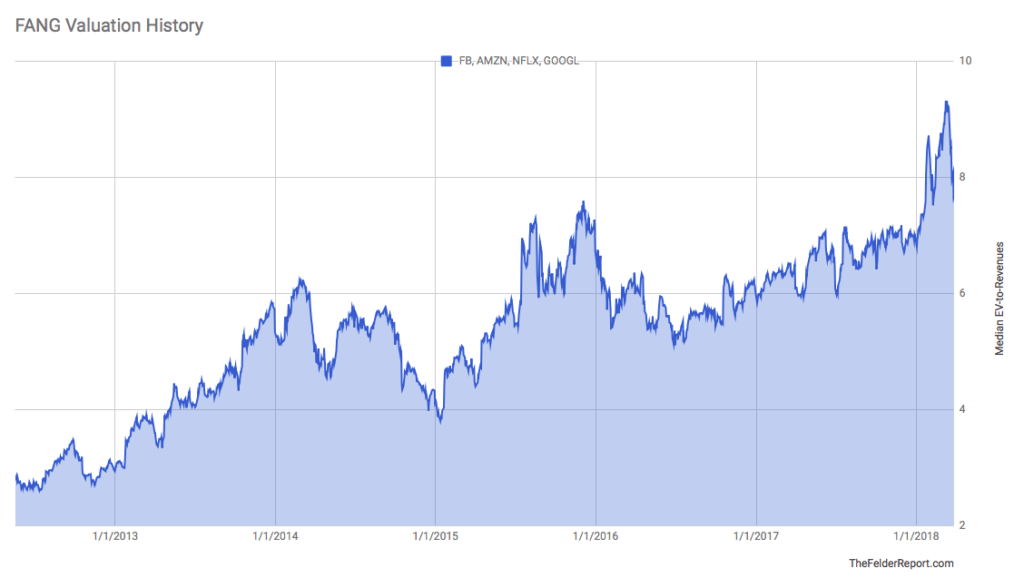

After an incredible run higher over the past couple of years and an especially remarkable ramp to kick off 2018, the FANG (Facebook, Amazon, Netflix and Alphabet, aka Google) stocks have recently come under some selling pressure leaving many investors to wonder whether this presents a unique buying opportunity in the group.

While it may be true the group is now oversold on a short-term technical basis, looking at the valuation history suggests these stocks as a group are anything but cheap. In fact, they still trade at their highest median valuation since Facebook came public back in 2012 – actually triple that level of roughly five years ago.

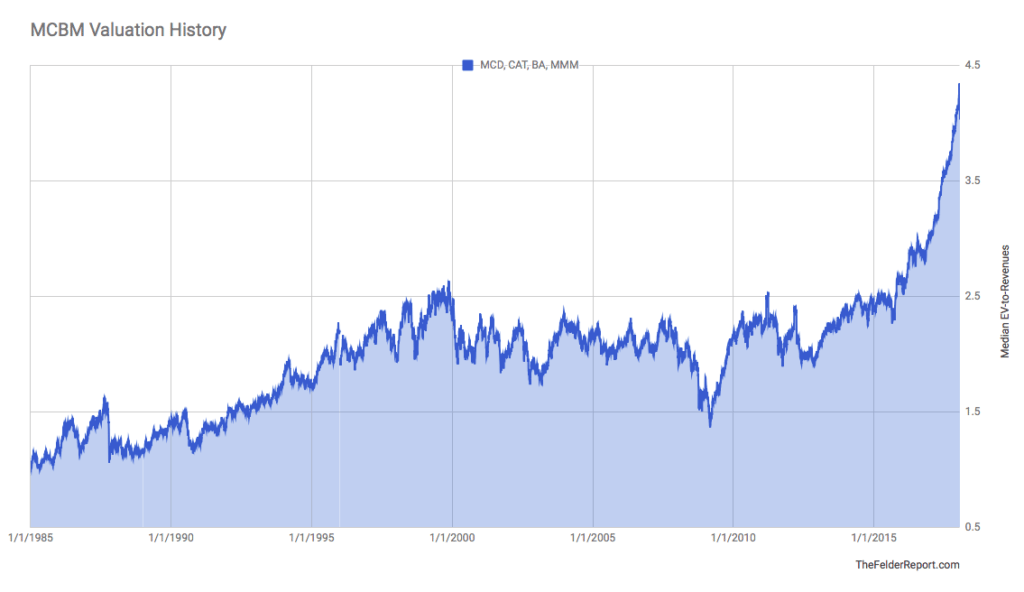

And while everyone is focused on tech, I’m also paying attention to that other fantastic four I first profiled a couple of months ago: MCBM (McDonald’s, Caterpillar, Boeing and 3M). Believe it or not, this group of old-school blue chips actually outperformed FANG for a lengthy period of time until very recently when they have come under at least as much selling pressure.

Here the valuation history is even more dramatic. Even after the bout of selling we have seen over the past couple of months these stocks currently trade more than 50% higher than their peak valuation at any point during the past several decades. Even at their 1987 peak just prior to the infamous crash, this group traded at a 65% discount to its current valuation.

The point is that while investor euphoria, as measured by valuations, appears to be just as extreme today it has not been confined to just one handful of stocks or even one sector as it was during the dotcom mania. It’s much broader and thus the potential risk to the overall stock market presented by a reversion in valuations to a more normal historical level is even more extreme. If the weakness in stocks to start this year is the beginning of that process it has much farther to go before it’s all said and done.

The point is that while investor euphoria, as measured by valuations, appears to be just as extreme today it has not been confined to just one handful of stocks or even one sector as it was during the dotcom mania. It’s much broader and thus the potential risk to the overall stock market presented by a reversion in valuations to a more normal historical level is even more extreme. If the weakness in stocks to start this year is the beginning of that process it has much farther to go before it’s all said and done.