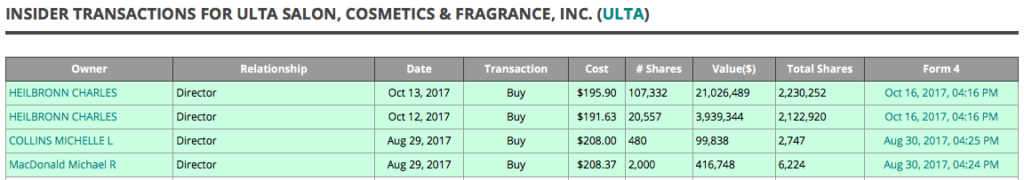

Ulta Beauty (ULTA) is a stock that has been hammered lately along with the rest of the retail sector. The company specializes in cosmetics and salon services and has grown rapidly over the past several years. Over the summer, it seems investors became concerned about increased promotional activity especially on the part of the department stores and how this might affect Ulta’s profitability but this doesn’t seem to have affected the company much at all. Still, Goldman Sachs removed the stock from its conviction buy list yesterday and that’s actually what put it on my radar. Ulta was a Wall Street darling, mainly due to its track record of exceptional growth and profitability, until the stock price lost over a third of its value and now they’re jumping ship. Several directors at the company, however, clearly see things differently with one in particular (a top executive at Chanel who has been on the board since 1995) buying $25 million worth last week.

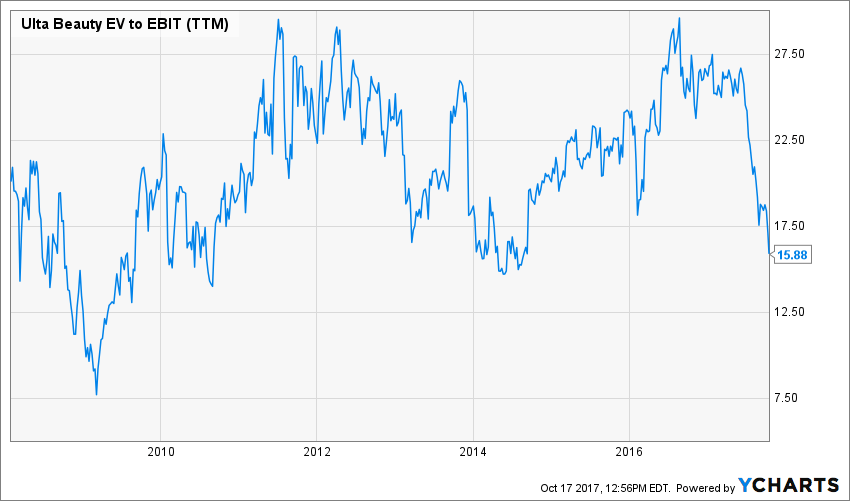

The stock does appear to be pretty cheap, especially for a company still growing the top line at 20% per year. In terms of enterprise value-to-EBIT the stock has only been cheaper than it is currently during the depths of the financial crisis.

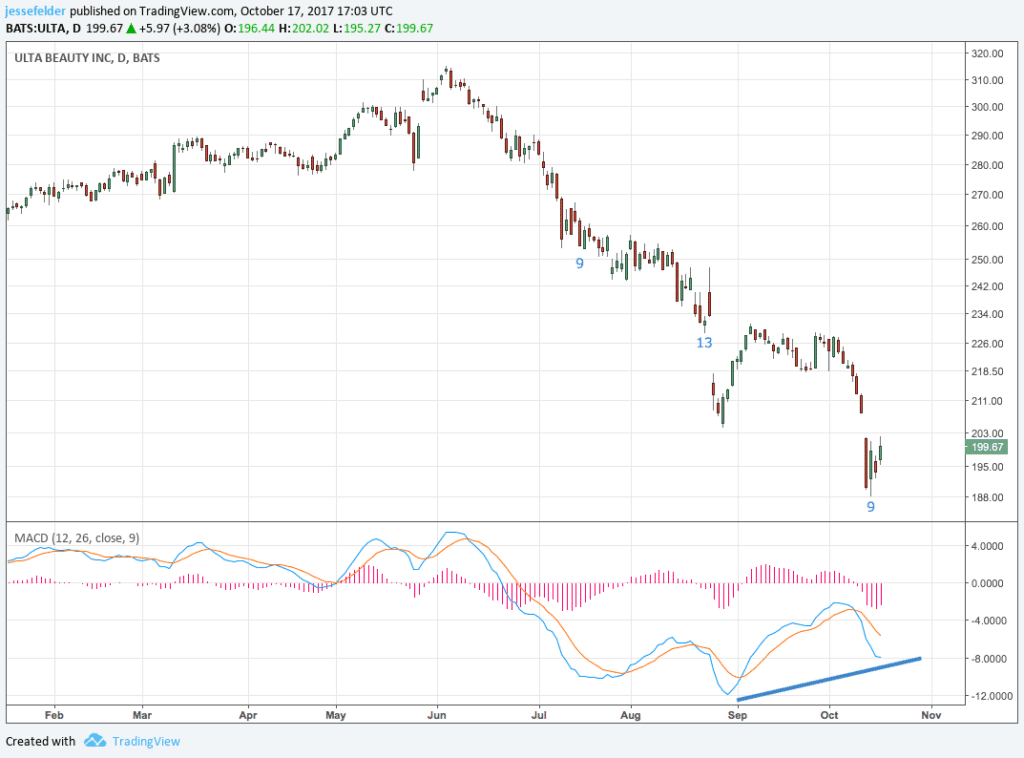

Technically, Ulta has completed a DeMark Sequential 9-13-9 buy signal on the daily chart with a potential bullish MACD divergence.

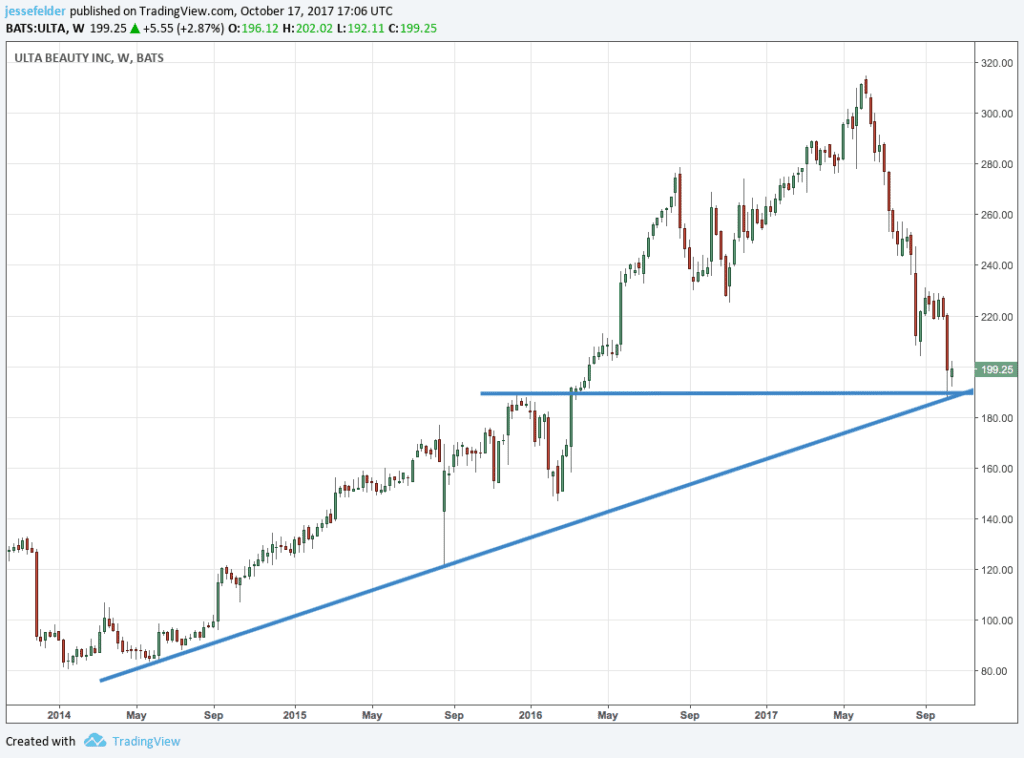

The weekly chart shows that there is decent support for the shares around the $185 level.

Considering all of this, I have started a small long position here with room to add in the future.