CF Industries first hit my radar last year when I heard John Burbank mention it as one of his favorite investment ideas. Back then the stock was trading north of $40. Since then it’s fallen to the low $20’s before bouncing only recently.

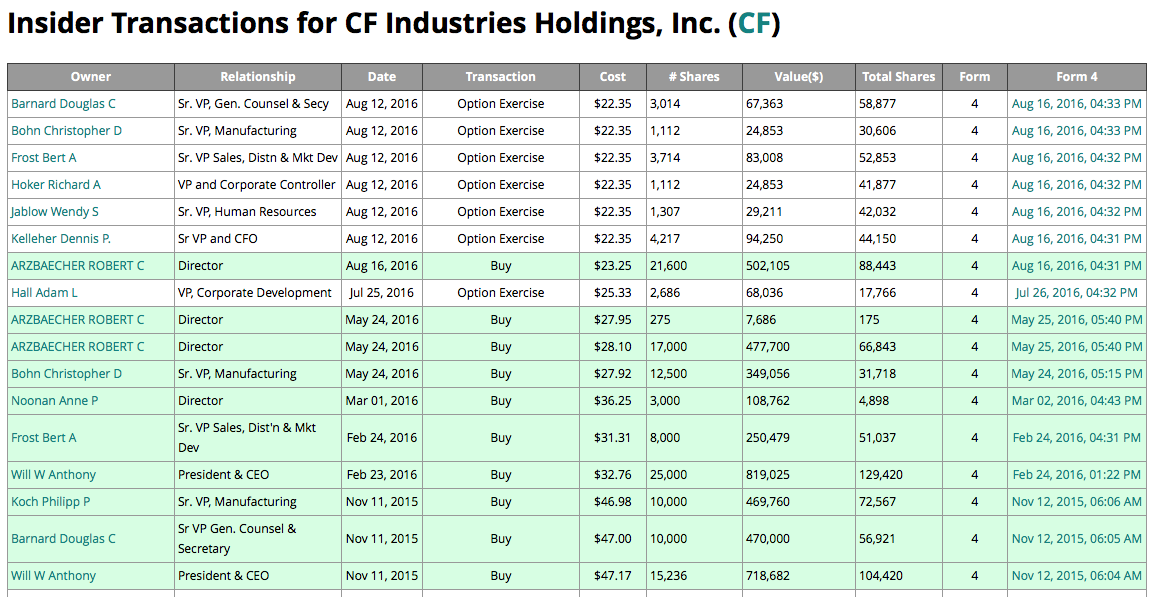

Over the past several months there have been a few other developments that have brought this stock from my back burner to front and center. Recently, I noticed some persistent insider buying. Since early 2014, there have been no insider sales and insider buying has been growing. Most recently, there was a wave of option exercises last month without any concomitant sales.

I also noticed that in his latest quarterly filing Stan Druckenmiller disclosed a brand new stake in the company of nearly one million shares. This is not a large position for him but it could be the start of one. So, in terms of smart money, we have two of the hedge fund managers I respect most taking significant positions while insiders clearly see value in the stock at current prices, as well.

Understandably, this got me to look into the company a bit deeper. (Sometimes it takes a number of these sorts of developments slapping me across the face before I sit up and take notice.) CF produces nitrogen fertilizer out of natural gas. They also have the best margins in the business mainly due to their ability to source cheap gas here in North America where a big chunk of our nitrogen needs are imported.

The stock has been hammered along with fertilizer prices as supplies have been plentiful. This is a very cyclical industry and I’ll be honest, I have no expertise here. That said, this company is the low cost producer amid a down cycle for the industry. And it certainly appears as if the insiders are optimistic about where we currently stand in the cycle. Here’s what CEO, Anthony Will, had to say on that topic during the company’s last conference call:

The industry is under pressure, facing several significant challenges. Fortunately, these issues tend to be more transitory in nature, and include: the nitrogen industry is in the state of significant overcapacity with additional new capacity yet to still come on stream through 2017. However there is little to no new capacity additions currently in flight beyond 2017, and with underlying demand growth in nitrogen, the global supply demand balance should start to resolve beginning in 2018. The combination of excess nitrogen capacity with lower global energy costs, coupled with devaluation of certain key currencies and assisted by low transoceanic freight, have led to the dramatic fall in nitrogen product prices. We expect this situation to persist in the near-term with prices under continued pressure for 2017.

As far as Wall Street’s concerned there is no light at the end of the tunnel. If this company sees pricing pressure persisting through 2017 that might as well be for perpetuity. ‘If it’s not turning around in a “New York minute” we don’t care’ is most investor attitudes these days. This is why fertilizer prices and the stock have been hammered. Clearly, management sees it differently and Will explains why:

Even in these conditions, CF enjoys greater than 30% gross margins. I want to pause for a moment and reemphasize this last point. We operate in the commodity business and, even in the face of significant industry overcapacity with prices that have cratered, CF Industries was able to deliver first half 2016 gross margin of 35%.

Translated: ‘It’s good to be the king.’ But here’s more on his thoughts about where we are in the cycle.

Current industry conditions are at a level that we believe is unsustainable over the medium-term. Pricing is below cash cost for a significant amount of total global production, and industry profitability in many regions is too low to support normal maintenance and turnaround activity, let alone equity returns, and certainly well below that required for investments in new capacity. This situation is leading to curtailment or permanent closure of high cost production. China alone has announced closure of over 4 million tons of urea, since the first quarter and over 7.5 million tons year-to-date, with utilization rates currently around 60%. Similarly, producers in countries with relatively high costs such as Lithuania, Hungary, and the Ukraine have utilization rates under 60% as well. The net result is that, although we expect difficult industry pricing conditions to persist through the next year, the lack of meaningful new construction activity after 2017 coupled with expected capacity closures is expected to lead to price recovery beginning in 2018.

Now normally I wouldn’t put too much stock (pun intended) into what a CEO has to say about his own industry but this guy is putting his money where his mouth is in buying significant chunks of stock (roughly equivalent to his 2016 salary). I’ve witnessed a few commodity cycles in my time and prices always bottom well before supply demand dynamics do. Once it becomes obvious that equilibrium will be achieved prices rebound and it sounds like CF believes they can already see this outcome.

Aside from the fact that it looks like the smart money is betting on a bottom in the cycle, the stock looks compelling from a valuation standpoint. Over the past 10 years the stock has bottomed around 1.5-times book value and peaked around 3-times. Today, it stands at 1.49.

Furthermore, the company has been in a position to invest heavily during this downturn. I always love to see a company that is both capable of doing this and disciplined enough to wait for these sorts of opportunities. These investments mean that when prices come back, sales are going to explode. And because of their unique cost position, profitability will explode, as well.

The company has also been consistently shareholder friendly. They have regularly bought back stock and currently pay an attractive 5% dividend that is well-covered by cash flow.

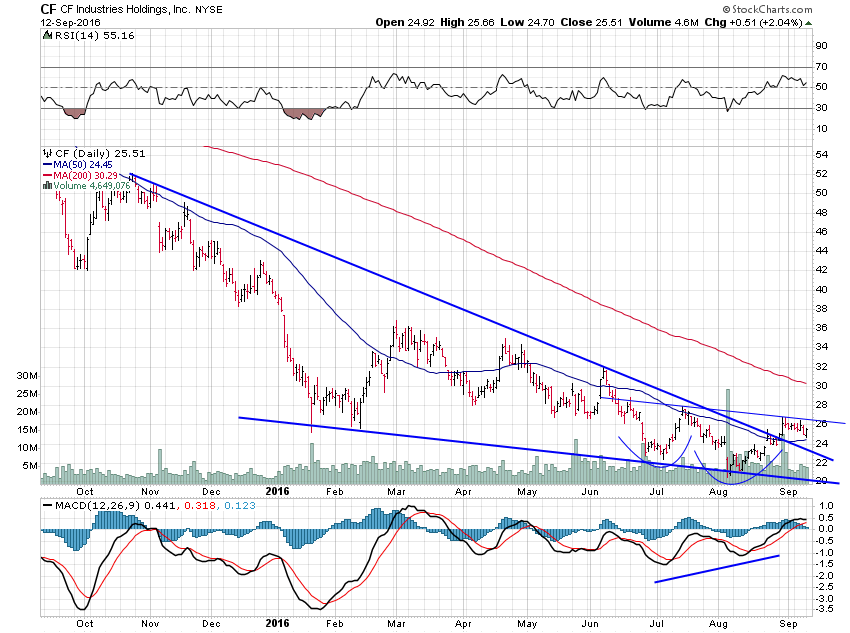

Taking a look at the stock chart, CF has already broken out above the upper trendline of an ending diagonal. It also looks like it could form a head and shoulders bottom with a move back down to the $23 area. I’ll be looking for just this sort of action to add to my small starter position.