I’ve recently argued that the success of passive investing potentially sows the seeds of its own demise. Patrick O’Shaughnessy also made a similar point recently and probably a bit more eloquently. But, to dig deeper into the push towards passive, there’s one big problem I have with virtually every one of the major robo-advisors that very few folks seem to be talking about. That is they all seem to advocate a heavily overweight position in equities, and for the most part this is skewed towards U.S. equities.

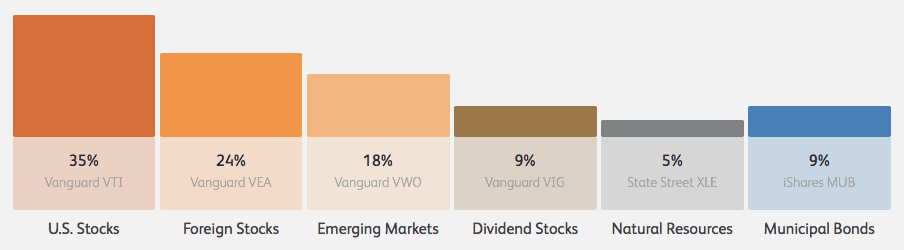

For example, below is the allocation WealthFront would put me in. It’s 91% in stocks, 49% U.S. stocks and 42% foreign, and 9% muni bonds. (This is their taxable allocation but the retirement allocation is very, very similar.)

I assume this massive equity overweight is simply based on the, “stocks for the long run,” dogma that everyone has bought into in recent years. The trouble with this is that it fails to take into account the simple fact that, in recent years and across a wide variety of time frames, bonds have outperformed stocks and with far less volatility, or what some might call, “risk.” As The Economist points out, “there was a point in 2011 when equities had lagged Treasury bonds over the previous 30 years.” 30 years!

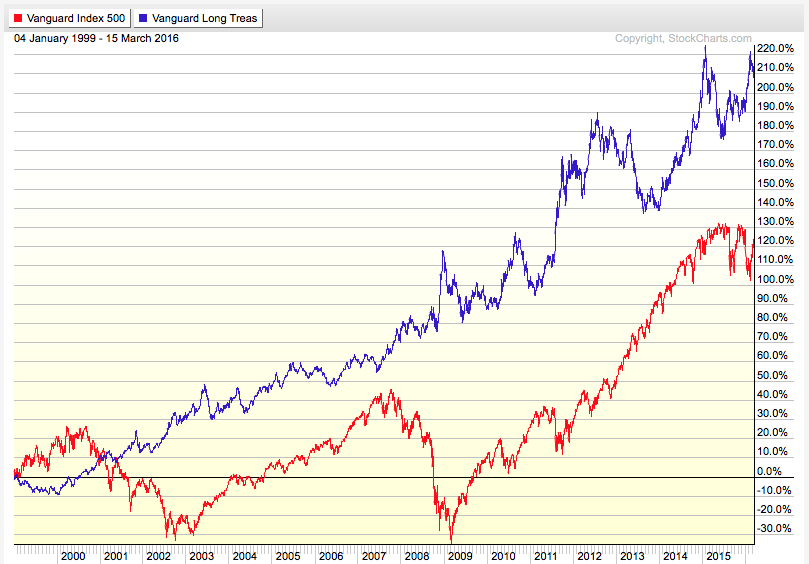

Intrigued, I decided to run some of the numbers myself. The chart below tracks the difference in performance between Vanguard’s S&P 500 index fund versus their long-term treasury fund. It dates back to the start of 1999; that’s as far as StockCharts.com will let me go. Notice that since then, bonds have nearly doubled up on the performance of stocks and this includes some of the greatest years in stock market history! This time frame is especially compelling to me because stocks are currently valued, according to the Buffett yardstick and a few other valuable measures, just as highly today as they were back in 1999-2000.

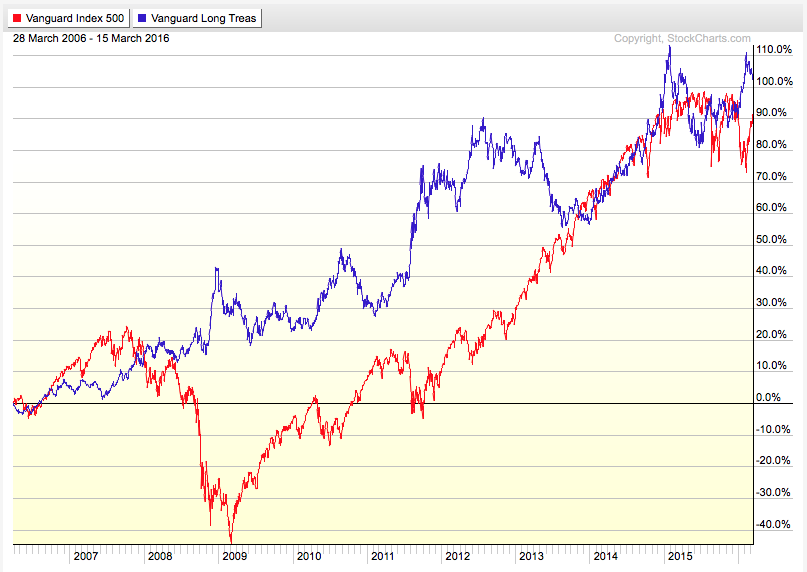

We can also just look at the past 10 years. Stocks have had an incredible run recently; surely they’ve outperformed bonds over the past decade. Nope. Bonds win again and, if you owned them instead of stocks, you felt much better about your investments during the financial crisis and were thus much more likely to stick with your investment strategy through that difficult period.

So it’s fascinating for me to see so many hang on so fiercely to the idea that buying and holding U.S. stocks over any and all time frames is the way to go, despite their much greater volatility and lagging performance in recent years. And to see this dogma take form across every robo-advisor I’ve found just validates how deeply ingrained this dogma has now become.

In fact, WealthFront is so in love with the idea they wouldn’t put any of my money at all into long-term treasuries. Why not? Because they’re clinging to a dogma that perhaps worked at one point a long time ago, when stocks were more consistently fairly valued. But this dogma hasn’t worked for quite a long time now. Maybe this is why Ray Dalio’s firm, which has adopted just the opposite dogma – overweight bonds versus stocks because they offer better risk-adjusted returns over the long-term, has become the largest hedge fund firm by assets in the world.

Now I’m not saying you should forget stocks and put all your money in bonds. But there is a wonderful case to be made for diversifying across a variety of asset classes. WealthFront makes it appear as if they’re doing so. They’re not. In fact, they would just put all my money in the stock market and say, “good luck!” True diversification is something very, very different and also something far more valuable. Sadly, it may take another painful bear market in equities before the robos learn this important lesson.