After the worst start to a new stock market year in history, some have begun to wonder if the unusual weakness is a sign of larger problems in the economy or financial system. Certainly, the growing strains in the credit market suggest it’s more than, “just an energy thing.”

These worries have been met with a popular response. I’ve seen a variety of headlines conclude, “why this market meltdown isn’t a repeat of 2008,” or something along those lines. But this rush to judge may be premature.

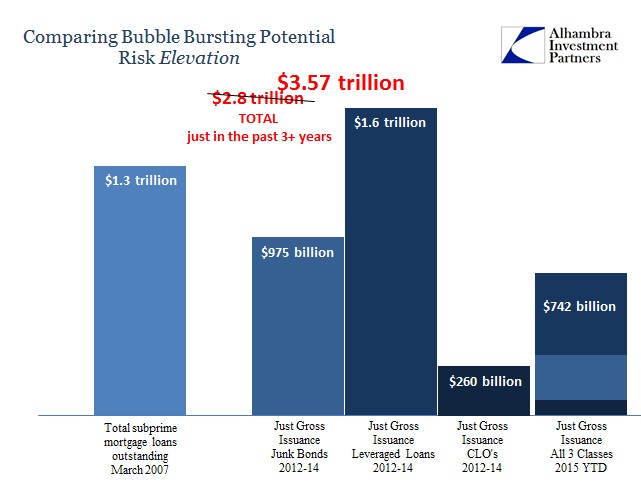

The incredible boom we have seen in corporate credit in recent years is actually very similar to the boom in the mortgage market which led to the financial crisis. As Jeff Snider noted yesterday, just the past few years issuance of lower-rated corporate debt dwarfs the size of the entire subprime mortgage market in 2007.

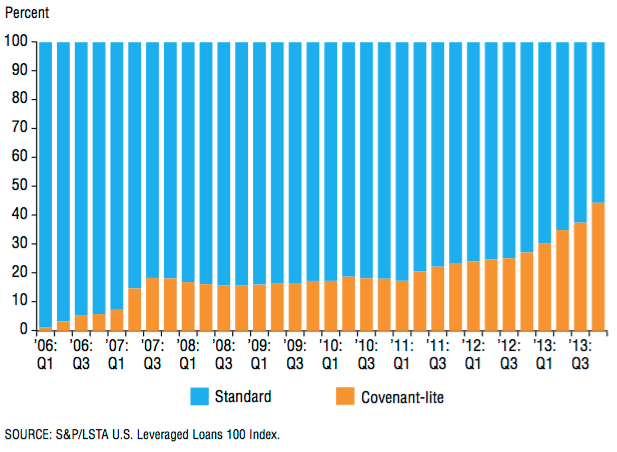

At the same time, lenders’ underwriting standards have never been more lenient. Covenant-lite lending, as a percent of total leveraged loans, has absolutely exploded in recent years. In effect, corporations have had access to their own version of NINJA (no income, no job, no assets) loans.

At the same time, lenders’ underwriting standards have never been more lenient. Covenant-lite lending, as a percent of total leveraged loans, has absolutely exploded in recent years. In effect, corporations have had access to their own version of NINJA (no income, no job, no assets) loans.

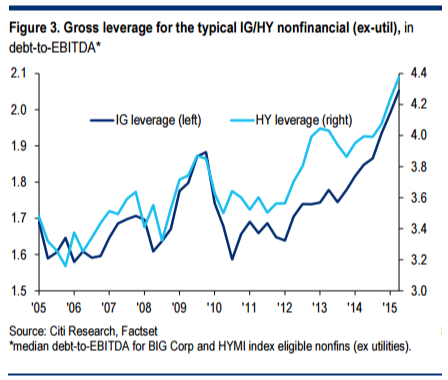

Finally, sub-prime mortgages were highly-levered (in terms of loan-to-value) and built upon inflated home prices compounding the problem. Similarly, corporate leverage is now off the chart.

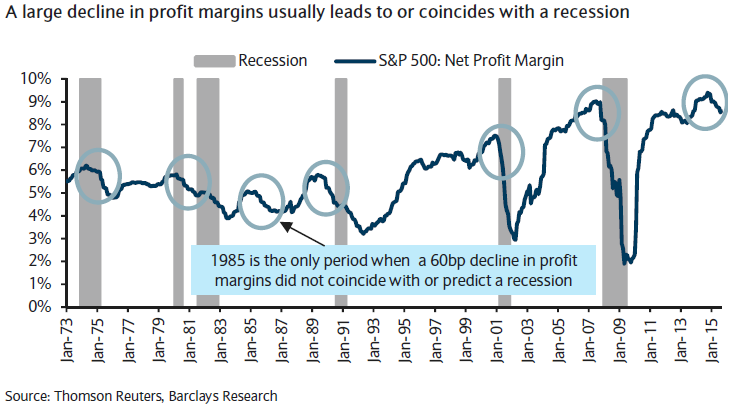

At the same time, these soaring leverage ratios are built upon similarly inflated profit margins.

So it’s probably far too early to say that the current weakness in risk assets, especially in the credit markets, is in any way, “contained,” as of yet. In fact, there are many similarities between today’s corporate credit boom and the mortgage boom that led to the financial crisis nearly a decade ago. And to dismiss the systemic risk once again? Shame on you.

RELATED:

The Only Guy On The FOMC With Any Experience Actually Managing Risk Is Sounding The Alarm