For all of the digital ink spent recently on the two interrelated topics of investment managers raising cash holdings and mutual fund outflows, very, very little of has been spent on why we have seen these new trends develop.

The Wall Street Journal on Sunday ran such a piece and out of 1,162 words, some readers may have been intrigued by the following two sentences:

Many mutual funds are facing rising requests for withdrawals from retiring Americans. About 10,000 baby boomers turn 65 every day.

It’s a shame the article’s authors didn’t see fit to delve into this topic to any greater extent. The balance of the article is spent discussing waning risk appetites, implying rising cash levels are more of a sentiment signal than anything else.

And the topic of demographics and its impact on the markets is consistently being given short shrift. Even in a recent feature on demographics in which they call the latest developments, “dramatic and unprecedented,” the Journal’s focus is squarely on the demographic effects on the economy without even a single mention of its potential effects on the financial markets.

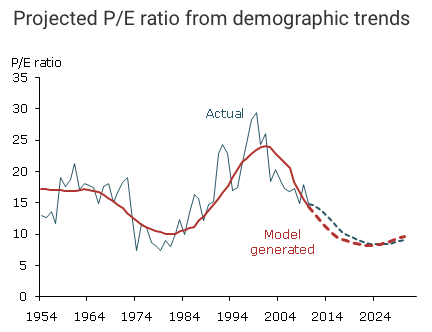

The Fed, in contrast, has made a point to demonstrate the strong link between demographic shifts and equity valuations here in the U.S. Using a ratio of middle-aged to old-aged cohorts, they find price-to-earnings ratios are highly correlated to long-term trends in demographics.

This measure of the population and its most active investors peaked around 2000, along with the dotcom bubble, and has been falling ever since with no bottom in sight for about a decade from now. If the relationship between folks and stocks is to hold up over that time, it suggests the broad stock market could once again become just as cheap as it was during the 1974-1982 period.

The larger point to be made here, however, is that simply due to the sheer number of baby boomers retiring, outflows from mutual funds and pension funds are likely to be more of a secular trend than a cyclical one. Investment managers are then forced, to some extent, to raise cash levels to meet these persistent redemptions.

Surely, there are cyclical forces at work, too. Investors always pour too much money into risk assets during bull markets and do the opposite during bear markets. But to dismiss the secular, demographic forces at work right now is to miss the big picture. And this could prove costly to those seeing contrarian signals in today’s rising cash levels that could eventually prove illusory.