Over the past few months I’ve been looking at gold and particularly the gold mining stocks for signs of a bottom. To be clear, I don’t own either… yet.

But here’s why I’m intrigued by the opportunity:

- Central banks are competing to devalue their currencies. The longer this goes on the more likely gold will benefit.

- Gold miners are extremely cheap relative to gold.

- This might just be the most hated asset class in the world right now.

The reasons I haven’t taken a position yet are:

- If we are, in fact, currently experiencing a global deflation this is not good for gold (or oil, copper, etc.).

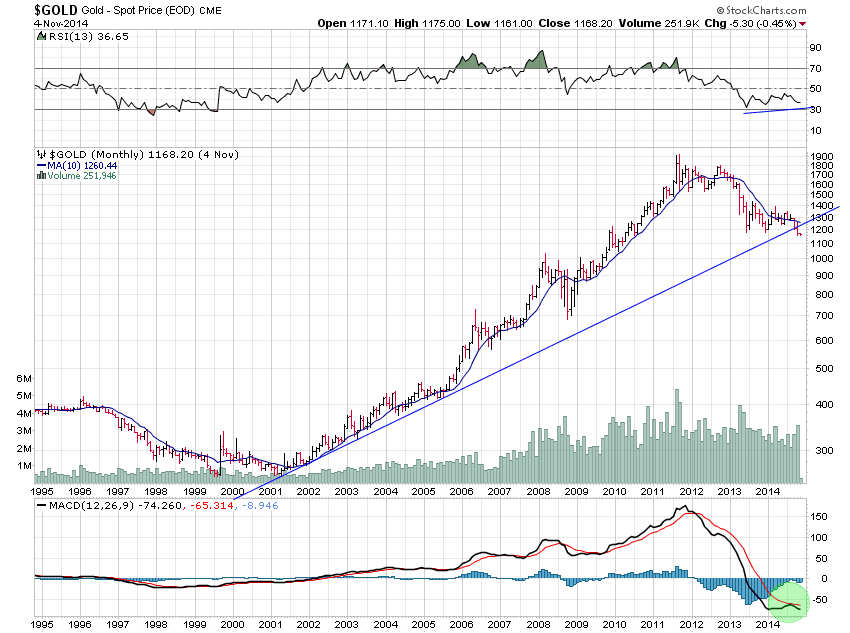

- The trend is super-fugly.

So basically, I’m waiting for the chart to confirm or deny the above. As it stands, the long-term uptrend broke last month:

So unless we see a major reversal soon (or at least some sort of attempt to form a bottom) I’ll have to assume deflation trumps money printing. However, if gold can manage to find a bottom it could end up being a helluva trade. Stay tuned.