How many Bitcoin "investors" can legitimately say the currency is within their "circle of competence"? $BTCUSD $BCOIN

— Jesse Felder (@jessefelder) February 18, 2014

You may not have a heard of Bitcoin but to finance nerds like me it’s been a fascinating story to watch over the past few months. So what is Bitcoin? In the words of CoinDesk, the self-proclaimed “voice of digital currency,” Bitcoin is:

Bitcoin is a form of digital currency, created and held electronically. No one controls it. Bitcoins aren’t printed, like dollars or euros – they’re produced by lots of people running computers all around the world, using software that solves mathematical problems. It’s the first example of a growing category of money known as cryptocurrency.

But what’s a “cryptocurrency”? According to Wikipedia:

Fundamentally, cryptocurrencies are specifications regarding the use of currency which seek to incorporate principles of cryptography to implement a distributed, decentralized and secure information economy… Within cryptocurrency systems, the safety, integrity, and balance of all ledgers is ensured by a swarm of mutually distrustful parties, referred to as miners, who are, for the most part, general members of the public, actively protecting the network by maintaining a high hash-rate difficulty for their chance at receiving a randomly distributed small fee. Subverting the underlying security of a cryptocurrency is mathematically possible, but the cost may be unfeasibly high… Most cryptocurrencies are designed to gradually introduce new units of currency, placing an ultimate cap on the total amount of currency that will ever be in circulation. This is done both to mimic the scarcity (and value) of precious metals and to avoid hyperinflation.As a result, such cryptocurrencies tend to experience hyperdeflation as they grow in popularity and the amount of the currency in circulation approaches this finite cap.

Got that? Great. Then get out there and join the Bitcoin gold rush!

But I won’t be joining you because there is no way in hell I’m going to begin to understand all that. In the words of Warren Buffett, it’s just not within my personal “circle of competence.” I’m just not capable of analyzing it and understanding whether my money will be safe in it.

And I bet there are only a handful of people on the planet that actually can. Which means 99% of the people trading it right now have no real investment reason for owning it and are just speculating that prices are going higher… just like they did in internet stocks in 1999 and in real estate in 2005.

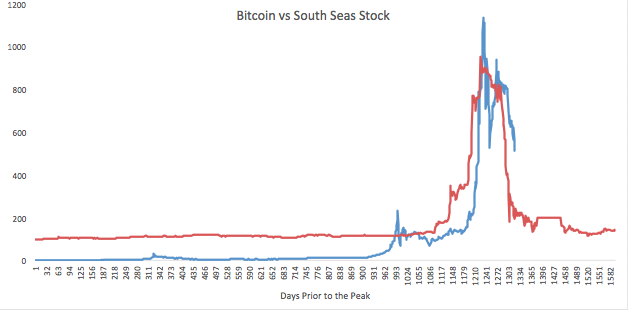

Oh… and in 1711 in South Seas stock:

via Meb Faber

via Meb Faber