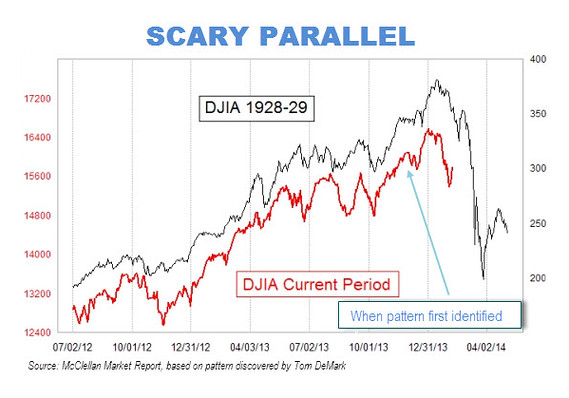

This analogue (discovered by Tom Demark) between the 1929 Dow Jones Industrial Average and today’s index has been around for months. It hasn’t gone away because the current market keeps fitting itself to the pattern:

via Marketwatch

via Marketwatch

Before you dismiss it as mumbo jumbo consider a couple of things:

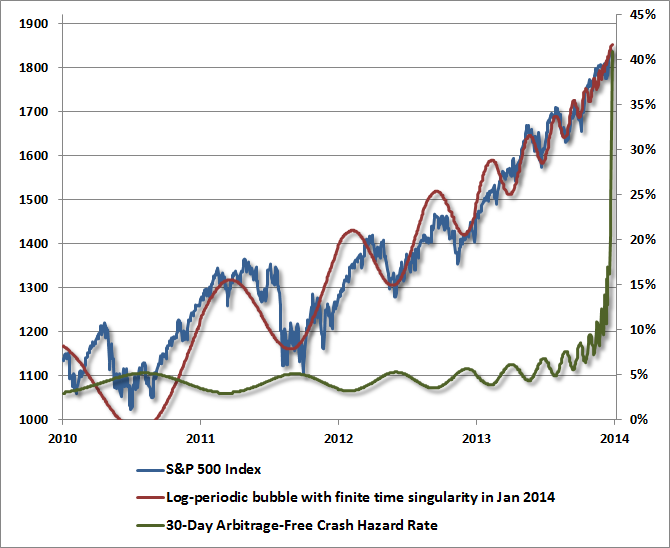

Option skewness (indicating the probability of a crash) recently hit its highest level ever recorded:

via John Hussman

via John Hussman

And the massive growth of margin debt and leveraged ETFs over the past few years poses a systemic risk to the stock market that has also never before been witnessed:

via dshort.com

via dshort.com

Now I didn’t post this to scare you. I just think it’s worthwhile to consider these things because they do happen from time to time and when they do it’s best to be prepared – to have a game plan.