By now, everyone and their mom knows that oil has been skyrocketing recently:

Perhaps you’ve even heard about gold’s latest runup:

The markets are screaming, “inflation!”

Or are they?

In stark contrast to these two commodities are the recent movements of interest rates. In an inflationary environment, bond investors expect greater yield. Bonds investors, however, have recently been so eager to buy bonds they’ve pushed yields down near historic lows:

Have the bond vigilantes retired? Are gold and oil speculators the new inflation vigilantes?

I think the jury is still out for now but there is one other commodity, an historically rather important one, that is suggesting the bond boys may have it right.

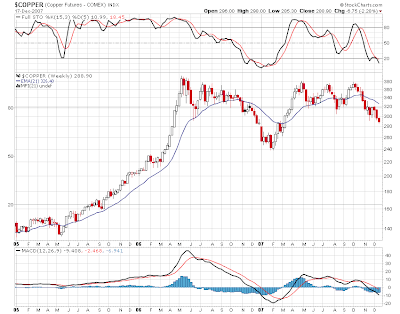

Dr. Copper (PhD in Economics) has not followed it’s brother commodities, oil and gold, to new highs:

In fact, it looks to me like it may have put in a long-term double top. And if Dr. Copper isn’t all that worried about inflation, I’m not gonna fret about it either.

As for deflation, the kind that is currently being painfully witnessed in the real estate market, that’s another story altogether…

-LIV