Being a die-hard contrarian, I regularly like to ask myself, “what is the most contrarian trade out there right now?” In other words, “what trade do the most people feel the most confident about?” Because, “all the people can’t be all right all of the time,” this is usually a good way for me to find good trades.

Currently, I keep coming back to the U.S. Dollar. There has been so much negative press lately – everyone and their Mom knows that even the Loonie is now more valuable than our beloved Greenback (so many that most would probably dispute the term, “beloved”) – that I find it irresistable.

Fundamentally, there are good reasons for the dollar to be down: our massive twin deficits and a Federal Reserve that shows a greater regard for protecting speculators than containing inflation, to name a couple.

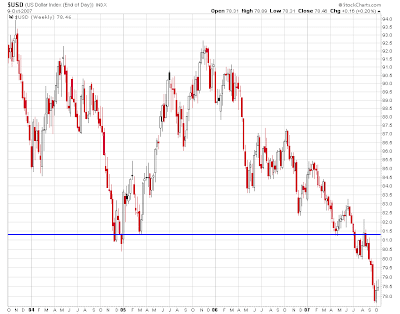

Technically, too, the dollar, on a weekly time frame, has recently broken down in classic bearish fashion:

The monthly chart shows that this breakdown has taken the dollar to lows it has never seen before:

However, RSI and MACD are diverging positively suggesting that this breakdown may prove to be a headfake.

Fundamentally, I believe we are beginning to see early signs of deflation. We are certainly seeing deflation in the real estate market right now. If it spreads to other asset classes the dollar may well see a bull market to rival some of the bubbles we’ve witnessed over the past decade. Regardless, the dollar is probably oversold and needs at least a bounce.

With so many in the dollar-bear camp, I think the current move to new, all-time lows has a very good chance of becoming false breakdown. In fact, I feel very comfortable being the lone bull in the dollar stable right now.

LIV