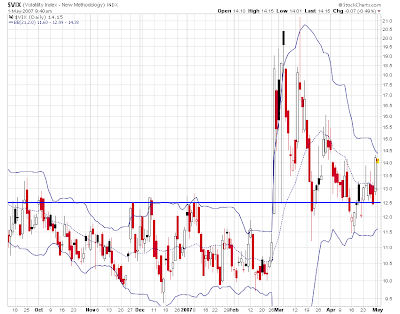

So the VIX has stubbornly refused to break down below the all-important 12.5 level even while the Dow has conspicuously broken out to new all time highs.

The Russell 2000 Index of small-cap companies has also failed to match the blue-chip-dominated Dow by breaking out to new highs. It’s attempt was firmly rejected.

These two glaring red flags bear watching especially during the first pullback we get in the Dow. If it pulls back to its breakout level and holds it it will create a classic bullish setup.

However, looking at the index on a weekly timeframe suggests a pullback now may setup some longer-term divergences between price and momentum creating a classic sell setup on a longer time frame.

This would also affirm the messages being given by the divergences in the VIX and Russell right now: caution is warranted. Considering the Dow’s historic run and the concomitant potential for a reversal in the markets’ synchronicity, a pullback now may mark the beginnings of a significant topping process.

LIV