Due mainly to the growing problems in finance, I believe that the Fed will be forced to lower short-terms rates sometime within the next year.

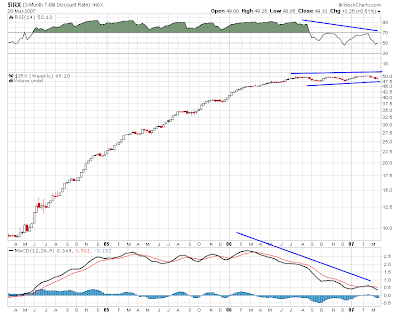

Technically, the yield on the 3-month Treasury Bill confirms this view. From the chart below, it’s looking very tired (ready for the Fed to give it a rest, i.e. lower rates):

Looking out longer-term, the yield on the 10-Year Treasury Bond is butting up against long-standing (multi-decade) resistance. A recession would be the perfect excuse for the this thing to retest its lows from a few years ago:

Finally, the 5-year Treasury note PRICE looks very bullish to me over the next couple of years (when yields go down prices go up in the bond market). It has broken out of its descending wedge and tested the breakout:

Fundamentally AND technically, then, the bond market is telling me to expect economic weakness over the next year or so (and I didn’t even mention the inverted yield curve). Then again, if I’m wrong and the yield on the 10-Year Note breaks out of its multi-decade downtrend, the markets (mainly real estate) will really find out what the backside of a bubble feels like.

LIV