Now that it’s clear home prices are beginning to decline, the obvious question is, “how far will they fall?”

In order to answer this question it is important to understand where we are and how we got here. Jeremy Grantham, chairman of investment firm GMO, LLC, has studied every asset bubble, defined as a move in price greater than 2 standard deviations above it’s long-term trend, in modern history. The type of price move that qualifies as a bubble under this definition should occur once only every 40 years and Grantham has found only 28 instances of price bubbles across all asset classes in modern history.

When measured against almost any type of yard stick such as incomes, rental rates or inflation, real estate prices have, in fact, attained this rarified status in the past few years. And according to Grantham, all but 1 of the 28 bubbles he’s recorded has returned to it’s normal trend over time. “I am patiently waiting for the 28th bubble, the S&P 500, to go all the way back to trend,” he writes. Indeed, after the bear market that began in 2000, it’s well on it’s way.

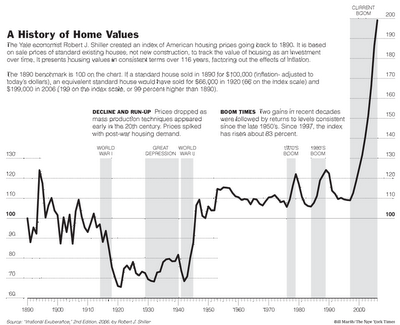

All of these indicators that tell us real estate is truly a bubble show that real estate is overvalued approximately 20 to 40% nationwide. This implies that, in order to return to its historical trend, real estate would need to decline in price a minimum of roughly 20% from current levels. Keep in mind that these are national numbers. Areas that boomed greater than average will necessarily experience greater busts and vice versa.

An inflation-adjusted chart of home prices since 1890, created by economist Robert J. Shiller, shows the dramatic rise in prices in recent years and implies how far they have to fall:

Dramatic price declines, equal to the price inflation of the past few years, will be driven by many factors. Speculators that were enticed by the prospect of flipping their way to millions have now flipped from buyers to sellers throwing their considerable weight from the demand side to the supply side of the price equation.

Looming problems in the finance industry will result in rising foreclosures that add inventory to the already saturated market; in addition, these problems will make borrowing to purchase a home far more difficult.

Another major problem facing the real estate market is the fact that the economy has become so dependent upon it. Real estate jobs have been responsible for over one-third of the nation’s job growth over the last four years. Without a booming real estate market the overall job market will taper off dramatically. Declining transaction volumes will actually neccesitate a loss of jobs among realtors, mortgage brokers, builders, etc.

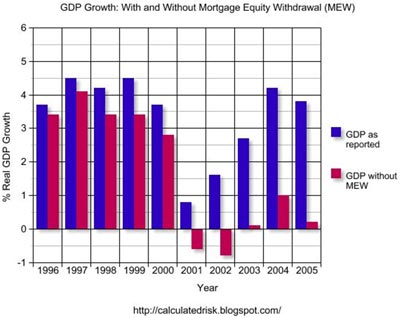

Rising home prices have also created a boom in cash-out refinancing that has been a large contributor to economic growth. Without this stimulus, the economy would have essentially suffered a prolonged recession since 2001:

All of the factors that have supported rising home prices are now reversing themselves. The vicious cycle of rising home prices attracting new money into the asset class is beginning to spin backwards and will ultimately exacerbate the downside of the boom.

This is how a bubble pops. And we all have front row seats at the popping of the biggest bubble in history.

LIV