I do a good deal of reading every day and I share the best of what I find on Twitter. The purpose of this reading is not so much to find out what’s really going on as it is to try to understand how people feel about what is going on. What are the trends and narratives that are important to market participants and where are they in their life cycle.

One trend I’ve been following for a while now is the growing participation in the financial markets on the part of young individuals. Since most brokers went commission-free, following in Robinhood’s footsteps, the interest in trading has gone through the roof. This week feels like the narrative is reaching a crescendo.

Total user positions at Robinhood was 16.41m on Feb 19, the SPX high.

It surged to 21.48m on Mar 23, the day of the low. This was a 31% increase as stocks declined 34% in six weeks.

From the low through yesterday, total user positions have soared to 37.13m, up 73%.

(1/2) pic.twitter.com/7ahRW21TBD

— Jim Bianco (@biancoresearch) June 9, 2020

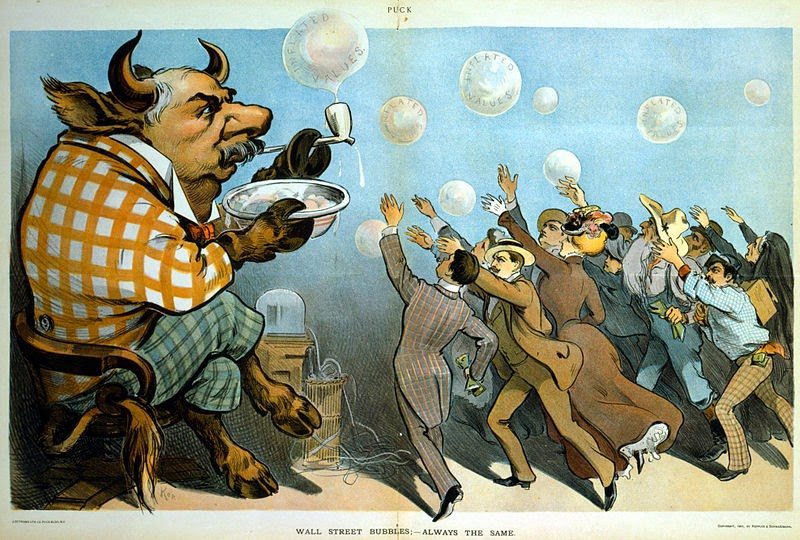

So I thought it might be important to immortalize some of the stories in my recent Twitter feed in a blog post here. During the dotcom mania, my friend Bill Fleckenstein tracked the bubble in what he called, “The Mania Chronicles.” Consider this my very limited version of the same.

Google search trends for "call options" and "day trading" is pretty telling: pic.twitter.com/C3mjoAOEv1

— Jesse Felder (@jessefelder) June 10, 2020

The stock market has set many records this year. After putting in the fastest 10% decline from a new high, it then put in the fastest 20% and 30% declines. Since then, however, it’s now put in the fastest recovery from a crash in history.

'The fastest stock market collapse on record has been followed by the fastest recovery. In the context of such an enormous gush of liquidity it is clear at an intellectual level that there was immense pressure on share prices to rise.' https://t.co/mvtdL6hVO2 pic.twitter.com/O7PeA3VnPj

— Jesse Felder (@jessefelder) June 9, 2020

An unprecedented boom in money printing for the explicit purpose of supporting asset prices is certainly part of the reason for the recovery but it is also important to note what that money printing has inspired: an unprecedented boom in financial market speculation by retail traders.

Speculative Fervor in U.S. Stocks Surges to ‘Stunning’ Levels https://t.co/xv9G5zdSSA pic.twitter.com/GbsLObPuWP

— Jesse Felder (@jessefelder) June 9, 2020

Combine massive money printing with mass speculation and record low liquidity (in futures and almost every other market) and you get the fastest 50-day rise in the stock market on record.

Stock market futures liquidity: https://t.co/gUB6CKrSgP via @SoberLook pic.twitter.com/DgyNEbLIWP

— Jesse Felder (@jessefelder) June 9, 2020

As a result, we now have an army of traders who believe they are the second coming of Warren Buffett. While the Oracle of Omaha now looks foolish for selling his airline stocks, those who bought them up over the past few months are gloating like you rarely see in this game.

I’m sure Warren Buffett is a great guy but when it comes to stocks he’s washed up. I’m the captain now. #DDTG pic.twitter.com/WqMR89c7kt

— Dave Portnoy (@stoolpresidente) June 9, 2020

Like Mark Cuban said, “everybody is a genius in a bull market,” and the largest 50-day gain in history is minting a ton of geniuses right now.

"If you're a day trader and you can walk and chew gum, you're making money right now. And so what are you doing? You're doing the same thing they did in the late-90's. Everybody is a genius in a bull market." –@mcuban https://t.co/gk7obCRuLg

— Jesse Felder (@jessefelder) June 9, 2020

To get a sense of the mindset of many of these traders, the Wall Street Journal spoke to a few of them and they make no bones about gambling with the funds the government sent them as part of the CARES Act, trying to double or triple it in just a day’s time.

"It was basically free money, so, you know, I decided to play around with it. You might lose some, you might win some. It’s like a gambling game."

"I’m happy with doubling my savings overnight. Where else are you gonna find that?" https://t.co/4XUFv5dfVw

— Jesse Felder (@jessefelder) June 9, 2020

In 1999 and 2000, day traders went for the hottest internet stocks of the day in trying to make outsized returns; eventually many went bankrupt. Today, they’re looking for outsized returns in the stocks that have already filed for bankruptcy protection!

"Something we really never think we’d see but we saw yesterday — Buying hundreds of billions of shares of bankrupt companies, sending their shares 300%. It’s sort of this speculative behavior that we saw at the end of 1999 and the beginning of 2020." https://t.co/2veHGijQXk

— Jesse Felder (@jessefelder) June 9, 2020

But if there’s a lesson from that earlier period, it’s this:

"A mania first carries out those that bet against it, and then those that bet with it."

–Jim Rogers

— La nuit sera calme (@NuitSeraCalme) June 9, 2020

This rally has humbled not only Warren Buffett but also Stan Druckenmiller, Sam Zell, Carl Icahn, Paul Singer, Jim Rogers and a host of other true geniuses of the industry whom have bet against it. It seems like it may soon be time for it to carry out those betting with it.