‘So I’ve set up my brokerage account. Now what do I do? Which funds should I use and how much of each one do I buy?’ This is the next question I’m going to tackle in this series and it’s probably the toughest one to answer definitively.

Ultimately, the answer to this question will vary greatly from person to person based on their individual risk tolerance and goals. Some folks want to shoot for the moon and some just want to preserve what they’ve got. Some are okay with big swings in the markets and some don’t like any volatility at all.

My goals is to educate you about which Schwab ETFs are considered more or less aggressive and more or less volatile. Once you understand this you can decide which are suitable for you and in what amounts based on your own individual risk tolerance and goals.

This process is called “asset allocation” and contrary to what your financial adviser has told you it’s not rocket science. Not even close. In fact, it’s really very simple. To keep it simple, the two main asset classes we are going to deal with are equities (aka, stocks) and fixed income (aka, bonds).

Typically, more aggressive investors allocate a greater portion of their portfolio to equities and conservative investors allocate a greater portion to fixed income. The reason for this is that historically stocks have outperformed bonds but they have also been more volatile.

Within these asset classes there is another degree of risk to consider. Large cap stocks (big, blue chip companies) are usually less volatile than small cap stocks (small companies). Small caps, though, have historically outperformed their bigger brethren. This is why conservative equity investors usually focus more on large caps and aggressive investors focus more on small caps.

When looking at overseas investments emerging markets are akin to small cap stocks. Rather than young companies, though, emerging markets are young countries, economically speaking, and commonly referred to as BRICs (Brazil, Russia, India and China). Emerging markets, like small cap stocks, tend to outperform their larger counterparts but are also more volatile. Most foreign funds, for this reason, have a larger weighting toward more established countries like the UK, Japan, Canada, Australia and France and are thus more conservative.

In terms of fixed income, short-term bonds are generally considered more conservative than long-term bonds because they carry less interest rate risk and credit risk. Long-term bonds, though, carry higher yields (they pay more in interest) than short-term bonds to compensate for the increased risk. Likewise, corporate bonds are considered more aggressive than government (treasury bonds) and municipal bonds because they too carry greater credit risk. For this reason they also carry higher interest rates.

So if we were to put together a scale of the most aggressive, diversified ETF portfolio sliding all the way over to the most conservative we would have a portfolio fully concentrated in small cap and emerging market stocks and long-term corporate bonds (most aggressive) at one end and at the other end would be a portfolio fully concentrated in short-term treasury bonds and large cap stocks (most conservative).

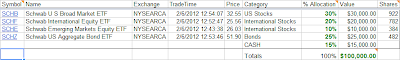

I expect your personalized portfolio to fall somewhere in the middle. I can’t build it for you; it’s up to you to design it yourself. After all, you have empowered yourself by becoming your own financial adviser. To help you get started I’ve built a very basic model portfolio of Schwab ETFs you can take a look at but this is in no way advice. It’s for illustration purposes only. You will need to decide how to build your portfolio to suit your personal needs and goals.

The Schwab US Broad Market ETF I use as an example covers all the stocks in the US equity markets but is more heavily weighted to large cap stocks. Similarly, the US Aggregate Bond ETF covers the entire bond market, both corporate and government of all durations, but is more heavily weighted towards government-backed bonds and shorter-term bonds.

I tossed in an International Fund and an Emerging Markets fund because there isn’t one fund that does both. With these four funds, then, you get exposure to all of the asset class permutations discussed above. There are others to explore but these are a good start and may be all you’ll ever want to consider.

Clearly, you will want to decide on your own allocation percentages and add or remove other fund choices. This is the fun part – build it to your exact specifications. Now that you have a basic understanding of the funds’ different characteristics you can put them together in way that works for you.

Know that there is no perfect asset allocation. It’s probably never going to feel just right. Like anything new this process is going to take some time and experience to get it dialed it in. But have confidence knowing that using a few of these ETFs gives you enough diversification to protect you from making the classic ‘putting all your eggs in one basket’ mistake.

And before you get started doing this in the real world you’ll need a couple more key safeguards that I’ll cover in tomorrow’s post. Stay tuned…