Below are some of the most interesting things I came across this week. Click here to subscribe to our free weekly newsletter and get this post delivered to your inbox each Saturday morning.

QUOTE

Many have lately been searching for meaning in the gold’s scorching rally. As DealBook puts it, “Gold prices are behaving like we’re on the brink of a financial crisis.”

LINK

This should put central bankers on alert. As Raghuram Rajan argues, “US financial conditions have eased throughout the Fed’s tightening phase. This suggests the excesses have not been squeezed out of the system, and will only grow again from a high level as monetary accommodation increases.”

LINK

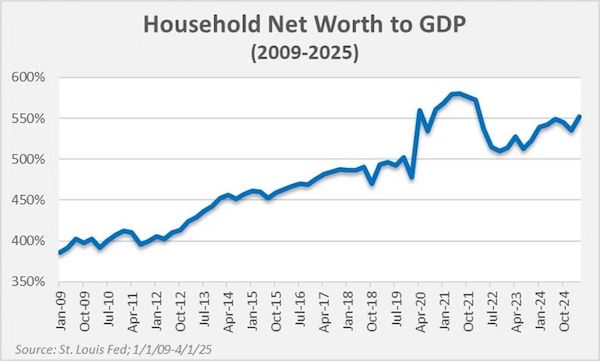

In addition to risks to financial stability, gold may also be warning about the persistence of inflation. “We believe asset inflation spilling over into consumer prices is one reason inflation has been stickier than expected. While price pressures have moderated from their 2022 highs, inflation is still running near 3% and has remained above the Fed’s target for over four years,” writes Eric Cinnamond.

CHART

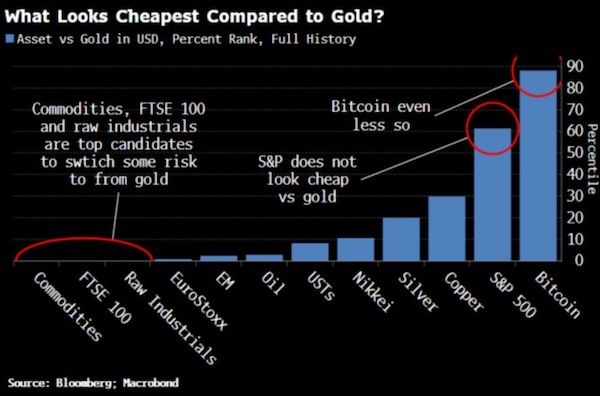

The move in gold prices also suggests that certain asset classes that historically have protected against persistent inflation may be deeply undervalued. “Some assets are remarkably cheap relative to gold. Top candidates among the major assets are commodities, the FTSE 100 and raw industrials — non-exchange-traded materials such as burlap, rubber, tin and steel scrap,” writes Simon White.

QUOTE

Some have also suffered from dramatic underinvestment. As Amin Nasser tells The FT, “We had a decade where people didn’t explore. It’s going to have an impact. Eighty to 90 per cent of growth came from shale. If you look at the next 15 years, shale is most likely to plateau and decline. Where are you going to bring the additional barrels to meet demand?”

For a deeper analysis of these themes subscribe to The Felder Report PREMIUM and get instant access to our Market Comments, Monthly Chartbooks, Tactical ETF Portfolio and more.