“Marriage is the triumph of imagination over intelligence. Second marriage is the triumph of hope over experience.” -Oscar Wilde

Substitute “investing during a mania” for “marriage” in the quote above and you’ll understand what is going on in the stock market today. To wit, in 1999, Warren Buffett famously told a select group of wealthy individuals at a confab in Sun Valley:

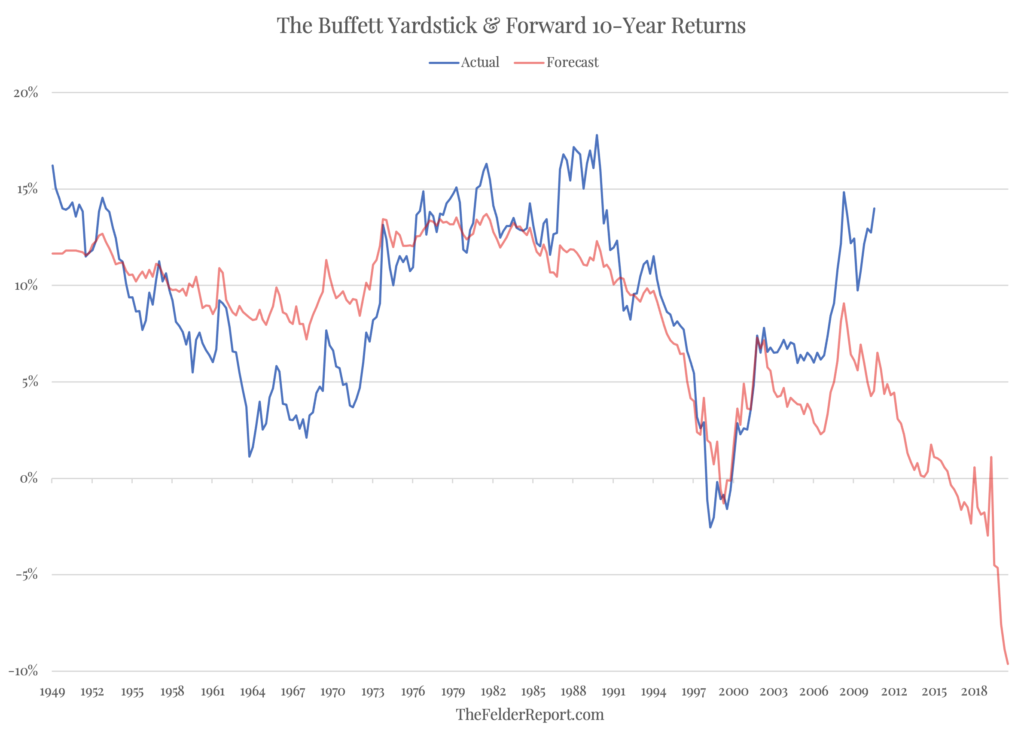

Investors in stocks these days are expecting far too much, and I’m going to explain why… A Paine Webber and Gallup Organization survey released in July shows that the least experienced investors–those who have invested for less than five years–expect annual returns over the next ten years of 22.6%. Even those who have invested for more than 20 years are expecting 12.9%. Now, I’d like to argue that we can’t come even remotely close to that 12.9%.

A couple of years later, in a piece for Fortune he explained:

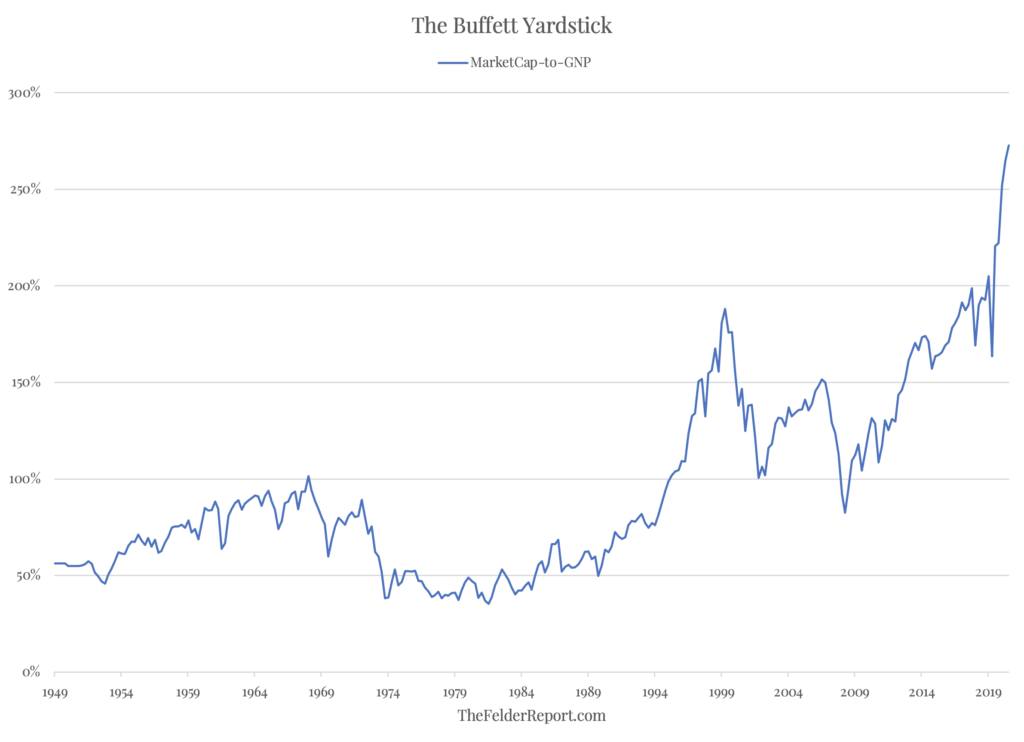

Below is a chart, starting almost 80 years ago and really quite fundamental in what it says. The chart shows the market value of all publicly traded securities as a percentage of the country’s business–that is, as a percentage of GNP. The ratio has certain limitations in telling you what you need to know. Still, it is probably the best single measure of where valuations stand at any given moment. And as you can see, nearly two years ago the ratio rose to an unprecedented level. That should have been a very strong warning signal. For investors to gain wealth at a rate that exceeds the growth of U.S. business, the percentage relationship line on the chart must keep going up and up. If GNP is going to grow 5% a year and you want market values to go up 10%, then you need to have the line go straight off the top of the chart. That won’t happen. For me, the message of that chart is this: If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you. If the ratio approaches 200%–as it did in 1999 and a part of 2000–you are playing with fire. As you can see, the ratio was recently 133%.

Interestingly, investor expectations have once again soared far beyond any reasonable figure. Natixis reports U.S. investors now believe they will achieve average annual returns after inflation of 17.5%, roughly in line with the most aggressive nominal return expectations seen at the peak of the DotCom Mania. As a result, they’re pouring money into the equity market like never before. This, despite the fact that the Buffett Yardstick has, in fact, gone, “straight off the top of the chart.”

In fact, this measure crossed above the level Buffett suggested investors were, “playing with fire,” years ago; it now stands more than 50% higher than its peak set in 2000, widely seen as the top of the greatest speculative mania in stock market history. However, if Mr. Buffett is right and, “price you pay determines your rate of return,” investors today are facing a much bleaker future than they were 20 years ago.

Then again, they didn’t listen to Buffett back then so why should they listen to him today?