This blog post is based on an excerpt from a recent report featured on The Felder Report PREMIUM.

“Even the most circumspect friend of the market would concede that the volume of brokers’ loans—of loans collateraled by the securities purchased on margin—is a good index of the volume of speculation.” -John Kenneth Galbraith, The Great Crash 1929

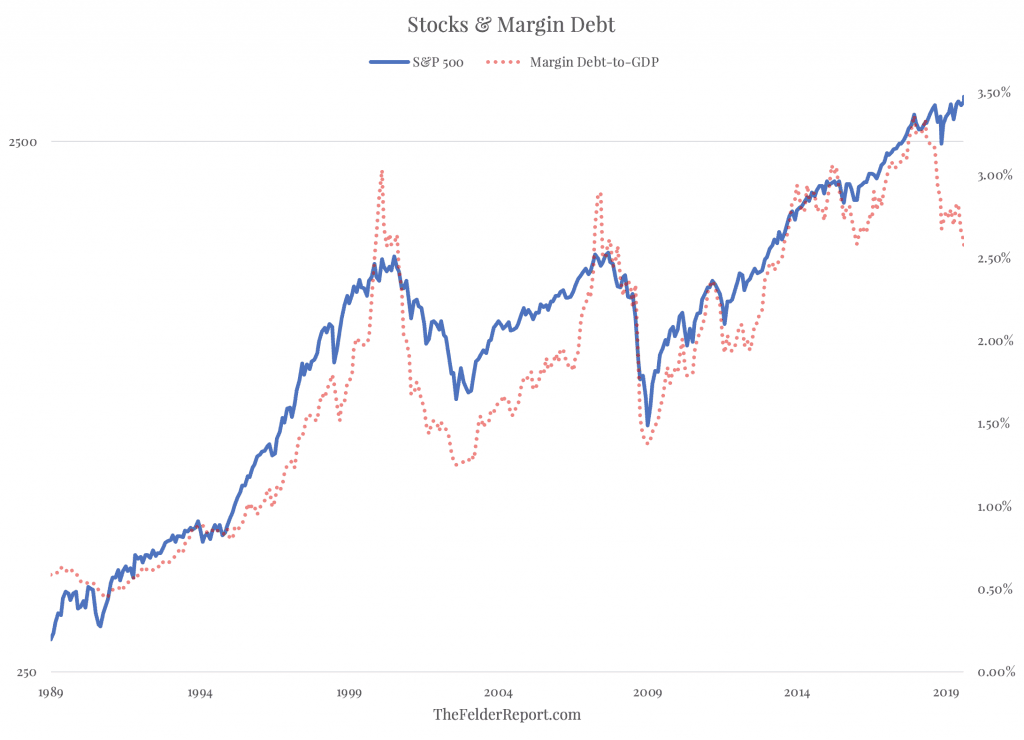

The “index of the volume of speculation,” as Galbraith called it, last year hit a high not seen at any point since prior to the Great Crash of 1929. And, while the S&P 500 recently hit new highs, margin debt relative to GDP recently fell below its lows from late last year. This suggests that investor risk appetites, after soaring to a euphoric extreme in 2018, are simply not supportive of stock prices in a broad sense in 2019.

What’s more, over the past 20 years, with the exception of the 2016 episode, when margin debt has begun to fall from such lofty levels it has coincided with a major market peak in stocks. Indeed, along with margin debt, the NYSE Composite, Russell 2000 and the Dow Transportation Average all remain below their 2018 highs. Investors chasing the new highs in the S&P 500 clearly believe, “this time is different.”

What’s more, over the past 20 years, with the exception of the 2016 episode, when margin debt has begun to fall from such lofty levels it has coincided with a major market peak in stocks. Indeed, along with margin debt, the NYSE Composite, Russell 2000 and the Dow Transportation Average all remain below their 2018 highs. Investors chasing the new highs in the S&P 500 clearly believe, “this time is different.”