A version of this post first appeared at The Felder Report Premium.

“This time is different.” Sir John Templeton famously called these, “the four most dangerous words in investing,” but that hasn’t stopped many pundits from pointing out the obvious ways in which this time is truly different from the past. And I don’t disagree with them. In fact, we have seen this plenty of times before. During the late-1920’s stocks rose to valuations that were unprecedented at the time. They did so again in the late-1990’s. And it’s true once again that things are now very different than what we have witnessed previously in the markets.

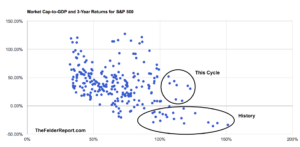

The median stock in the S&P 500 has never been valued higher than it is today. Corporate profit margins over the past decade have soared and sustained at heights rarely if ever seen before. In the past, margin debt was a valuable way to assess risk in the stock market. This relationship has broken down in recent years. The Buffett Yardstick was also not just a good way to assess forward 10-year returns for stocks but also 3-year risk in the stock market, as well. During this cycle this relationship has also failed. Finally, the relationship between demographics and equity valuations has also broken down in recent years.

The median stock in the S&P 500 has never been valued higher than it is today. Corporate profit margins over the past decade have soared and sustained at heights rarely if ever seen before. In the past, margin debt was a valuable way to assess risk in the stock market. This relationship has broken down in recent years. The Buffett Yardstick was also not just a good way to assess forward 10-year returns for stocks but also 3-year risk in the stock market, as well. During this cycle this relationship has also failed. Finally, the relationship between demographics and equity valuations has also broken down in recent years.

We can speculate about any number of causes for these phenomena including global central bank coordination in attempting to create a wealth effect, the mania in price-insensitive strategies like passive investing or the abnormally high risk appetites of baby boomers during this cycle. Who knows the real reason? I suspect it’s some combination of them all.

But what those who claim “this time is different” are really saying has nothing to do with the present environment. What they are really saying is that things will continue to be different in these ways forever. Not only do the old methods not work right now, they propose, they will never work again. In other words, there has been some seismic shift that has vaulted us into a new era where the old methods and measures no longer apply and never will again.

But what those who claim “this time is different” are really saying has nothing to do with the present environment. What they are really saying is that things will continue to be different in these ways forever. Not only do the old methods not work right now, they propose, they will never work again. In other words, there has been some seismic shift that has vaulted us into a new era where the old methods and measures no longer apply and never will again.

This is precisely the part of this popular sentence that Templeton was warning about. He wasn’t warning about unprecedented occurrences that are obvious to all. He was warning about extrapolating them indefinitely into the future. In essence, he was warning investors about the dangers of recency bias.

It’s not difficult to argue this time is different. It’s much more difficult to argue the next time will also be different and in the very same way this time is different. And the next time and the next time, too. Still, considering where all of the measures mentioned above currently stand investors better hope that we have, indeed, reached a “permanently high plateau” for asset prices because a reversion to historical norms from this point could be just as painful as the last time these four words became so popular.