Josh Brown, blogger extraordinaire, wrote a post the other day about the breakout in the financials which argued that investors should overweight them. All due respect to Josh (who I think highly of), here’s 5 reasons why I think that’s a bad idea, especially in regards to the bank stocks:

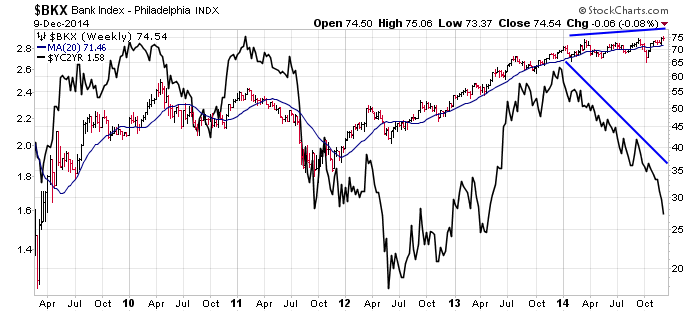

- The yield curve has been falling all year and lately more like a brick. Because banks borrow at the short end and lend at the long end this always leads to pressure on profit margins. That’s why, until this year, banks’ share prices were so sensitive to changes in the curve. I don’t know why their share prices haven’t noticed yet this time around but I’m thinking it’s just a delayed reaction:

- The default cycle is about as low it can possibly get and now looks to be turning upwards again. The 40% crash in the price of oil over the past few month raises the real prospect of rising defaults in the energy sector. Canadian and Texas banks are especially vulnerable and their share prices have taken a hit recently. But if there’s one thing we’ve learned from the financial crisis it’s that these things are never isolated. They are all closely and inevitably intertwined.

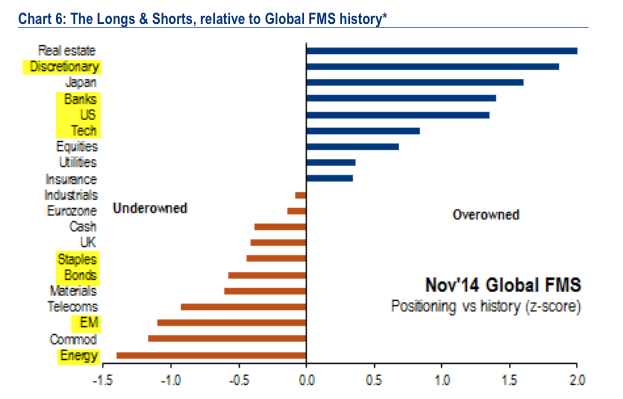

- Everyone and their mom is overweight the banks and has been for quite some time. And if everyone already owns them where’s the incremental demand going to come from to push prices even higher or at least faster than the broader market? That’s a tough question to answer.

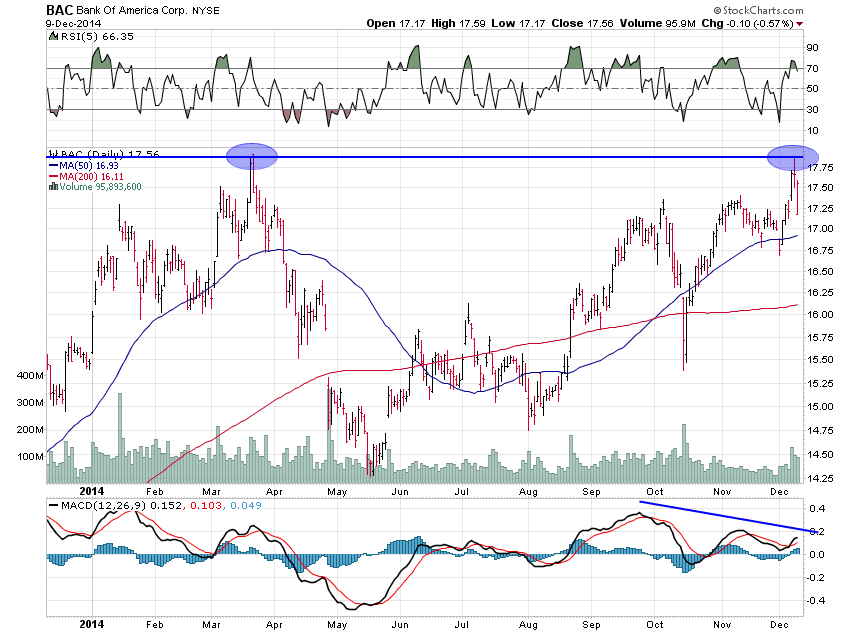

- What if these breakouts everyone is watching are nothing but a head fakes? False breakouts are one of my favorite chart patterns to trade because they are visual evidence of the crowd become overly euphoric for something. They are a text book example of price getting ahead of fundamentals (exactly where I think the banks are today). The resulting fall back to reality of sentiment usually brings with it a pretty dramatic price reversion, as well. (JPM, C, WFC all look vulnerable to me and BAC is merely working on a double top.)

- They are impossible to value. If the companies themselves can’t even determine how much money they made or lost in a given quarter how can anyone else be expected to? In fact, since FAS-157 was repealed (or “relaxed”) who knows if they’re even solvent? You just can’t possibly “invest” in something you can’t begin to understand (but speculate away; that’s your prerogative).

Ultimately, I think the banks might be the most vulnerable sector to a cyclical downturn and there are plenty of signs (global economic weakness, interest rates, commodities and bond market risk appetites) we could be headed in that direction fairly soon.

Disclosure: I am short financials.