Sentiment surveys are fun. They tell us how investors feel about stocks at a given point in time. Personally, though, I find it more interesting to see what investors are actually doing with their money. And right now there are two signs that suggest investors have rarely been as bullish as they are today, if ever.

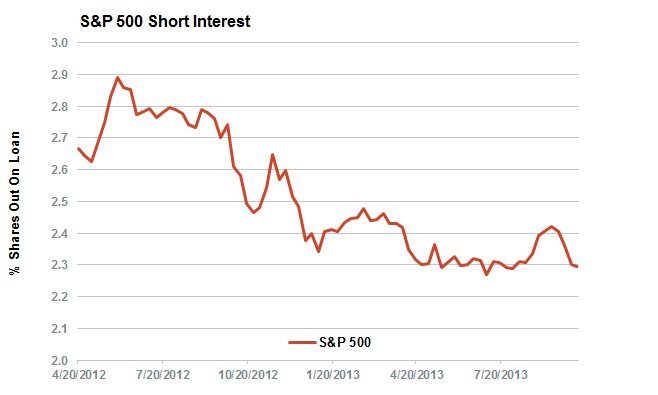

First is short selling. Short sellers borrow shares from investors who own them and sell them in the open market hoping to buy them back at a lower price. Essentially, they are betting share prices will fall over a given period of time. Back in July the proportion of S&P 500 company shares borrowed for the purpose of short selling fell to an all-time record low. Currently, we are still very close to that number (see chart below courtesy of Markit).

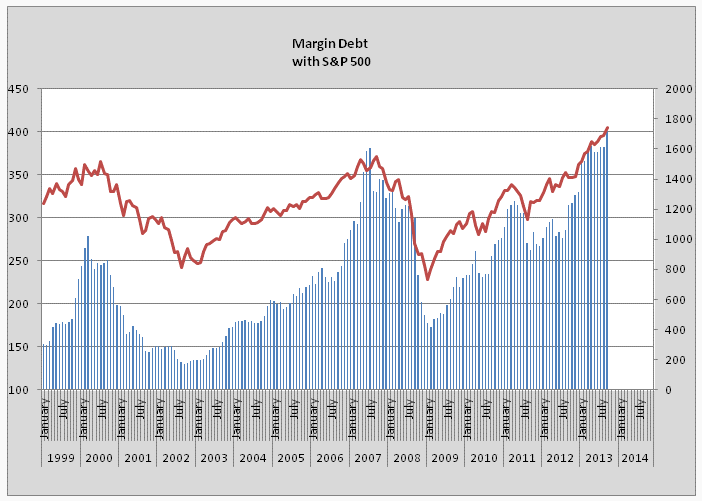

Today we found out that investors using margin debt to leverage their upside also reached a new milestone. Total margin debt levels hit a new record last month (see chart below courtesy of Helene Meisler).

Today we found out that investors using margin debt to leverage their upside also reached a new milestone. Total margin debt levels hit a new record last month (see chart below courtesy of Helene Meisler).

All in all, it looks like the number of bears (short sellers) has hit an all-time record low just as the level of bullishness (margin debt) reaches and all-time new high. Rarely have we seen such a disparity in opinion backed up by real money. And rarely (never?) has it ended well.

All in all, it looks like the number of bears (short sellers) has hit an all-time record low just as the level of bullishness (margin debt) reaches and all-time new high. Rarely have we seen such a disparity in opinion backed up by real money. And rarely (never?) has it ended well.