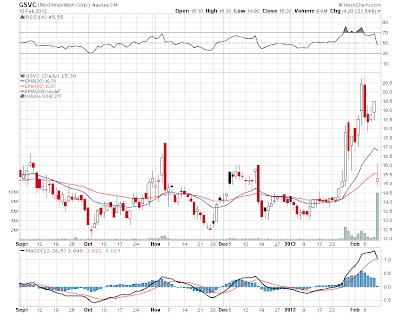

The problem was that Facebook was a very small and very recently acquired position for GSV. Investors buying the stock at $20 were paying a very large premium to the fund’s net asset value ($13 as of 9/30/11). I warned as much via StockTwits and Twitter:

Clearly $gsvc investors don’t know that the fund’s Facebook cost basis valued the company around $70B…

— Jesse Felder (@jessefelder) February 2, 2012

Clearly $gsvc investors don’t know that the fund’s Facebook cost basis valued the company around $70B…

— Jesse Felder (@jessefelder) February 2, 2012

So buyers of $gsvc are essentially already paying $100B for its Facebook stake (and a 40% premium to its other investments).

— Jesse Felder (@jessefelder) February 2, 2012

No position in $gsvc #justsaying

— Jesse Felder (@jessefelder) February 2, 2012

At its current value, $gsvc buyers are also paying $35/share for its $grpn stake

— Jesse Felder (@jessefelder) February 2, 2012

Buyers are also paying $12B for $gsvc’s Twitter stake, whose most recent round valued it at $8B

— Jesse Felder (@jessefelder) February 2, 2012

A few days later it seemed the fund’s management saw things as I did and announced a secondary offering. The problem was rather than selling shares at $20 they announced the offering price would be $15.