Below are some of the most interesting things I came across this week. Click here to subscribe to our free weekly newsletter and get this post delivered to your inbox each Saturday morning.

LINK

“Can anything stop the stock market?,” asks The Atlantic this week. “As the stock market soars ever higher, the theories of why it rises have suffered the opposite fate. One by one, every favored explanation of what could be going on has been undermined by world events.”

CHART

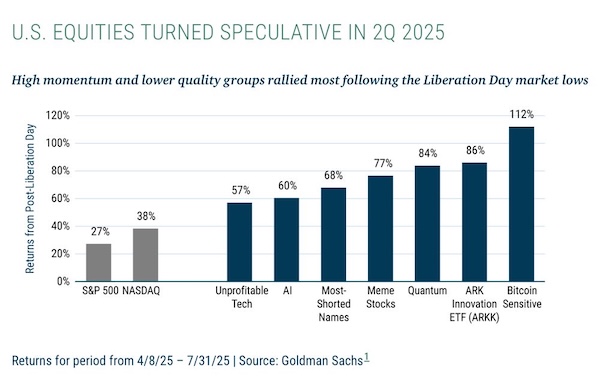

As GMO points out, it may simply come down to frenzied speculation. “Animal spirits are roaring, and strong momentum has pushed both valuations and signs of speculation to risky levels.”

LINK

A big part of that speculation has centered on the explosion in so-called crypto treasury companies. “Most are ordinary businesses with no previous experience in crypto but whose digital asset holdings are worth substantially more than any money the company actually makes,” reports The Financial Times.

LINK

Much like we saw during the Dotcom Bubble, many of these may turn out to be little more than pump-and-dump schemes. “…some of the transactions have involved insiders loading up on shares in the entity and the digital token it will invest in before its pivot is made public — and then selling when the announcement is made,” reports Bloomberg.

STAT

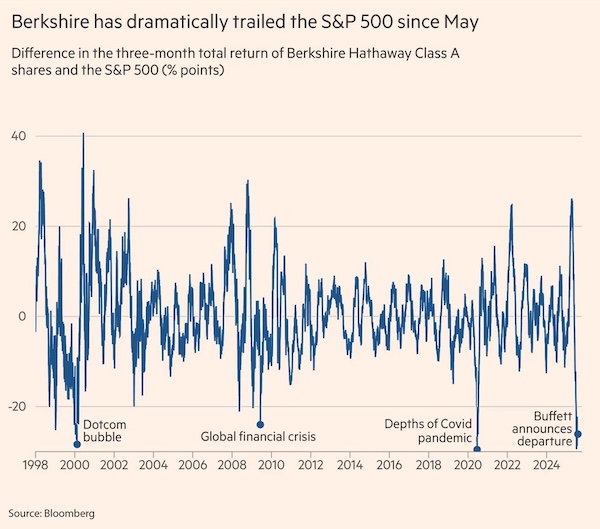

At the same time, The FT points out, any hint of prudence is being punished by investors. “In other periods of market exuberance, notably the dotcom bubble in 1999, Buffett sat on the sidelines. While that generated opprobrium from critics at the time, with Berkshire shares lagging the technology-heavy Nasdaq Composite, the ensuing correction underscored his investment bona fides.”