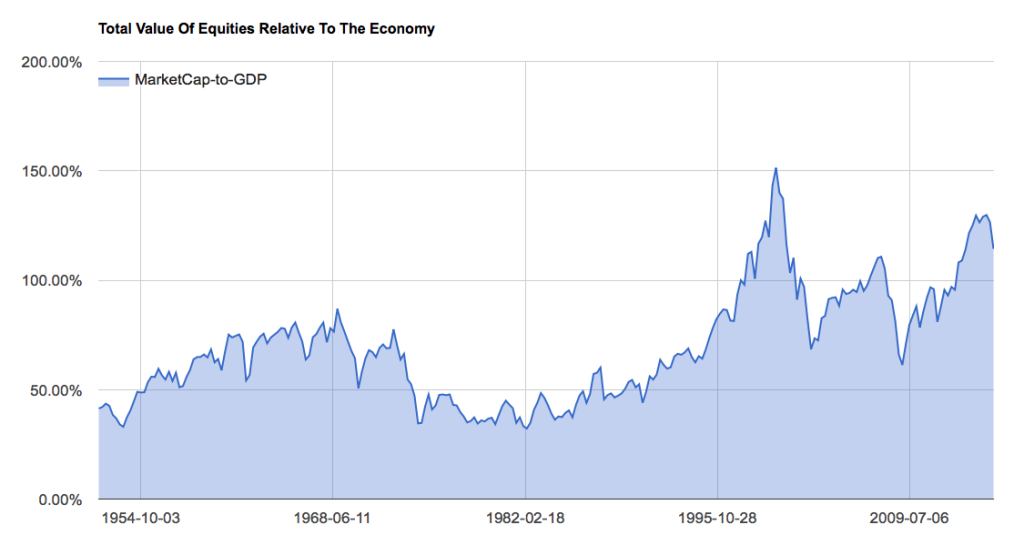

The Fed released its latest Z.1 report today and, though it’s not the timeliest of data, there are a few interesting data points to go over. First, the “Buffett Yardstick,” market cap-to-GDP, shows some erosion from very elevated levels as stock prices fell during Q3.

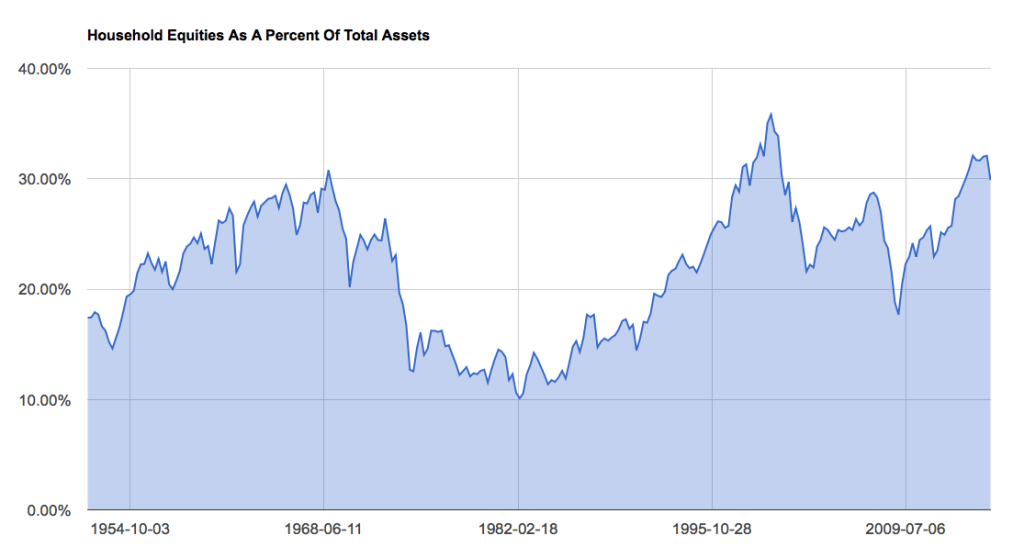

The selloff in stocks also precipitated a fall in the amount of total financial assets households have allocated to the stock market. This was also recently sitting at levels very rarely seen over the past sixty years or so.

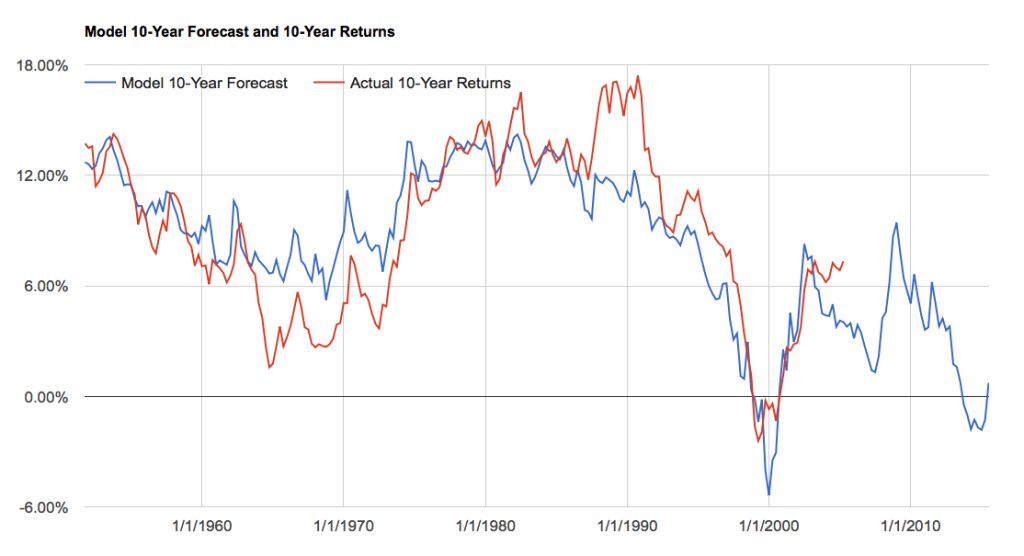

Both of these measures have high negative correlations to future 10-year returns in the stock market. In other words, the higher they are the lower your future returns. This is just another demonstration of, “the price you pay determines your rate of return.” Pay a high price for equities (or any asset, for that matter) today and you essentially guarantee yourself a low return.

As of the end of Q3, a composite forecast of both of the above measures along with a simple regression model suggests forward 10-year returns should be somewhere in the neighborhood of 0.72% per year. While this is nothing to get excited about, it is the first positive return expectation for this model in two years.

Ben Graham famously wrote:

An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.

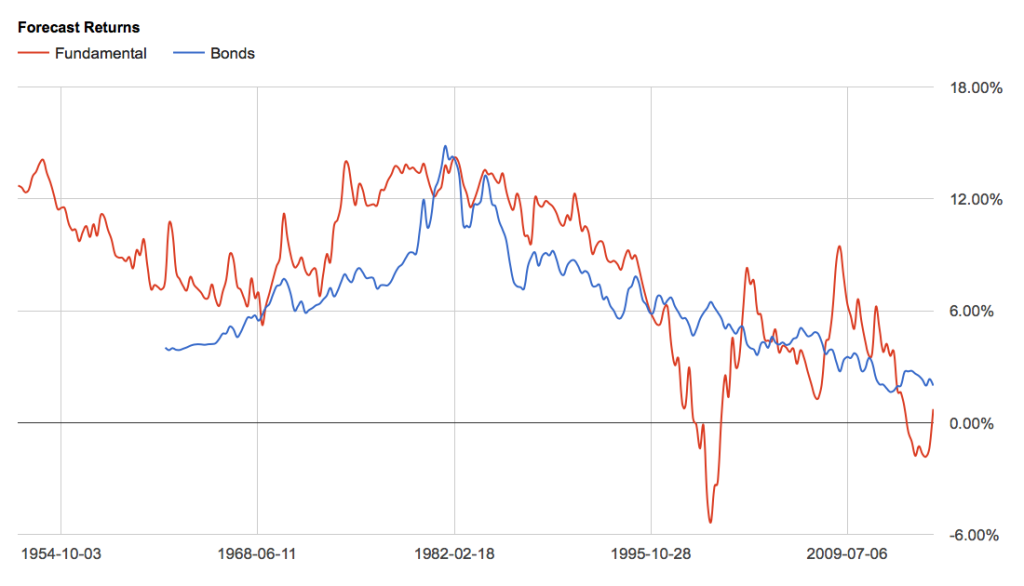

In terms of an adequate return, I’ve argued that stocks should at least offer better prospective returns than those offered by risk-free treasuries. As I explored in my “How to time the market like Warren Buffett” post, simply comparing the forecast for equities to the 10-year treasury rate is a simple way to determine whether stocks make sense from an investment standpoint.

Though the prospective return for stocks has turned positive it is still below the risk-free rate. Historically, this has been a rare occurrence. Only during the dotcom mania and at the height of the real estate bubble did we see a sustained periods of stocks offering less return than 10-year treasury yields. Clearly, those were not good times to take the added risk of owning stocks.

But I believe it makes sense to add a trend-following component to this fundamental analysis to improve its timing. Stocks can stay overvalued for long periods of time. Following the Warren Buffett model helps you avoid major bear markets but it also gets you out of the market far too early at times.

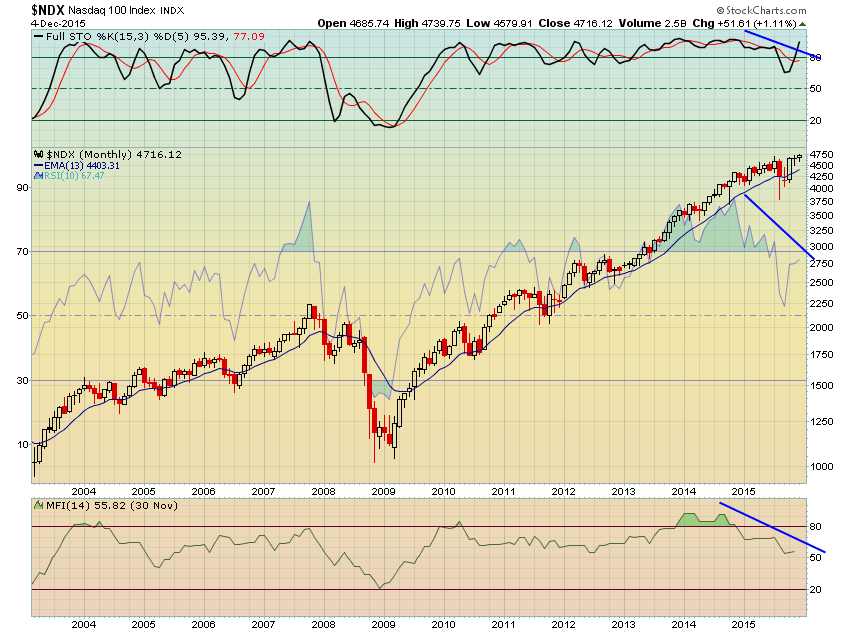

The end of Q3 saw the S&P 500 close below its 10-month moving average, a measure that is highly effective at determining the overall trend. The 10-month rate-of-change also turned negative suggesting the long-term uptrend has officially reversed course.

All told then, at the end of Q3 the broad stock market was extremely overvalued (the “Buffett Yardstick” was only higher during the dotcom mania), extremely euphoric (households have rarely had a greater allocation than they do now), and the trend had reversed to the downside. This is why I called it, “the worst possible environment for stock market investors.”

Now, as I suggested at the open of this piece, this data is delayed quite a bit. Since the end of Q3, the S&P 500 has rallied nearly back to its all-time high set in May. It’s also regained its 10-month moving average as of the end of last month. However, it is doing battle with that very level today as I write. It will be very interesting to see if it can continue to hold its head up from here even as earnings continue to decline and bond market risk appetites rapidly wane.

I also find it noteworthy that this trend-following component is really inspired by Paul Tudor Jones, who has famously expounded on the value of the 200-day moving average (roughly equivalent to the 10-month moving average). His second tenet of successful investing, however, concerns the risk/reward ratio. PTJ only pursues a trade that offers a 5-to-1 reward-to-risk ratio.

In this light, the broad stock market today offers less than a 1% annual return over the next decade along with a large double-digit potential drawdown. It would take another major bear market, similar to the last two, for stocks to simply fall to their median valuations over the past several decades. This potential downside is also confirmed by the record level of margin debt in the market.

So owning the broad stock market today is essentially risking dollars to make pennies. And that’s a reward-to-risk ratio that should make both investors, like Warren Buffett, and traders, like Paul Tudor Jones, stay far away.