Earlier this week I wrote, “why I’m bearish,” focusing more on why I am willing and able to take a contrarian stance than on the real reasons for taking it in the first place. So here I’m going to make the case for being bearish right now.

The stock market is held up by four pillars: fundamentals, technicals, sentiment and macro (see Todd Harrison’s “The Four Pillars of Trading“). All of these must work in concert, to some degree, for stocks to go either higher or lower. Right now I believe they are conspiring to send prices lower.

The stock market is held up by four pillars: fundamentals, technicals, sentiment and macro (see Todd Harrison’s “The Four Pillars of Trading“). All of these must work in concert, to some degree, for stocks to go either higher or lower. Right now I believe they are conspiring to send prices lower.

Fundamentals

The most fundamental part of investing is knowing that ‘the price you pay for a stock determines your rate of return.’ If a stock is worth $100 and you pay $50 you will make 100% when/if the market recognizes its true value. However, if you pay $150 for the same stock you stand to lose 33% so price, and more importantly valuation, is absolutely critical in the investment process.

Right now stocks are very expensive. Based on four different valuation metrics, courtesy of Doug Short, stocks are currently overvalued somewhere in the range of 42%-70%. In other words, if stocks were to immediately return to their average historical valuations tomorrow they would have to fall 30%-40%. This is why James Montier and Jeremy Grantham have calculated that the probable return for the stock market over the next seven years is roughly 0% (earnings should grow but valuations should decline leading to zero return).

Right now stocks are very expensive. Based on four different valuation metrics, courtesy of Doug Short, stocks are currently overvalued somewhere in the range of 42%-70%. In other words, if stocks were to immediately return to their average historical valuations tomorrow they would have to fall 30%-40%. This is why James Montier and Jeremy Grantham have calculated that the probable return for the stock market over the next seven years is roughly 0% (earnings should grow but valuations should decline leading to zero return).

It’s important to note, as well , that there are only two other times in the past 100 years when stocks were prices as high: the 1929 bubble and the 2000 bubble.

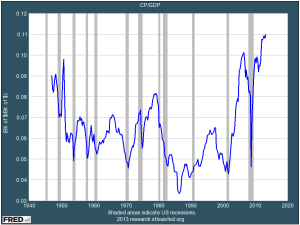

Fundamentally then, the only way this “pillar” becomes bullish for stock is if corporate earnings grow very rapidly over the next few quarters. The problem with this idea is that corporate profit margins are already historically stretched AND earnings growth has slowed nearly to a stop as companies revise their forward guidance downward faster than ever.

Fundamentally then, the only way this “pillar” becomes bullish for stock is if corporate earnings grow very rapidly over the next few quarters. The problem with this idea is that corporate profit margins are already historically stretched AND earnings growth has slowed nearly to a stop as companies revise their forward guidance downward faster than ever.

Technicals

Stocks are up nicely this year but there are signs that momentum has begun to wane. As the S&P 500 has made new highs RSI and MACD have failed to confirm them. In addition, the index has now formed a clear “ending diagonal” or “wedge” reversal pattern.

Stocks are up nicely this year but there are signs that momentum has begun to wane. As the S&P 500 has made new highs RSI and MACD have failed to confirm them. In addition, the index has now formed a clear “ending diagonal” or “wedge” reversal pattern.

Turning to the Nasdaq, it has also formed a similar pattern. What’s more, on Tuesday it completed a 9-13-9 DeMark Sequential sell signal on the monthly chart. At the same time it has now retraced 61.8% of its decline since the internet bubble burst. This is a key Fibonacci level that traders follow because it regularly marks changes in trend. Notice that the 2007 top was formed very near the 38.2% level (the inverse of 61.8%). The triple threat of the ending diagonal, DeMark sell signal and key resistance significantly increases the probability of an imminent reversal on this long-term time frame.

Sentiment

We can look at all the surveys there are to gauge sentiment but I prefer to look at what investors and traders are actually doing with their money. There are two in particular we should pay close attention to.

The first is short selling; there’s no better way to determine how many bears there are out there than to take a look at short selling levels. According to this measure, bears just hit an all-time record low. Markit recently revealed to CNBC that a mere 2.4% of S&P 500 companies’ shares have been borrowed to sell short, a record low. Clearly, rising stock prices have forced bears into hibernation.

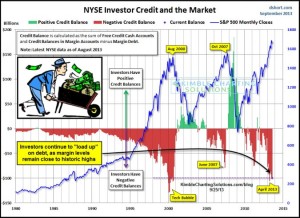

On the flip side, the bulls are out in force. Margin debt levels have recently risen higher than any other time since the internet bubble. Not only are most investors heavily long stocks, they are leveraging their exposure with a massive amount of margin debt.

On the flip side, the bulls are out in force. Margin debt levels have recently risen higher than any other time since the internet bubble. Not only are most investors heavily long stocks, they are leveraging their exposure with a massive amount of margin debt.

The bottom line is we currently have a record low in the number of bears while bulls numbers near record highs. Contrarians rarely see sentiment so extremely skewed.

Macro

Here’s an area I’ve been writing about for months. This stock market is essentially ‘all Fed, all the time.’ And if you doubt the impact the Fed has had on the bull run stocks have made over the past few years, take a look at the chart to the right, courtesy of TheArmoTrader.

Here’s an area I’ve been writing about for months. This stock market is essentially ‘all Fed, all the time.’ And if you doubt the impact the Fed has had on the bull run stocks have made over the past few years, take a look at the chart to the right, courtesy of TheArmoTrader.

The Fed has made it clear it sees the need to “taper” its bond buying programs. And in the words of one of the most successful investors of all time:

If you didn’t believe before that the exit was gonna be tough, the mere hint that maybe in 3 months, if the economy’s good, we might go from 85 billion a month to buying 65 billion a month caused that kind of havoc and risk around the world how in the world does anybody think that when the actual exit actually happens prices are not gonna respond? It’s silly. -Stan Druckenmiller

Make no mistake, the stock market has benefited greatly from the Fed’s money printing; the end is near and stocks will suffer when it comes. The only question that remains is ‘will investors try to get ahead of the actual announcement?’ because it seems the “smart money” is already doing so.

Investors in the bond market have certainly gotten ahead of any tapering that may be on the horizon. Interest rates have shot up over the past few months, a development that is neither good for the economy nor for other asset classes. Take a look stocks reacted at prior times interest rates surged to this degree. Two out of the past three occurrences coincided with major stock market tops.

Investors in the bond market have certainly gotten ahead of any tapering that may be on the horizon. Interest rates have shot up over the past few months, a development that is neither good for the economy nor for other asset classes. Take a look stocks reacted at prior times interest rates surged to this degree. Two out of the past three occurrences coincided with major stock market tops.

Conclusion

All in all, each of the four pillars presents a challenge for stocks at present. In fact, we haven’t seen this combination of extreme valuations, waning momentum, rampant bullishness and macro threats since just before the financial crisis. Now I’m not calling for another stock market crash but the risk-reward equation seems heavily skewed to the risk side with very little possibility of reward. That’s a game I have no desire to play so go ahead and color me “bearish.”