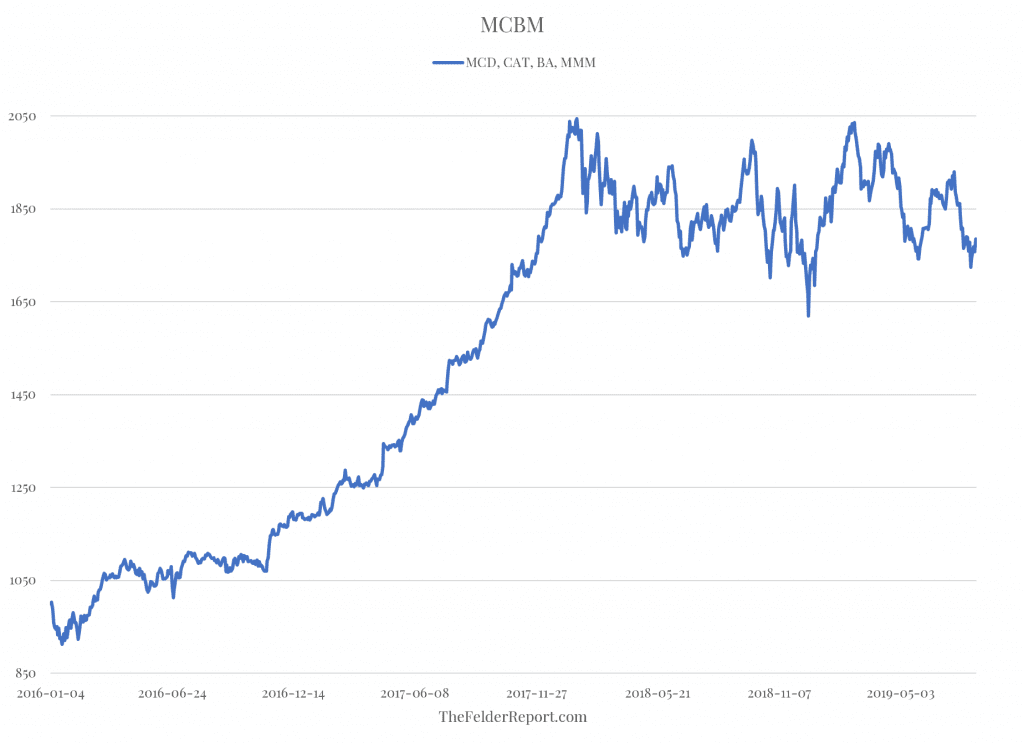

Just about 18 months ago, I wrote about The Fantastic Four That Make FANG Look Tame. To me, the parabolic move in MCBM (McDonald’s, Caterpillar, Boeing & 3M – pronounced, “McBaM”) from 2016 to 2018 was representative of the breadth of overvaluation in the broader stock market. Since that time, MCBM has fallen a little over 10% as the broad market has gone sideways.

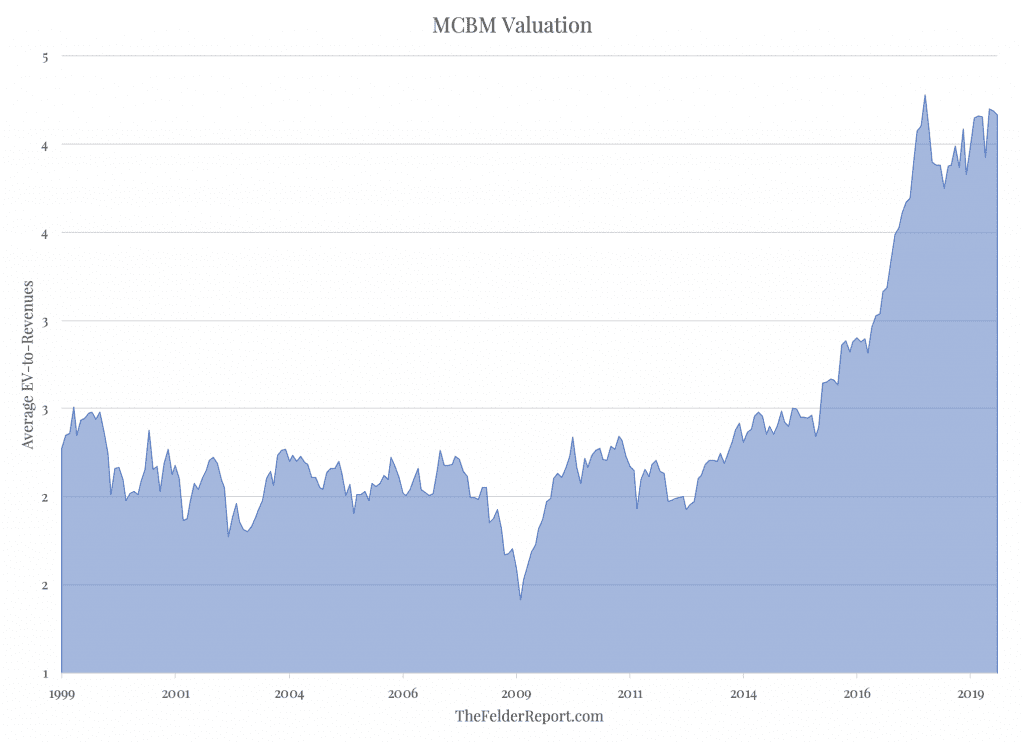

But before you go a buy these “blue chip” stocks thinking they’re cheap you should know that, as a group they still trade at a valuation that is more than 30% higher than at any other time over the past 35 years even as long-term revenue growth has turned negative. In other words, it’s going to take a lot more 18 month periods like we have just had before these stocks approach anything near a historically normal valuation level (let alone a level that could be deemed “cheap”).

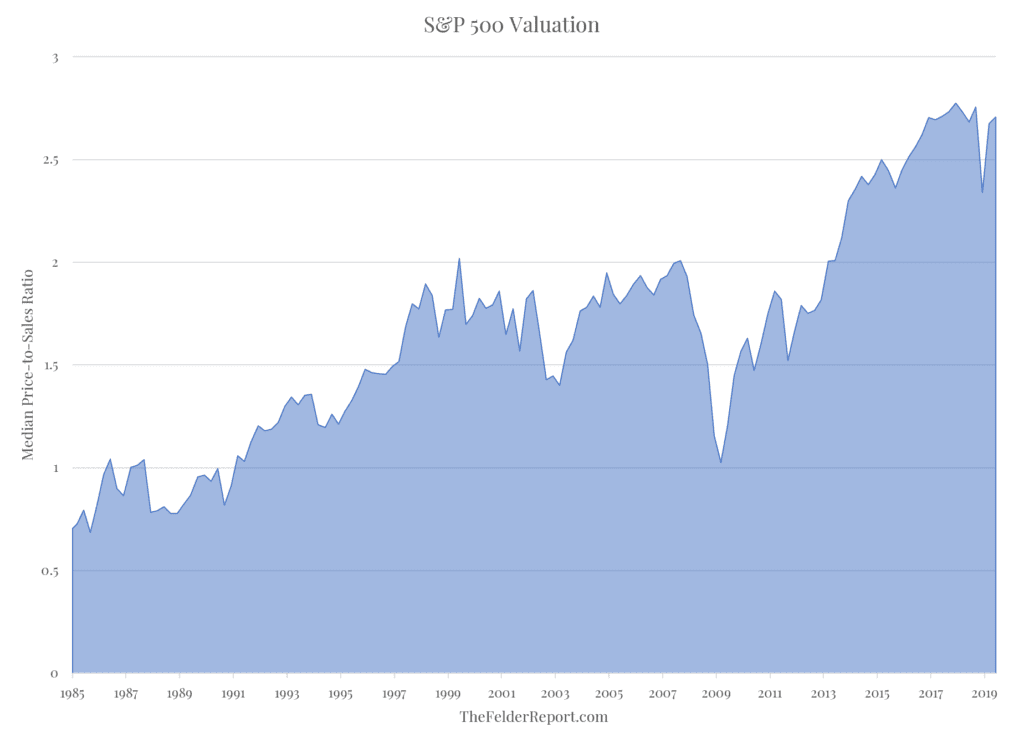

And, just as I wrote back then, this group is a fairly good representation of the broad market. When looking at the median price-to-sales metric on the S&P 500, it’s immediately apparent that the entire market is trading at a dramatic premium to its historical valuation range. What’s more, it will take a much more significant and prolonged drawdown than the one we saw late last year to bring prices back to a level that would represent something even close to “normal.”

Understanding how we got here is especially helpful in understanding the risks going forward. Record high profit margins and record low interest rates have certainly played their part. But buying stocks today then means you must assume that both of these supports to equity prices will be sustained indefinitely. Together, they may represent the most heroic sort of euphoria we have ever seen. But isn’t that just what bubbles are made of?