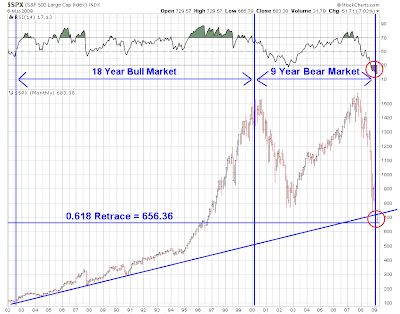

The other day I wrote an Elliott Wave analysis of GE. The chart below is an Elliott Wave analysis of the S&P 500.

As you can see, today’s trading took the index very close to retracing 61.8% of the 1982-2000 bull market. In addition, the bear market of the past 9 years, has now retraced 50% of the 18 year bull market that preceeded it:

Aside from the technical picture, sentiment has recently set a historic extreme. AAII announced this week that in the history of their sentiment survey there have never been more bears than there are today (this has historically been an accurate contrary indicator):

In stark contrast, corporate insiders, aka the “smart money,” have been net buyers in size of their own stock lately:

All in all, there are many signs that the indexes are close to forming a major market bottom.

Sources:

The Running of the Bears

Bespoke Investment Group

March 05, 2009

Insiders Are Starting To Wade In

Jason Goepfert

SentimenTrader

March 6, 2009